News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily Report | US-Japan-EU-Mexico Collaborate on Key Minerals Development; Nasdaq Introduces Fast Inclusion Rules; Software Stocks Continue Under Pressure (February 5, 2026)2Hyperliquid treasury seeks revenue boost using HYPE holdings as options collateral3Bitcoin drops following Treasury Secretary Bessent's statement that the US government cannot require banks to rescue crypto

Cryptocurrencies continue to "crash" on Monday, with some tokens falling back to the flash crash lows of October

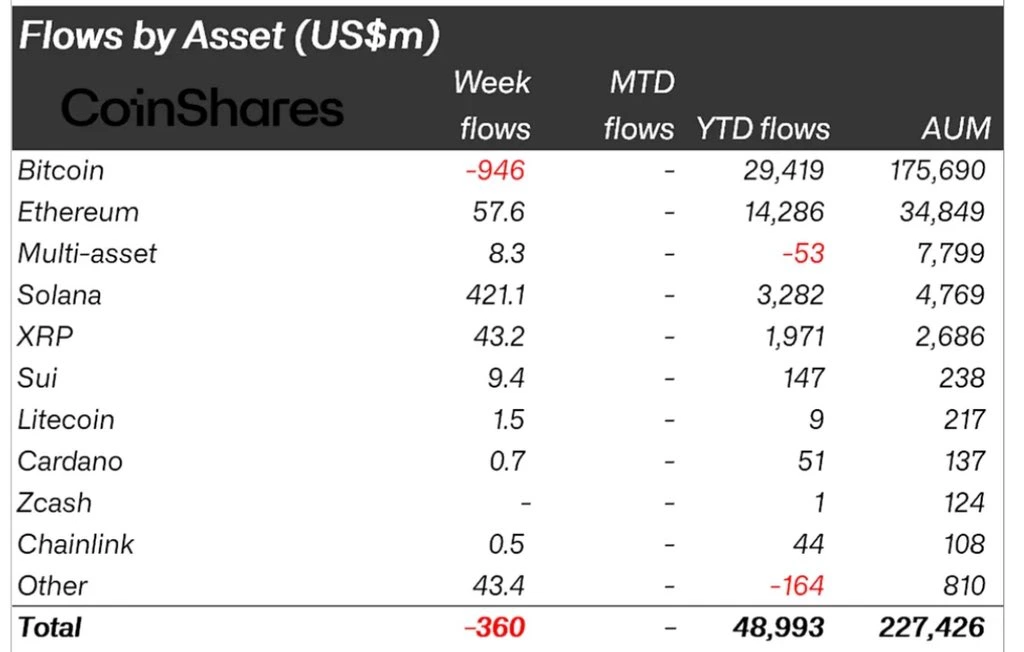

Institutional demand for Bitcoin has fallen below the rate of new coin mining for the first time in seven months, suggesting that major buyers may be pulling back.

ForesightNews·2025/11/04 07:01

How Zcash reclaimed the privacy crown from Monero

CryptoSlate·2025/11/04 07:00

BlackRock’s $213 Million Bitcoin Move Exacerbates Fears of Sub-$100,000 Drop

BlackRock’s $213 million Bitcoin transfer to Coinbase has rattled traders, reigniting fears of a drop below $100,000.

BeInCrypto·2025/11/04 06:54

Crypto Market Crash: Henrik Zeberg Says Capitulation Is Setting Stage for a Massive Bull Run

Coinpedia·2025/11/04 06:51

Ripple Unlocks 1 Billion XRP Amid Market Weakness What It Means for Investors

Coinpedia·2025/11/04 06:51

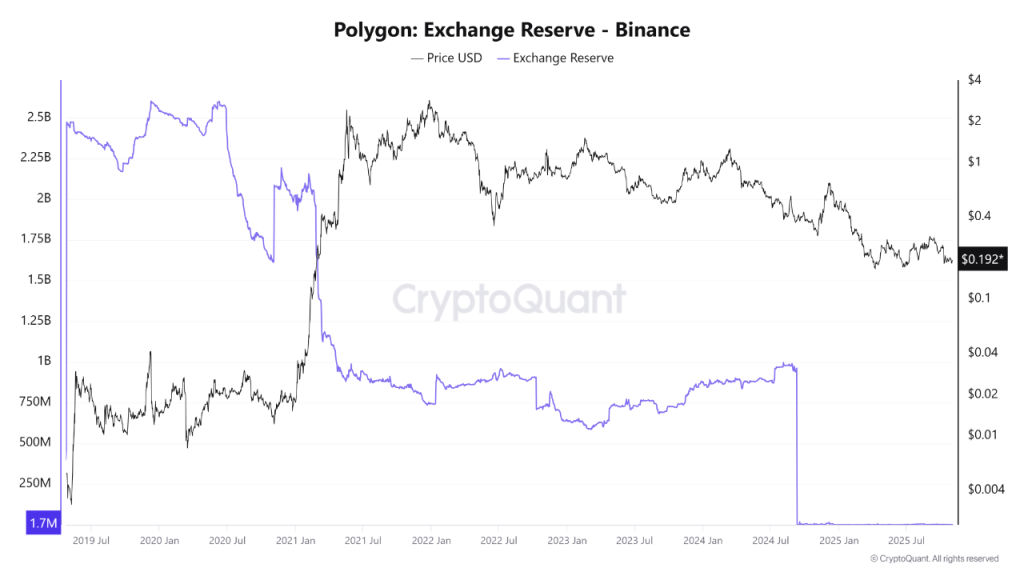

Can Polygon Rise 500%? A Look at Polygon Price Prediction 2025

Coinpedia·2025/11/04 06:51

Cycle Scientist Says No Altcoin Season Is Coming as Bitcoin Nears Its Peak

Coinpedia·2025/11/04 06:51

Crypto Bloodbath: Bitcoin and Ethereum Drop Sharply Amid Market Sell-Off

Coinpedia·2025/11/04 06:51

Bitcoin Price Drop is Likely a Pause and Not a Reversal; LMAX Strategist Joel Kruger Says

Coinpedia·2025/11/04 06:51

Solana Whales Aggressively Accumulate Amid Midterm Bearish Sentiment

Coinpedia·2025/11/04 06:51

Flash

18:10

BNB breaks below the trendline maintained since 2023—can bulls hold the $675 level?BNB has broken below a key ascending trendline support, dropping 10% to $697, with trading volume surging 40% to $3.75 billion. Analysts warn that if the closing price falls below $675, it could trigger a further 10% decline, with a target price of $610. On-chain data shows that major holders have not increased their positions, while derivatives traders are holding $21.21 million in leveraged short positions, indicating strong bearish sentiment in the market.

17:44

US Treasury Secretary criticizes crypto advocates opposing the market structure billU.S. Treasury Secretary Scott Besant criticized some members of the cryptocurrency industry for obstructing the legislative process of the Digital Asset Market Clarity Act while testifying before the Senate Banking Committee. He stated that these market participants seem to have no desire for any regulation at all. He also suggested that those who do not support strong regulation could choose to move to El Salvador.

17:44

Michael Lewis and Tom Lee comment on the trillion-dollar software stock plunge: "I don't think it's a bad idea to go long on fear stocks right now."According to a report by Bijie Network: In a recent speech, Michael Lewis and Tom Lee from Fundstrat highlighted how extreme market volatility and AI-driven industry transformation are reshaping the investment landscape. Lewis cited a Fidelity study indicating that the best-performing retail accounts belonged to deceased clients, emphasizing that "inactivity" often outperforms "overtrading." Lee pointed out that hedge funds typically hold stocks for only a few seconds, while retail investors with "permanent capital" perform better. He noted that AI has led to a significant shrinkage in software stocks, with a related ETF recently losing about 100 billions USD. Lewis warned against conflating the potential of AI with guaranteed profitability, noting that AI could reduce corporate earnings. The two also discussed the existential risks faced by assets such as bitcoin and gold. Lewis revealed that he holds a "doomsday trade" defensive position in gold, reflecting his cautious investment approach.

News