News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

The End of the Four-Year Cycle: Five Major Disruptive Trends in Cryptocurrency by 2026.

Hedera price dropped 3% despite $44 million ETF inflows, with investors showing preference for HBAR ETF over Litecoin, technical charts hint a potential 150% breakout to $0.50.

Mining-as-a-service is gaining traction in the UAE, with telecom giant du launching its cloud mining service via its sub-brand for local customers.

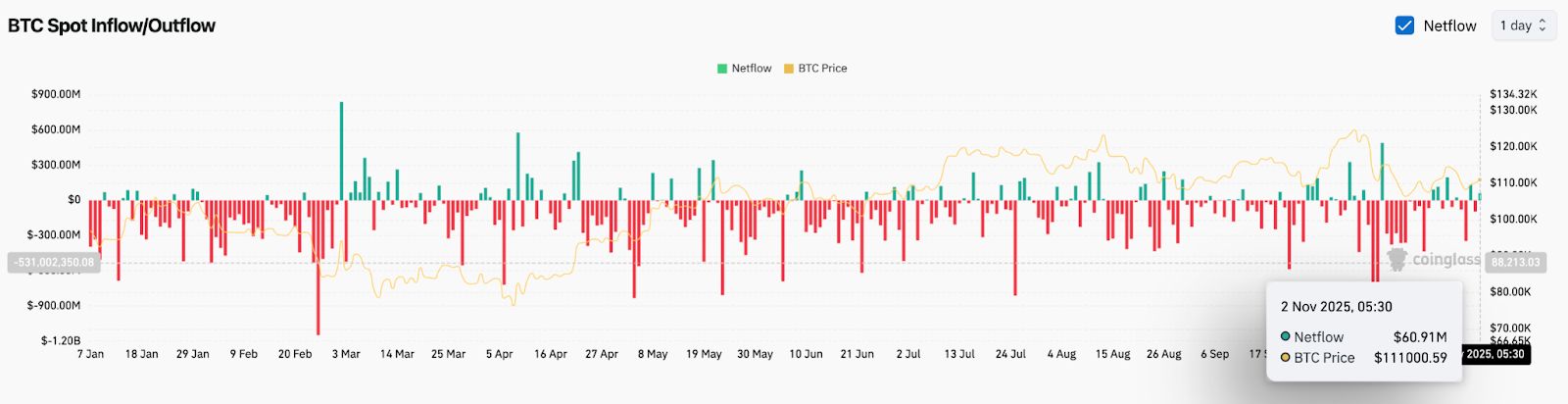

Bitcoin trades around $110,970 inside a $109K–$112K compression zone, signaling an imminent volatility breakout. Spot flows remain balanced with $60.9M inflows, while long-short ratios near 1.8 reflect cautious optimism. A breakout above $112,400 could trigger upside toward $114K–$117K, while $109K remains key support.

Quick Take The European Commission, supported by the president of the European Central Bank, will propose creating a single supervisor over crypto exchanges, stock exchanges, and clearing houses modeled after the U.S. SEC, FT reported. The proposal may extend the powers of the existing European Securities and Markets Authority to cover cross-border entities. The move is intended to make it easier for European firms to scale across borders without having to deal with scores of national and regional regulato