News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Mainstream mining algorithms include Bitcoin's SHA-256, Dogecoin/Litecoin's Scrypt, Ethereum Classic's Ethash, and more. Each algorithm has its specific hardware requirements and mining experience.

GAEA is the first decentralized AI training network that incorporates human emotional data. It aims to make real human-centric data more accessible to open-source AI projects and understandable while ensuring privacy and security. GAEA envisions to build a network platform that fosters AI evolution.

PUMP defies market weakness with a 40% weekly surge, driven by Pump.fun’s $4 billion volume. With RSI and BoP flashing bullish, traders eye a run to $0.00402.

According to reports, the Trump family’s net worth jumped by about $5 billion after the launch of the WLFI token through their World Liberty Financial venture. The debut silently became one of their biggest milestones in decades. It pushed digital assets to the center of their portfolio and even outpaced real estate in value. WLFI … <a href="https://beincrypto.com/trump-family-wlfi-token-wealth-profit-taking/">Continued</a>

How important is having an appropriate corporate structure?

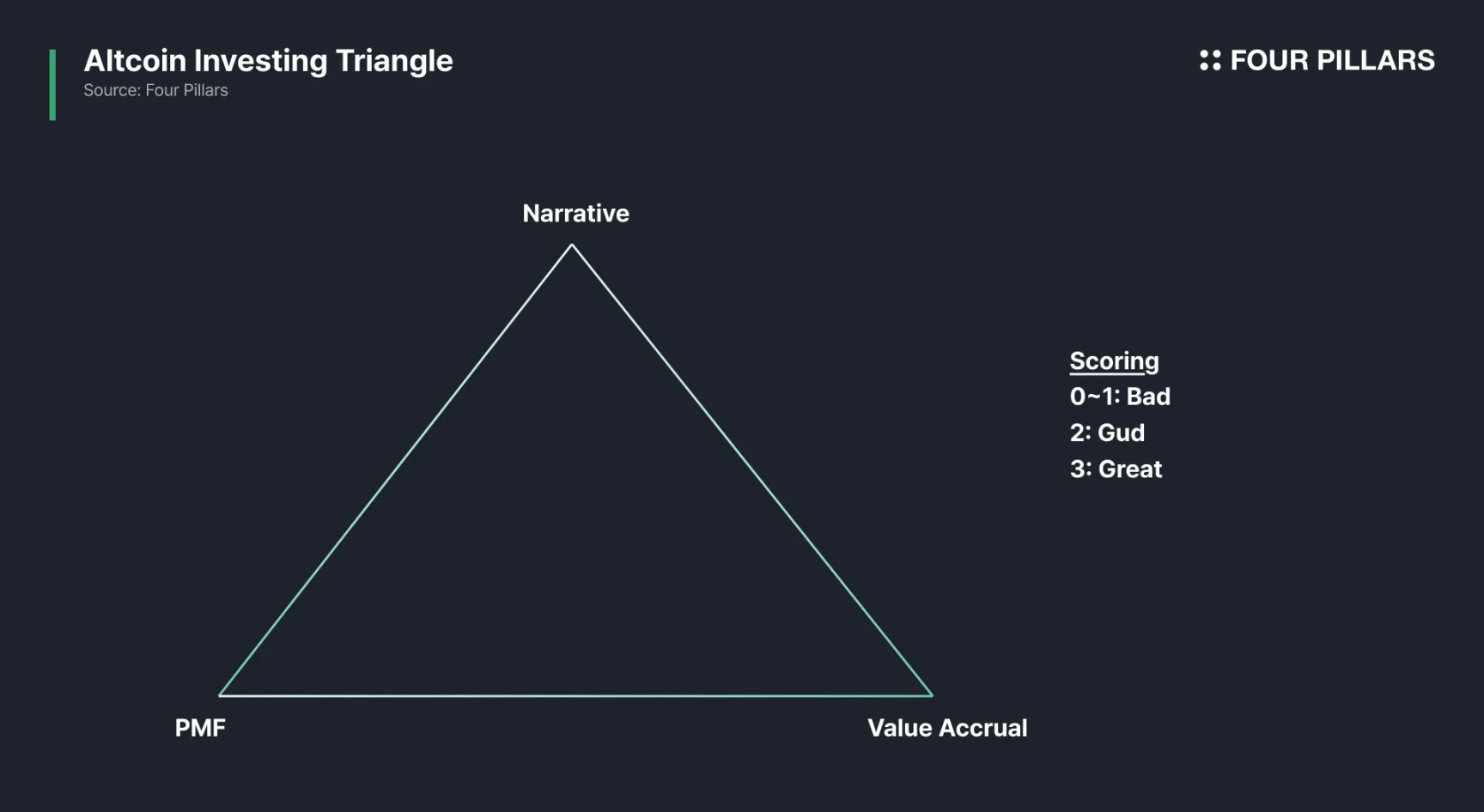

In an era where indicators can be manipulated, how can we see through the narrative fog surrounding token economics?

- 19:05BTC surpasses $91,000Jinse Finance reported that according to market data, BTC has surpassed $91,000 and is now quoted at $91,100. The 24-hour decline has narrowed to 1.58%. The market remains highly volatile, so please manage your risks accordingly.

- 18:56Data: ETH surged briefly, then dropped over 5.04% within 5 minutesChainCatcher News, according to market data, ETH experienced significant volatility and is now quoted at $3,227.36, with a 5-minute drop of 5.04%. Please be aware of market risks. Risk Warning

- 18:41As competition with Google intensifies, OpenAI launches GPT-5.2Jinse Finance reported that as competition with Google intensifies, OpenAI has launched GPT-5.2. Currently, there are no plans to deprecate GPT-5.1, GPT-5, or GPT-4.1 in the API.