News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

The market may have entered a mild bear market.

Sideways movement is not the end, but the starting point for increasing positions.

Elon Musk's trillion-dollar compensation plan will be put to a vote on Thursday. The board of directors has made it clear: either retain him with this sky-high package, or face the risk of a potential stock price drop if he leaves.

Despite its recent slump, XRP’s improving on-chain metrics hint at a brewing rebound, with a decisive move above $2.35 potentially marking the start of a larger upward trend.

The market may have entered a mild bear market.

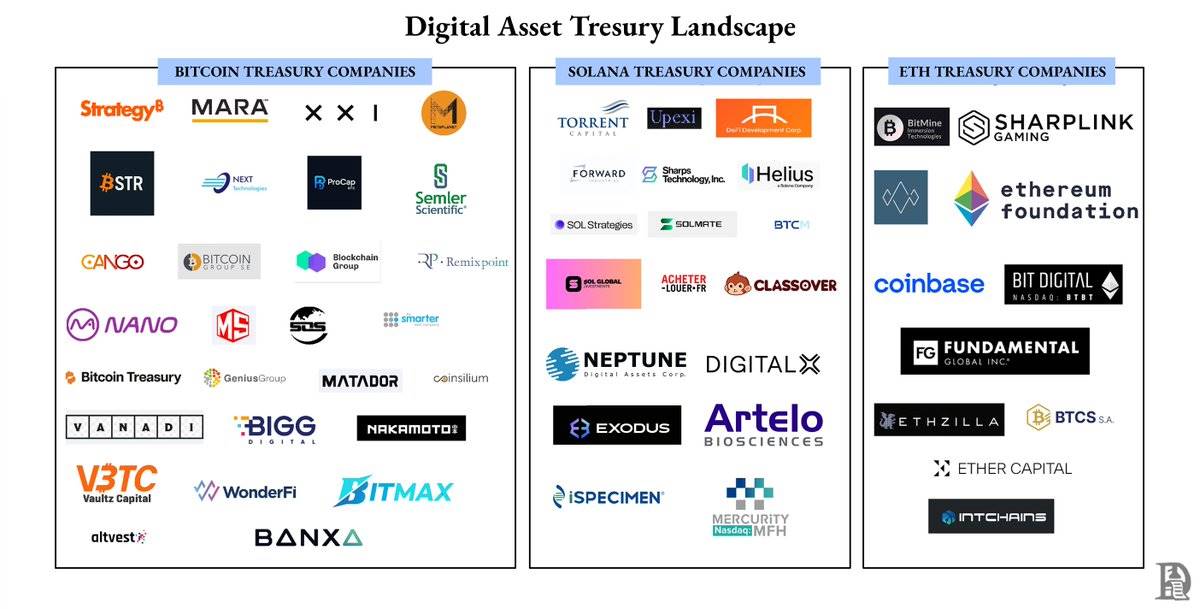

How did DATCo grow from a fringe corporate experiment into a powerful force spanning Bitcoin, Ethereum, and various altcoins, with a scale of 130 billions USD?

When "tokenization" loses its meaning: Why are we paying a premium to buy gold on-chain?

They imitated the asset and liability structure of Strategy, but did not replicate its capital structure.

In Brief Arthur Hayes shares insights on the genuine emergence of an altcoin season. Investors now focus on income-generating and share-distributing projects. This shift reflects the evolving maturity of the crypto market.