News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

South Korea plans to use central bank digital currency (CBDC) to pay more than 110 trillion won (approximately $79.3 billion) in government subsidies.

The overall market was flat over the past week, with the US market almost ignoring the two most anticipated events—NVIDIA's earnings report and Friday's PCE data.

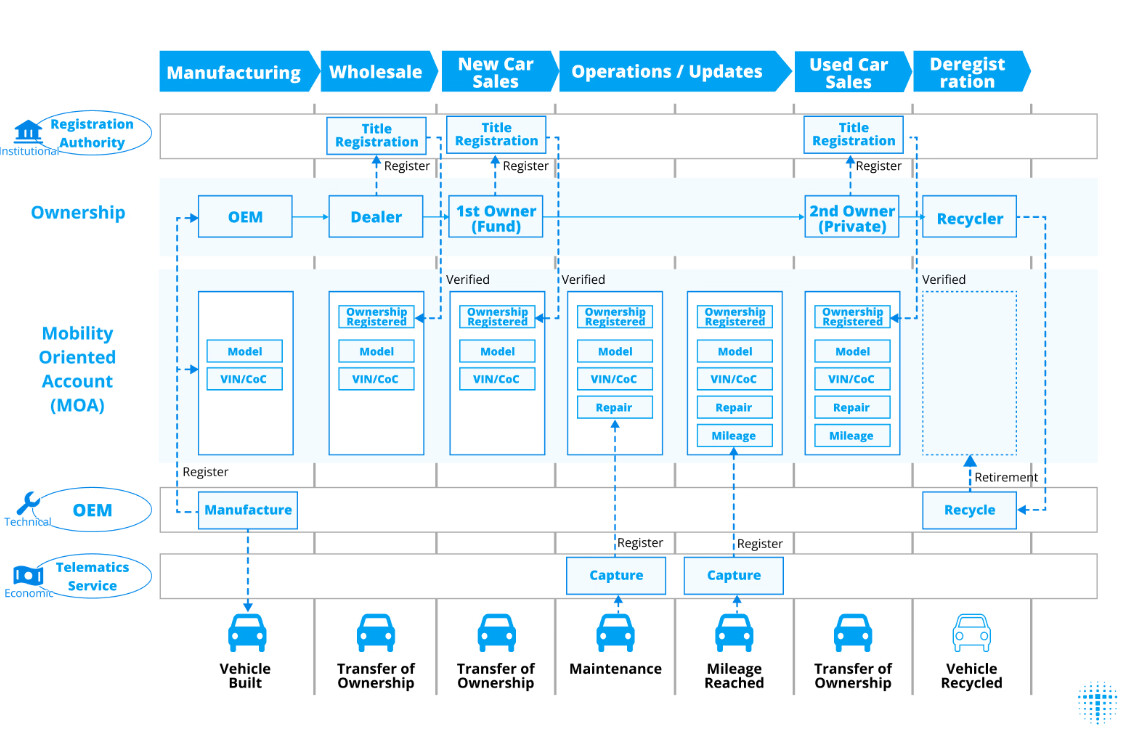

Share link:In this post: Avalanche and Toyota Blockchain Lab unveil research on a new blockchain layer to boost trust and mobility. Investors can raise their funds and track their robotaxis via the blockchain. The VehicleOwnership token is a simple ERC-721 token representing a vehicle’s ownership right.

Share link:In this post: • National Bank of Ukraine has no plans to add crypto assets to its reserves. • The move may undermine Ukraine’s integration with the EU, deputy governor says. • Digital asset reserves would go against IMF requirements as well, the NBU official warns.

Share link:In this post: Metaplanet Inc. has secured shareholder approval for a proposal that will enable it to raise as much as $3.8 billion via preferred shares. Metaplanet has recorded a 468% yield in the second quarter of 2025 and a treasury of 18,113 BTC. Over 170 businesses around the world now have Bitcoin on their books, worth a total of over $111 billion.

A new wave of liquidity is surging on the Solana chain, with World Liberty providing TWAP services, possibly led by the Trump family, sparking concerns about centralization and regulation. Summary generated by Mars AI This summary was generated by the Mars AI model, and its accuracy and completeness are still being iteratively improved.

The article reviews the evolution of cryptocurrency airdrops from their golden age to the current state of disorder, comparing high-quality early airdrops such as Uniswap with the low-quality airdrops seen today. It also explores the game dynamics between project teams and users. Summary generated by Mars AI. This summary was produced by the Mars AI model, and its accuracy and completeness are still undergoing iterative updates.

The article analyzes bitcoin's historical performance during Federal Reserve rate cut cycles, noting that it typically rises before rate cuts but falls back after the cuts are implemented. However, in 2024, this pattern was disrupted due to structural buying and political factors. The trend in September 2025 will depend on bitcoin's price performance before the rate cuts. Summary generated by Mars AI. The accuracy and completeness of this summary are still undergoing iterative updates.

10 highly promising idle mining projects.

- 02:10Vanguard executive: Bitcoin is a speculative asset, but may have practical applications during inflation or turmoilChainCatcher news, according to a report by Cointelegraph, John Ameriks, Global Head of Quantitative Equity at Vanguard, stated that bitcoin is purely a speculative asset, similar to collecting toys. Although John Ameriks expressed criticism, he also noted that in cases of high inflation in fiat currencies or political turmoil, this cryptocurrency could find real-world use cases beyond market speculation.

- 02:10A certain whale address spent 539.6 BNB to purchase 1.65 million RAVE tokens.According to ChainCatcher, monitored by Lookonchain, a whale address starting with 0x2ee6 spent 539.6 BNB (approximately $476,000) to purchase 1.65 million RAVE tokens 8 hours ago. The current value has reached $950,000, with an unrealized profit of over $474,000 and a return rate close to 100%. .

- 02:10An exchange: The Federal Reserve's "stealth QE" will support the crypto market, and the policy environment may be more accommodative than expected.ChainCatcher news, a certain exchange posted on social media stating that the Federal Reserve's announcement of a 25 basis point rate cut this week was in line with market expectations, but its plan to implement Treasury reserve management purchases within the next 30 days can at least be seen as a positive signal. The specific arrangements for this plan are as follows: · Initial operation size of $4 billion · Launch date is December 12. This liquidity injection comes earlier than expected, and reserve growth may continue until April 2026. We believe that the Federal Reserve's shift from balance sheet reduction to net injection can be regarded as "mild quantitative easing" or "stealth QE," which may provide support for the cryptocurrency market. Considering the reserve management purchase plan and the federal funds futures market's expectation of two more rate cuts (a total of 50 basis points) in the first nine months before 2026, the policy environment may be more accommodative than expected.