News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily|Gold and Silver Turn Positive After Volatility; Huang Renxun Clarifies OpenAI Investment; SpaceX Applies for Million Satellites (February 2, 2026)2Bitcoin Plunge Could Get Much Worse as Death Cross Gains Power3 Crypto Market Today Turns Red But LTH Data Signals Structural Stability

VanEck: Bitcoin’s Dip Is a Mid-Cycle Reset

VanEck says Bitcoin’s October pullback signals a mid-cycle reset, not a new bear market.Market Correction or Cycle Reset?Leverage and Liquidity Tell a Different StoryWhat This Means for Investors

Coinomedia·2025/10/23 02:57

Massive XRP Liquidity Cluster Emerges Above $3.2 as Price Holds Key $2.38 Support

CryptoNewsNet·2025/10/23 02:39

Crypto ETF Boom: 155 Filings Across 35 Assets, Analyst Backs Index Funds

CryptoNewsNet·2025/10/23 02:39

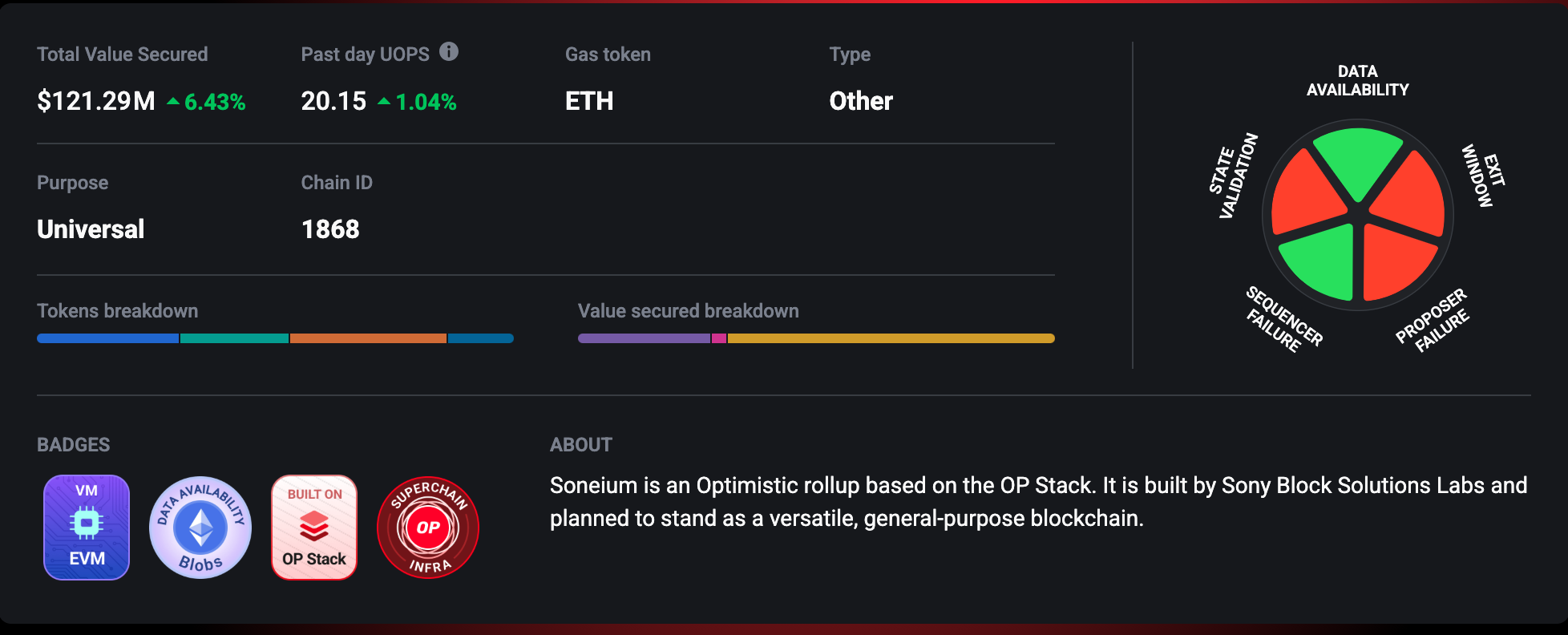

Japan’s Soneium Bets Big: Sony, SBI, and Startale’s Bid to Build a Global Layer-2 Powerhouse

CryptoNewsNet·2025/10/23 02:39

Citi Gives “Buy” Rating to Strategy Amid Bitcoin Upside—Warns of High Volatility Risk

Cointribune·2025/10/23 02:33

Crypto Wallets Join Forces to Launch Global Phishing Defence Network

DeFi Planet·2025/10/23 02:30

Kadena Shuts Down Operations Amid Market Pressures, Blockchain to Remain Decentralized

DeFi Planet·2025/10/23 02:30

Chainlink Labs Proposes On-chain Compliance Framework to U.S. Treasury

DeFi Planet·2025/10/23 02:30

Flash

18:34

TD Cowen says that Trump's "personal intervention" may be a necessary condition for advancing cryptocurrency market structure legislation.According to a report by Bijie Network, TD Cowen stated that without President Trump personally intervening to broker a compromise, cryptocurrency market structure legislation is unlikely to pass in Congress. Meanwhile, industry and banking groups are holding meetings to discuss key issues such as stablecoin rewards, with banks viewing stablecoin rewards as a threat to deposits. Analysts pointed out that there are deeper political obstacles, including the need for strong support from the Democrat-controlled Senate to pass stricter regulatory provisions, which may face opposition from the industry.

18:21

The Federal Reserve's overnight reverse repurchase agreement usage reached $1.0415 billion on Monday.The Federal Reserve's overnight reverse repurchase agreement (RRP) usage on Monday was $1.0415 billion.

18:10

Bostic: Current policy is not highly restrictive, no rate cuts expected in 2026ChainCatcher News, according to Golden Ten Data, Federal Reserve's Bostic stated that the current policy is not highly restrictive, and perhaps one or two rate cuts would be enough to reach a neutral level. He previously predicted that there would be no rate cuts before 2026.

News