News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily|Gold and Silver Turn Positive After Volatility; Huang Renxun Clarifies OpenAI Investment; SpaceX Applies for Million Satellites (February 2, 2026)2Bitcoin Plunge Could Get Much Worse as Death Cross Gains Power3 Crypto Market Today Turns Red But LTH Data Signals Structural Stability

Bunni DEX Shuts Down, Cites Recovery Costs After $8.4M Exploit

CryptoNewsNet·2025/10/23 10:39

Revolut Secures MiCA License in Cyprus, Expanding Regulated Crypto Services Across EU

CryptoNewsNet·2025/10/23 10:39

OpenAI Launches ChatGPT Atlas, a Browser With Integrated AI

Cointribune·2025/10/23 10:39

Aave formalizes a massive annual buyback plan financed by DeFi

Cointribune·2025/10/23 10:39

Hyperliquid (HYPE) To Surge Further? Key Harmonic Pattern Signals Potential Upside Move

CoinsProbe·2025/10/23 10:36

Solana Price Eyes Bullish Crossover as New Addresses Hit Monthly High

Solana’s network growth and bullish MACD signal hint at recovery potential. A breakout above $192 may send SOL toward $200, but losing $183 risks deeper losses.

BeInCrypto·2025/10/23 10:30

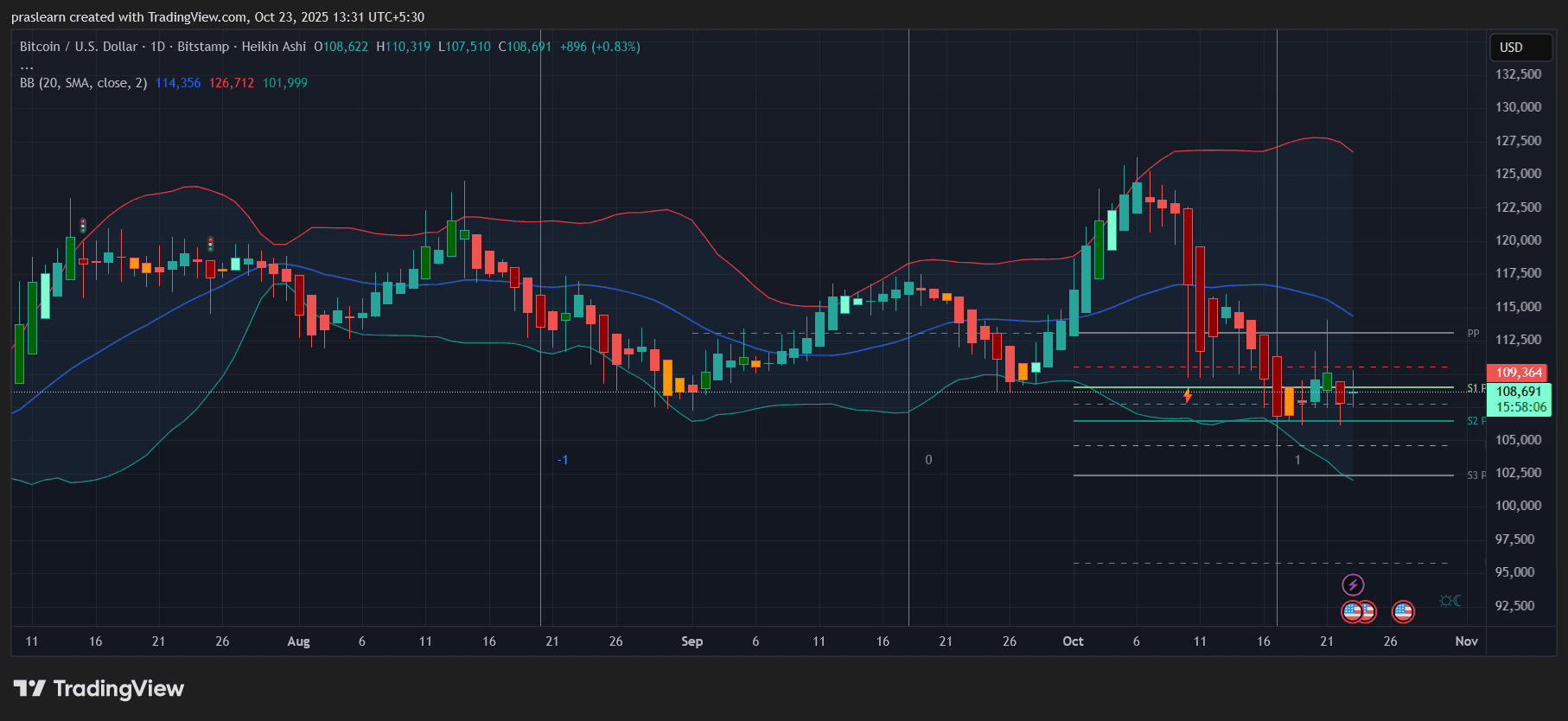

Bitcoin price prediction: BTC reclaims $109k as analysts predict dump

Coinjournal·2025/10/23 10:27

Something Big Is About to Happen to Bitcoin Price

Cryptoticker·2025/10/23 10:15

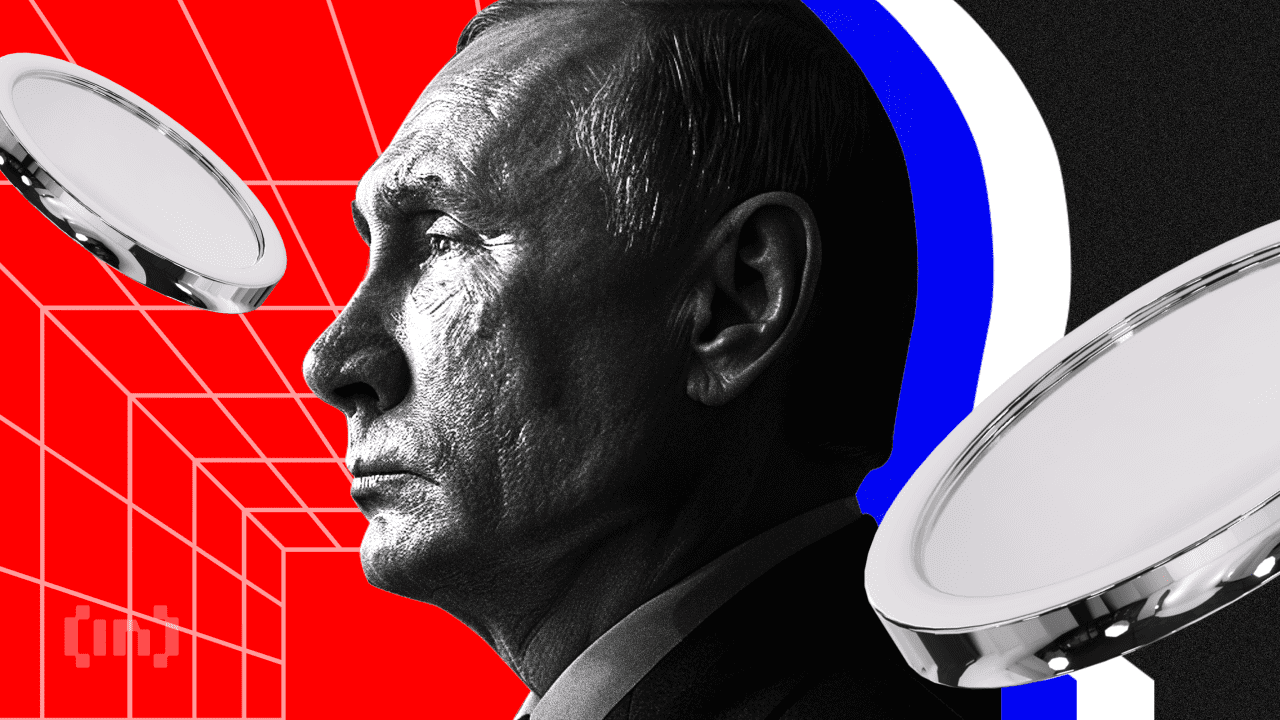

EU Bans Russia-Backed Stablecoin In First Crypto Sanction

Brussels sanctioned a ruble-backed stablecoin used to bypass SWIFT, marking its first crypto-specific penalty on Russia. The EU is now preparing a MiCA-compliant euro token to assert financial sovereignty and counter alternative payment networks.

BeInCrypto·2025/10/23 10:10

Can Google’s 13,000× “quantum echoes” put Bitcoin’s keys on a clock?

CryptoSlate·2025/10/23 10:00

Flash

18:34

TD Cowen says that Trump's "personal intervention" may be a necessary condition for advancing cryptocurrency market structure legislation.According to a report by Bijie Network, TD Cowen stated that without President Trump personally intervening to broker a compromise, cryptocurrency market structure legislation is unlikely to pass in Congress. Meanwhile, industry and banking groups are holding meetings to discuss key issues such as stablecoin rewards, with banks viewing stablecoin rewards as a threat to deposits. Analysts pointed out that there are deeper political obstacles, including the need for strong support from the Democrat-controlled Senate to pass stricter regulatory provisions, which may face opposition from the industry.

18:21

The Federal Reserve's overnight reverse repurchase agreement usage reached $1.0415 billion on Monday.The Federal Reserve's overnight reverse repurchase agreement (RRP) usage on Monday was $1.0415 billion.

18:10

Bostic: Current policy is not highly restrictive, no rate cuts expected in 2026ChainCatcher News, according to Golden Ten Data, Federal Reserve's Bostic stated that the current policy is not highly restrictive, and perhaps one or two rate cuts would be enough to reach a neutral level. He previously predicted that there would be no rate cuts before 2026.

News