News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitcoin Whale’s $360M Transfer May Signal Further Rotation Into Ether and Potential Selling Pressure2Bitget Daily Digest(October 9)|UK FCA lifts retail ban on crypto ETNs; Linea to unlock 1.08 billion tokens tomorrow; Bitcoin ETF sees net inflow of 7,743 BTC in a single day.3BlackRock’s Bitcoin ETF May Signal Institutional Shift as Record Crypto ETF Inflows Push Bitcoin to $126,223

Price predictions 9/26: BTC, ETH, XRP, BNB, SOL, DOGE, ADA, HYPE, LINK, AVAX

Cointelegraph·2025/09/26 21:36

Bullish Bitcoin bets unraveled below $110K: Will October revive risk-on sentiment?

Cointelegraph·2025/09/26 21:36

AiCoin Daily Report (September 26)

AICoin·2025/09/26 21:10

Plasma Mainnet Beta Launches With XPL Token Trading at $10.5 Billion FDV

TheCryptoUpdates·2025/09/26 20:51

Ethereum whales accumulate $1.6 billion in ETH as price falls below $4,000

TheCryptoUpdates·2025/09/26 20:51

BlackRock requires strong investor demand before launching altcoin ETFs

TheCryptoUpdates·2025/09/26 20:51

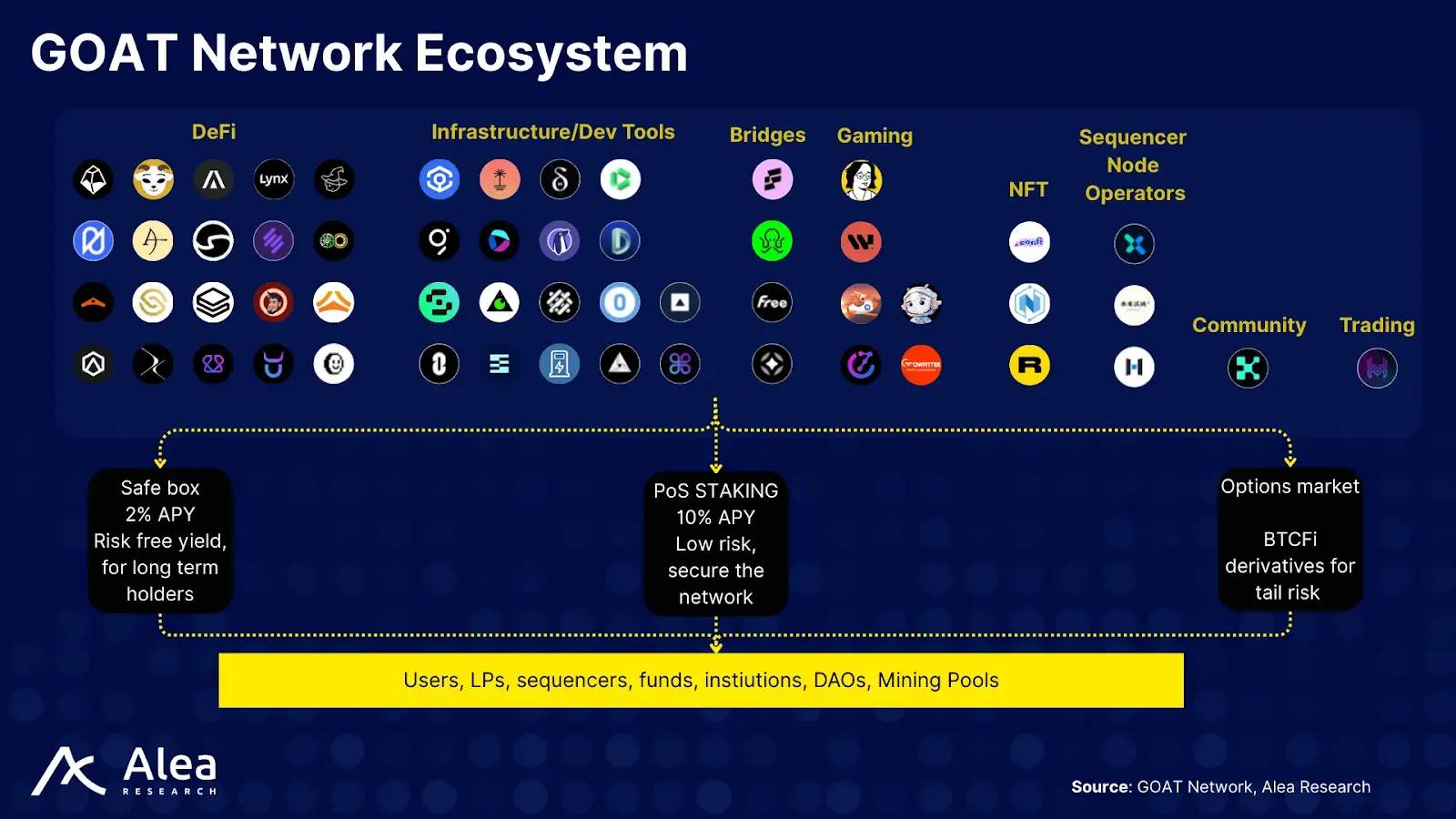

The "Fog" and "Lighthouse" of Bitcoin L2: GOAT Network's Path Choices and Industry Baseline

When everyone can call themselves Layer2, a more fundamental question emerges: What does the Bitcoin ecosystem truly need?

深潮·2025/09/26 20:24

Japan’s Crypto Market Surges 120% as Stablecoins Take Over

Coindoo·2025/09/26 19:18

Flash

- 09:41Data: Over $5.3 billion worth of BTC and ETH options on Deribit are about to expire, with the BTC max pain price at $117,000.ChainCatcher News, according to Deribit data, over $5.3 billions worth of cryptocurrency options will expire tomorrow. Among them, BTC options have a notional value of $4.3 billions, with a Put/Call ratio of 1.12 and a max pain price of $117,000; ETH options have a notional value of $940 millions, with a Put/Call ratio of 0.9 and a max pain price of $4,430. Currently, BTC traders are clearly divided between the $110,000 put options and the $120,000 call options, while ETH capital flows are more bullish.

- 09:40Arthur Hayes: The new popular narrative in TradFi is the "devaluation trade," and they don't care about crypto's "four-year cycle"ChainCatcher News, BitMEX co-founder Arthur Hayes published an article stating that the new popular narrative in TradFi is the "debasement trade." It took them nearly twenty years to notice. Don't think for a second that they will forget this just because of bitcoin's "four-year cycle." Now it's the bankers' turn to sell gold, cryptocurrencies, and tech stock derivatives to their clients. The so-called "debasement trade" refers to investors seeking to protect wealth or gain returns in an environment of currency devaluation by allocating their asset portfolios accordingly. This usually involves investing in asset classes that perform well during periods of inflation or currency debasement.

- 09:40The six Hong Kong virtual asset ETFs recorded a total trading volume of HKD 21.3512 million today.According to Jinse Finance, Hong Kong stock market data shows that as of the close, the total trading volume of the six Hong Kong virtual asset ETFs today was 21.3512 million HKD. Among them: China Asset Management Bitcoin ETF (3042.HK) had a trading volume of 8.53 million HKD, China Asset Management Ethereum ETF (3046.HK) had a trading volume of 6.22 million HKD, Harvest Bitcoin ETF (3439.HK) had a trading volume of 863,000 HKD, Harvest Ethereum ETF (3179.HK) had a trading volume of 1.85 million HKD, Bosera HashKey Bitcoin ETF (3008.HK) had a trading volume of 3.01 million HKD, and Bosera HashKey Ethereum ETF (3009.HK) had a trading volume of 878,200 HKD.