News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Jan.26)|SIGN, and JUP are set for large token unlocks this week; crypto market long liquidations reached $612 million; a Spark lending whale sold 11,190 ETH2Bitget UEX Daily | EU Suspends Tariffs on US; Gold Hits Record High Breaking $5000, Silver Breaks $100; Rieder Top Fed Contender (January 26, 2026)3a16z-backed Entropy shuts down, promises investors refunds

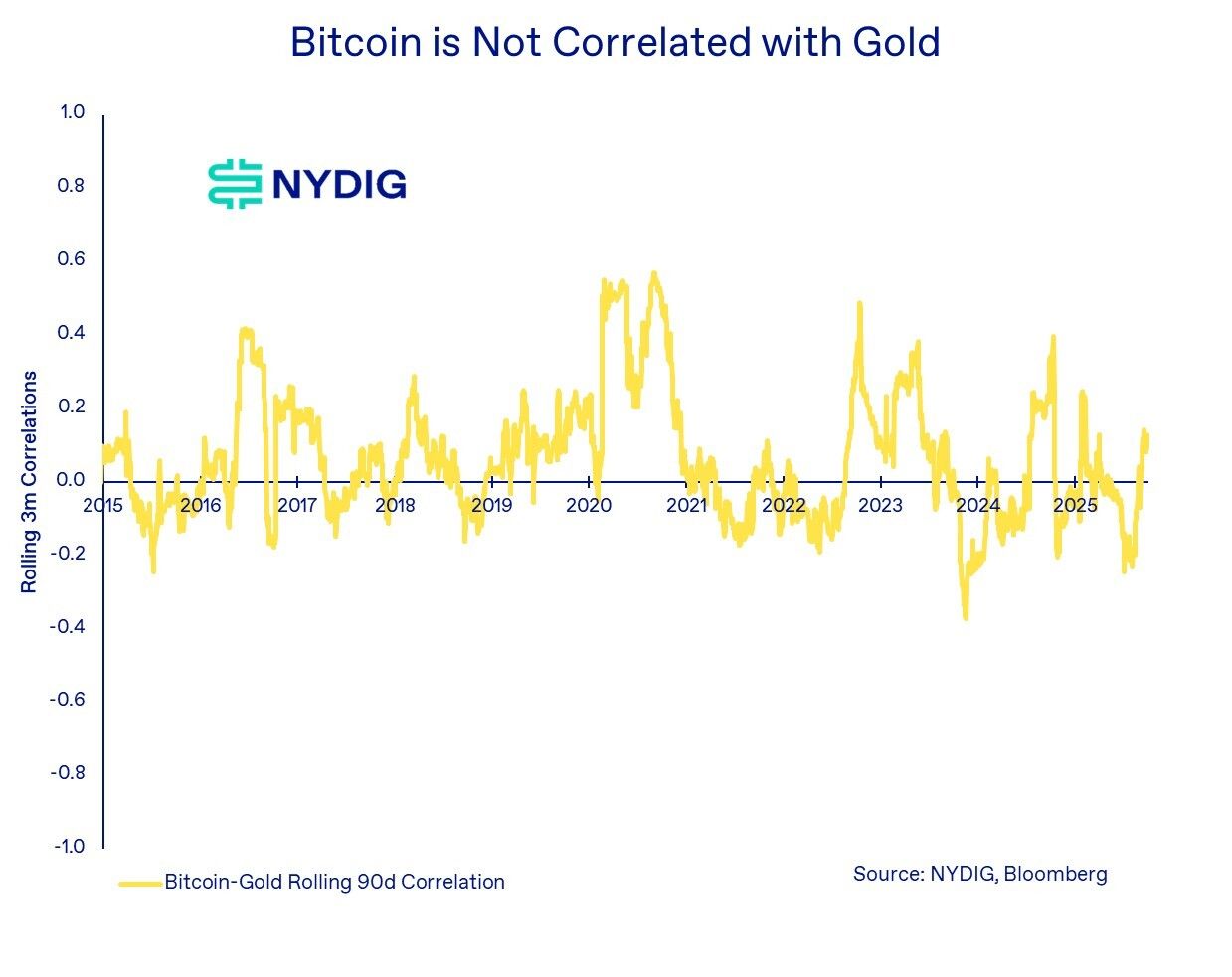

Bitcoin is no inflation hedge but thrives when the dollar wobbles: NYDIG

CryptoNewsNet·2025/10/27 04:39

Bitcoin Reclaims $115,000 as US–China Trade Hopes Lift Markets

CryptoNewsNet·2025/10/27 04:39

Bitcoin Accelerates Higher As Bulls Target Break Above $115,500 Resistance

CryptoNewsNet·2025/10/27 04:39

Buterin and Yakovenko Clash Over Ethereum Layer-2 Security

CryptoNewsNet·2025/10/27 04:39

Bitcoin Surpasses 50-Day Average, but CoinDesk BTC Trend Indicator Remains Bearish

CryptoNewsNet·2025/10/27 04:39

Altcoin Market Breakout Looms as Bitcoin Dominance Weakens

After a long accumulation phase, altcoins are showing early signs of revival. With Bitcoin dominance nearing resistance and on-chain data turning bullish, the conditions for a major Altseason breakout may finally be aligning for crypto investors.

BeInCrypto·2025/10/27 04:37

XRP Hits $26.9B in CME Futures Trading as Institutional Demand Soars

Cointribune·2025/10/27 04:33

Is Xai (XAI) Poised for a Breakout? Key Bullish Pattern Formation Suggests So!

CoinsProbe·2025/10/27 04:33

Japan’s First Regulated Yen Stablecoin Launches

JPYC Inc. launched Japan's first regulated yen-pegged stablecoin, introducing compliance-focused infrastructure in Asia's third-largest forex market challenging dollar-dominated stablecoin landscape.

BeInCrypto·2025/10/27 04:25

NYDIG Analysis Challenges Bitcoin Inflation Hedge Narrative as Dollar Weakness Emerges as Key Driver

BTCPEERS·2025/10/27 04:19

Flash

01:21

Santiment: The decline in stablecoin market capitalization indicates that funds are flowing into gold and silver rather than bitcoinPANews, January 27 – According to Cointelegraph, crypto analytics platform Santiment pointed out that the total market capitalization of stablecoins has decreased by $2.24 billions over the past 10 days, which may indicate that funds are flowing out of the crypto ecosystem or delaying market recovery. The agency's analysis suggests that these funds appear to have shifted to traditional safe-haven assets such as gold and silver, driving their prices to new highs, while bitcoin, the overall crypto market, and stablecoin market capitalization have experienced a pullback. Santiment stated that the decline in stablecoin market capitalization reflects that investors are cashing out to fiat rather than preparing to buy the dip, and the increased demand for precious metals shows a greater market preference for risk aversion. Historical data shows that a strong recovery in the crypto market often begins when the stablecoin market capitalization stops falling and starts to rise again, signaling the entry of new funds and a restoration of confidence. Before this happens, risk assets such as altcoins may continue to be under pressure; although bitcoin is relatively resilient, the shrinking supply of stablecoins will still limit the overall upside potential.

00:57

U.S. Marshals Service investigates government contractor's son for allegedly stealing $40 million in seized cryptocurrencyPANews, January 27 — According to CoinDesk, the U.S. Marshals Service is investigating a theft case involving over $40 million in seized cryptocurrency. Blockchain investigator ZachXBT accused John “Lick” Daghita, the son of the president of CMDSS—a service provider for the Department of Defense and the Department of Justice—of stealing these assets from government crypto wallets managed by his father's company. ZachXBT stated that he has confirmed at least $23 million is related to approximately $90 million in cryptocurrency seized by the government in 2024 and 2025, and reported the matter to authorities last week. The suspect inadvertently exposed the wallet address he controlled by recording a video to flaunt his wealth in a Telegram group chat, and ZachXBT confirmed the fund connection through on-chain tracking. Brady McCarron, Public Affairs Chief of the U.S. Marshals Service, stated that no further comment could be made as the investigation is ongoing. Previous reports indicated that the U.S. Marshals Service may not be fully aware of the exact amount of crypto assets under its control, and this incident has once again raised concerns about the transparency of government oversight of cryptocurrency holdings.

00:39

WhiteWhale market cap briefly surpasses 80 million USD, up over 91% in 24 hoursAccording to ChainCatcher, GMGN market data shows that the market cap of the Solana ecosystem meme coin WhiteWhale rebounded after falling below $20 million, briefly surging past $80 million in the early hours today. It is currently reported at $74.6 million, with a 24-hour trading volume of $13.9 million and a 24-hour increase of over 91%. Meme coin trading is highly volatile, largely dependent on market sentiment and speculative concepts, and lacks actual value or use cases. Investors should be aware of the risks.

News