News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 5) | 21Shares Launches 2x Leveraged SUI ETF on Nasdaq; U.S. Treasury Debt Surpasses $30 Trillion; JPMorgan: Strategy’s Resilience May Determine Bitcoin’s Short-Term Trend2Bitcoin looks increasingly like it did in 2022: Can BTC price avoid $68K?3The Chainlink ETF Disappoints Despite $41 Million Inflows — Why?

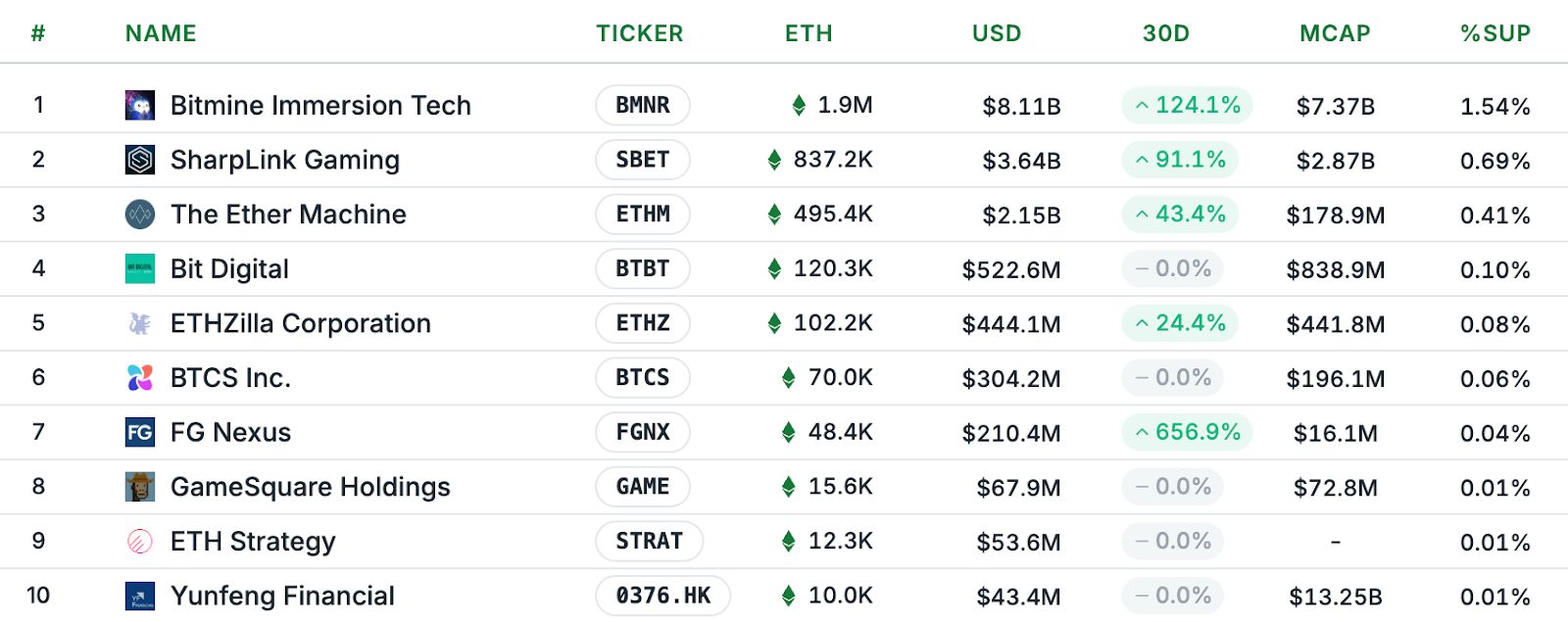

Yield-chasing ETH treasury firms are most at risk: Sharplink Gaming CEO

CryptoNewsNet·2025/09/03 06:05

XRP Ledger’s Entire Carbon Footprint Equals Just 1 Transatlantic Flight: Research

CryptoNewsNet·2025/09/03 06:05

Bitcoin Correction Could Deepen Before Recovery as Only 9% of Supply at Loss

CryptoNewsNet·2025/09/03 06:05

XRP (XRP) Price Prediction: Analysts Eye $3.60 Breakout As ETF Speculation Heats Up

CryptoNewsNet·2025/09/03 06:05

Here is XRP Price by December 2025 if SEC Approves ALL Spot XRP ETFs by October

CryptoNewsNet·2025/09/03 06:05

Something unusual is building in $9.81 billion of Bitcoin futures flows and it could break either way

CryptoSlate·2025/09/03 06:01

US SEC, CFTC clear path for registered firms to trade spot crypto

Coinjournal·2025/09/03 06:00

SharpLink buys 39,008 ETH for $177M at an average price of $4,531

Cointribune·2025/09/03 05:55

EU stablecoin regulations leave Europe vulnerable, says ECB chief

CryptoSlate·2025/09/03 05:39

Trust Wallet Brings Tokenized Stocks & ETFs Onchain for 200M+ Users Worldwide

Trust Wallet, the world’s leading self-custody Web3 wallet with over 200 million users, today announced the launch of tokenized real-world assets (RWAs)—unlocking seamless access to tokenized versions of U.S. stocks and ETFs for users around the globe*. Users can now discover, hold, and swap tokenized RWAs* that track the prices of leading equities and major … <a href="https://beincrypto.com/trust-wallet-tokenized-stocks-etfs-onchain/">Continued</a>

BeInCrypto·2025/09/03 05:30

Flash

- 12:53Machi Big Brother No.2 closes all ETH long positions, earning $1.055 million, a significant pullback from the $5.3 million peak.Foresight News reported, according to monitoring by @ai_9684xtpa, Machi Big Brother's floating profits have been completely given back. Machi No.2 closed the ETH long position that had been held for nearly four days 17 hours ago, ultimately making a profit of $1.285 million, which is a significant pullback compared to the peak of $5.3 million. After closing the position, Machi No.2 opened two more long positions during the decline, both of which ended in losses, giving back nearly $230,000. In total, the three ETH long trades resulted in a cumulative profit of $1.055 million.

- 12:53Prediction market DeFi layer Gondor completes $2.5 million financing, beta version to launch next weekForesight News reported that the prediction market DeFi layer Gondor has announced the completion of a $2.5 million funding round. Gondor will launch its beta version next week, supporting lending with Polymarket positions as collateral and enabling trading with 2x leverage. In the future, leverage will be expanded to 4-5x through cross-margining.

- 12:52France's second largest banking group BPCE will support customers in buying and selling cryptocurrenciesForesight News reported, according to The Big Whale, that France's second largest banking group BPCE will support customers in buying and selling cryptocurrencies via its banking app starting December 8, 2025. This service will be launched in 4 of the group's entities (out of a total of 29), which belong to the Banque Populaire and Caisse d’Épargne networks. The service will gradually expand across the entire French territory, targeting BPCE’s approximately 35 million retail customers. Currently supported assets include bitcoin, ethereum, Solana, and USDC.

News