News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

From Wintermute to Lubian: Retrospective on the Largest PRNG Vulnerability in Crypto History

The integration of cryptocurrencies into the daily financial system is a lengthy process, but this process has now officially begun.

From discovering a 2-second price difference vulnerability on HyperEVM blocks, to building an arbitrage bot that outperformed competitors, and finally introducing perpetual contracts to achieve a $5 million profit, we completed this crypto arbitrage operation in 8 months.

The real crypto bull market is expected to start in the second quarter of 2026.

Deepseek currently ranks first, while Gemini is at the bottom.

Everyone is nostalgic for the "golden age" that has already passed.

This article explains why the author has gradually stopped writing specific project analyses. He believes that by 2025, the Web3 industry has undergone fundamental changes, and the traditional research and investment methodology based on public information has basically lost its effectiveness as a short-term profit path.

- 20:51MetaMask launches rewards points program MetaMask RewardsForesight News reported that MetaMask has officially launched its rewards points program, MetaMask Rewards, allowing users to earn points through trading, swapping, cross-chain bridging, and inviting friends, as well as receive points rewards from past activities. Points can be used to upgrade reward tiers, unlocking benefits such as fee discounts, token allocations, and partner offers. New incentives and rewards will be updated each quarter. Users can link multiple MetaMask accounts to combine points and accelerate tier upgrades. Some rewards, such as points multipliers and fee discounts, will be automatically applied or can be redeemed during the season.

- 20:51A certain exchange will launch a betting feature supported by PolymarketForesight News reported that the decentralized trading protocol GTE announced on Twitter that it will launch a betting feature supported by Polymarket.

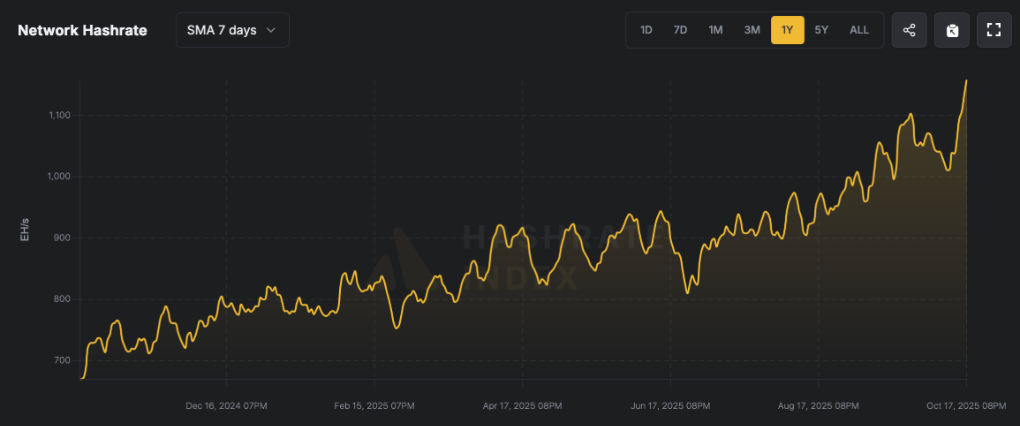

- 20:51Analysis: Whales are accumulating more BTCForesight News reported that Swiss block published an analysis stating that whales are accumulating more coins. From September to October, the accumulation has increased, and bitcoin is flowing from exchanges into whale wallets. They are stockpiling coins in advance, strategically positioning themselves for the next potential bull run.