News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

- Sharps Technology raised $400M via private placement, aiming to become a top Solana (SOL) institutional holder with potential $1B total funding. - The firm secured a 15% discount on $50M SOL from Solana Foundation and hired advisor James Zhang to scale its treasury strategy. - Proceeds will prioritize SOL acquisitions while shares surged 50% post-announcement, driven by institutional confidence and insider purchases. - The move mirrors MicroStrategy's Bitcoin strategy, positioning Sharps as a public vehi

- U.S. government publishes GDP data on Ethereum and Solana, elevating them as economic infrastructure over Bitcoin. - Ethereum's $300B GDP-like metrics (TVL, fees) and Solana's 65,000 TPS position them as programmable finance engines. - Bitcoin's 7 TPS and lack of on-chain programmability limit its role to macro hedge vs. Ethereum/Solana's broader utility. - Ethereum 2.0 upgrades and Solana's PoH consensus drive scalability, attracting $72B in institutional crypto assets.

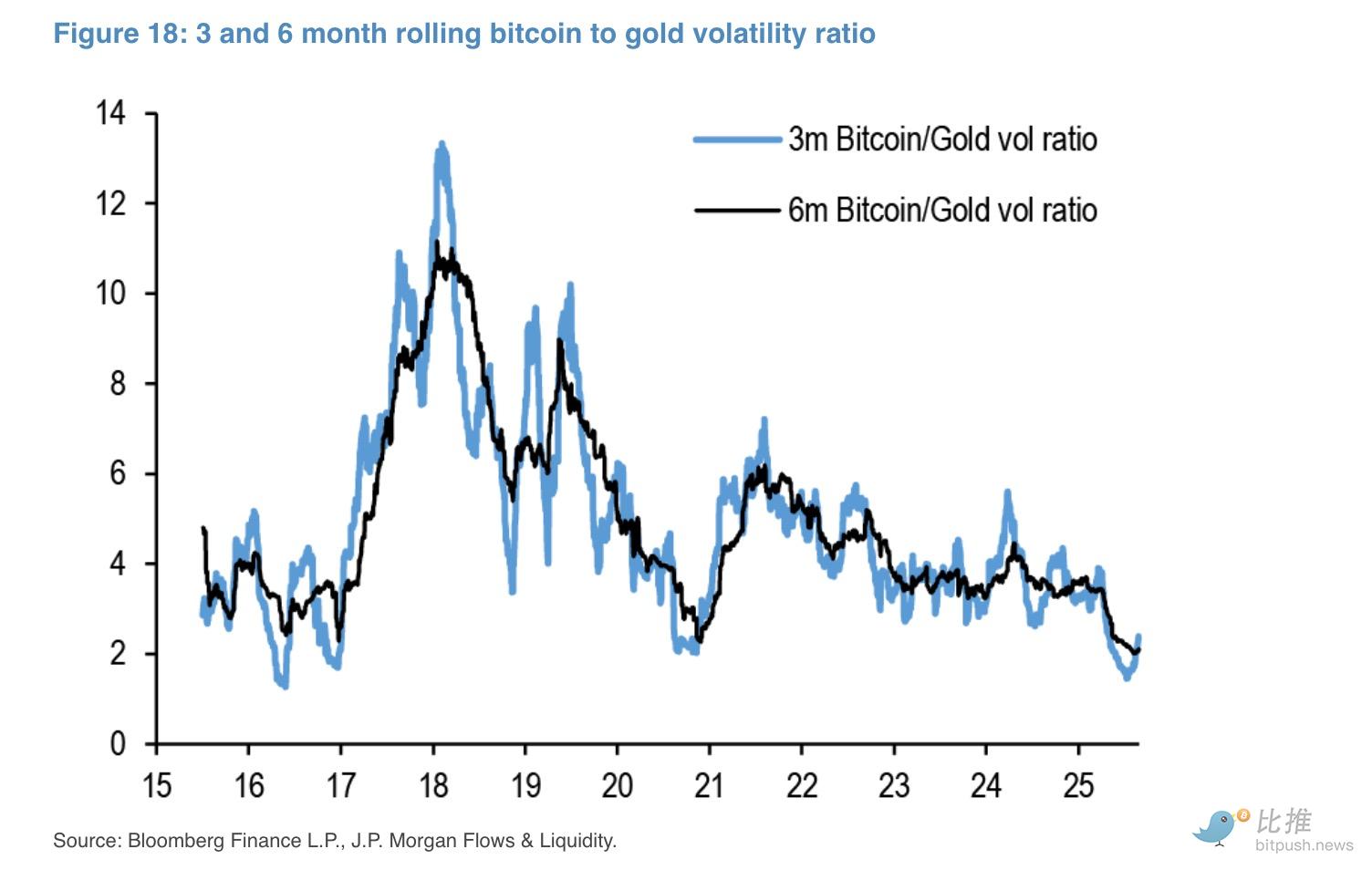

This Wall Street giant has clearly stated that bitcoin is significantly undervalued compared to gold.

Although stablecoins, like traditional fiat currencies, rely on sovereign credibility, they are able to separate trust in sovereignty from trust in corporate power.

- XRP faces critical $3.10 resistance, with technical indicators suggesting potential breakout into $3.60+ range via bullish pennant pattern. - SEC's October 2025 ETF decision and RLUSD's $1.3T transaction volume highlight institutional adoption accelerating XRP's mainstream acceptance. - Whale accumulation of $3.8B XRP since July 2025 signals anticipation of price surge, reinforcing infrastructure-driven utility over speculation. - Break above $3.10 could trigger $4-$5 retest mirroring 2017 rally, while b

- Meme coins like DOGE and PEPE rely on social media hype and Bitcoin trends, lacking real-world utility despite volatile price swings. - Remittix (RTX) targets the $19T remittance market with crypto-to-bank infrastructure, projecting 35x returns by 2026 through partnerships and adoption. - Investors seeking 1,000x returns must weigh speculative meme coin risks against RTX's utility-driven growth tied to tangible financial solutions and institutional backing.

- Chainlink partners with U.S. Department of Commerce to bring real-time macroeconomic data (GDP, PCE) onto blockchain networks via Data Feeds, enabling automated trading and inflation-linked assets. - The initiative aligns with U.S. policy goals, modernizing public infrastructure while supporting institutional adoption through ISO 27001/SOC 2 compliance and cross-chain asset tokenization. - Chainlink's Automated Compliance Engine and Onchain Compliance Protocol embed KYC/AML rules into smart contracts, at

- Whale activity in 2025 drives $1.1B BTC transfers and $2.5B ETH accumulation, shifting capital from Bitcoin to altcoins and Ethereum derivatives. - Institutional whales exploit fragile altcoin/DEX liquidity, triggering flash crashes and inflows to AAVE, UNI, and WLD amid Ethereum's deflationary appeal. - Retail investors leverage MVRV/SOPR metrics and TVL diversification to navigate whale-driven volatility, while regulatory shifts like U.S. BITCOIN Act reshape market dynamics.

- Early Dogecoin investors are pivoting to utility-driven altcoins like Remittix (RTX) in 2025, prioritizing real-world infrastructure over meme-driven speculation. - RTX’s PayFi platform targets the $19 trillion remittance market with real-time fiat conversion and low fees, offering scalability beyond DOGE’s niche use cases. - Backers cite RTX’s $21.7M presale, BitMart listing, and deflationary tokenomics as key advantages, contrasting with DOGE’s stagnant price and speculative risks. - The shift reflects

- 01:16After the 1011 flash crash, insider whales increased their short positions by adding 19,108.69 ETH, bringing their latest holdings to 120,094.52 ETH.Jinse Finance reported that, according to on-chain analyst @ai_9684xtpa, ETH briefly dropped to the order placement level. After the flash crash at 1011, all insider whales who opened short positions have completed their trades and increased their holdings by 19,108.69 ETH. The latest position now stands at 120,094.52 ETH, valued at $392 million, with an opening price of $3,177.89 and an unrealized profit of $10.13 million.

- 01:16A certain whale withdrew 101,000 SOL from a certain exchange 10 hours ago, accumulating a total of 628,000 SOL.According to Jinse Finance, Onchain Lens monitoring shows that a certain whale address withdrew 101,365 SOL, worth approximately $13.89 million, from an exchange 10 hours ago. Currently, this whale holds a total of 628,564 SOL (worth about $84.13 million), of which 519,217 SOL are stored in the wallet and 109,348 SOL are staked.

- 01:11The US OCC has issued a warning to Wall Street regarding the debanking of industries such as digital assets, stating that such practices are illegal.ChainCatcher news, according to CoinDesk, U.S. President Trump has taken action against the country's debanking measures targeting controversial industries such as digital assets, prompting the Office of the Comptroller of the Currency (OCC) to release a new report. This report further confirms past practices and warns that banks suspected of involvement may face penalties. This brief OCC report reviewed the nine largest national banks in the United States, concluding that these banks have established both public and non-public policies restricting certain industries from accessing banking services, including requiring enhanced review and approval before providing financial services. The report states that some major banks have set higher entry thresholds for controversial or environmentally sensitive businesses, or for activities that conflict with the banks' own values. Financial giants such as JPMorgan, Bank of America, and Citigroup are specifically mentioned, with links to their past public policies, especially those related to environmental issues. The report states: "The Office of the Comptroller of the Currency intends to hold these banks accountable for any illegal debanking activities, including referring relevant cases to the Attorney General." However, it is currently unclear which specific laws these activities may have violated.