News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec.23)|Michael Selig Appointed as the 16th Chair of the CFTC; Powell Has Secured Three Rate Cuts; Strategy Adds $748M to Its Reserves2Bitget US Stock Daily Report | Gold Breaks $4,460; Tesla Approaches $500; Novo Nordisk Oral Drug Approved (December 23, 2025)3Bridgewater founder: Enormous risks from huge bubbles and vast wealth gaps

UK Trade Groups Push for Blockchain in US Tech Deal

UK trade bodies urge the government to include blockchain in the UK-US Tech Bridge to avoid falling behind in innovation.Warning Against Falling Behind the USStrengthening Transatlantic Blockchain Ties

Coinomedia·2025/09/12 14:42

Maple Finance Fees Surge 238% to $3M in a Week

Maple Finance sees a 238% rise in fees over 7 days, hitting $3M and ranking 2nd in growth among major crypto protocols.What’s Driving Maple Finance’s Growth?Maple Finance’s Position in DeFi

Coinomedia·2025/09/12 14:42

Crypto Fear & Greed Index Hits 57: Greed Zone

The Crypto Fear & Greed Index rises to 57, signaling market greed. What does this mean for Bitcoin and altcoins?What Does Greed Mean for Crypto Markets?Staying Smart in Greedy Times

Coinomedia·2025/09/12 14:42

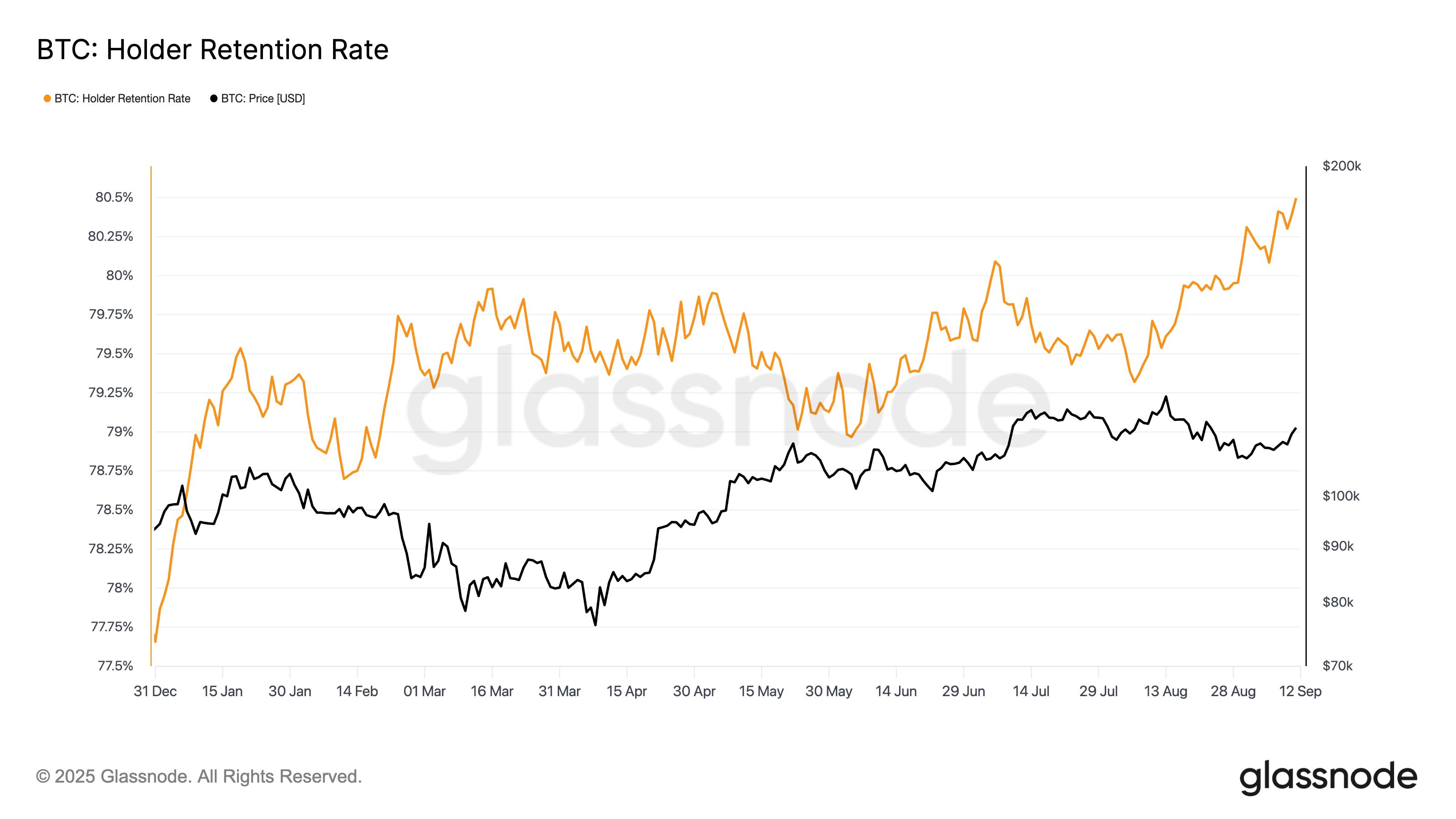

Bitcoin Clears $112,000 Wall, Eyes Return to $120,000 as Hodlers Double Down

CryptoNewsNet·2025/09/12 14:39

Not Just Another Marketplace: How Afrikabal Is Building the ‘SWIFT of Agriculture’ on Lisk

CryptoNewsNet·2025/09/12 14:39

Hedera’s HBAR Climbs 15%, But Diverging Flows Suggest Bulls May Tire Soon

CryptoNewsNet·2025/09/12 14:39

Traders Load Up on Nine-Figure Bullish Bitcoin Bets, Raising Liquidation Risks

CryptoNewsNet·2025/09/12 14:39

US spot Bitcoin ETFs record $552.8M inflows as prices rebound

Coinjournal·2025/09/12 14:36

Nasdaq-listed Safety Shot launches BONK memecoin treasury-focused subsidiary

Coinjournal·2025/09/12 14:36

REX-Osprey Solana ETF crosses $200M milestone as SOL hits seven-month high

CryptoSlate·2025/09/12 14:30

Flash

12:39

IG releases 2026 commodity outlook: gold rally expected to continue, gold rally expected to continuePANews, December 23 – IG market analysts Farah Mourad and Ye Weiwen released their 2026 commodity outlook report, pointing out that the precious metals and energy markets will continue to diverge: Gold: Benefiting from declining real yields, high government spending, and continued central bank demand for gold, the upward trend in gold prices is expected to continue. Major investment banks forecast a gold price range of $4,500–$4,700 in 2026, and under favorable macro conditions, it may break through $5,000. Silver: After surging 120% in 2025, silver has entered a price discovery phase. With supply in deficit for the fifth consecutive year and accelerating industrial demand, the target price is expected to break through $65, with technical models pointing to $72 or even $88. Energy: The oil market is under pressure as supply growth far outpaces demand. The average price of Brent crude oil in 2026 is expected to be $62.23, and WTI crude oil is expected to average $59. JPMorgan warns that if the supply glut worsens, Brent crude prices could fall to the $30 range. The report points out that the precious metals sector is driven by real macro demand and has long-term structural support, while the energy market faces structural downward pressure, with geopolitical risks potentially limiting the downside for oil prices.

12:38

The dollar hit a three-month low against the Swiss franc, last trading at 0.7873. US dollar against the Swiss franc USD/CHF continues to decline, hitting a three-month low, latest down 0.57%, at 0.7873.

12:36

The US dollar against the Swiss franc hit a three-month low, last reported at 0.7873.ChainCatcher news, according to Golden Ten Data, the USD/CHF continues its decline, hitting a three-month low, recently down 0.57% at 0.7873.

News