News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

The victim is an MEV bot.

After the October 11 crash, Bitcoin whales have reawakened. Increased inflows, wallet reactivations, and rising exchange ratios reveal growing whale dominance — and potential short-term volatility ahead.

ChainOpera’s (COAI) price has surged over 50% in a day after breaking out of a symmetrical triangle on the 4-hour chart. On-chain signals show improving buying pressure, but weakening momentum hints that the rally might pause before extending. A clean move above $31 could send COAI to a new all-time high, yet one key risk remains that could trigger a short-term pullback first.

Cardano sees strong inflows and renewed investor interest, but whale sell-offs worth $120 million are limiting ADA’s recovery potential.

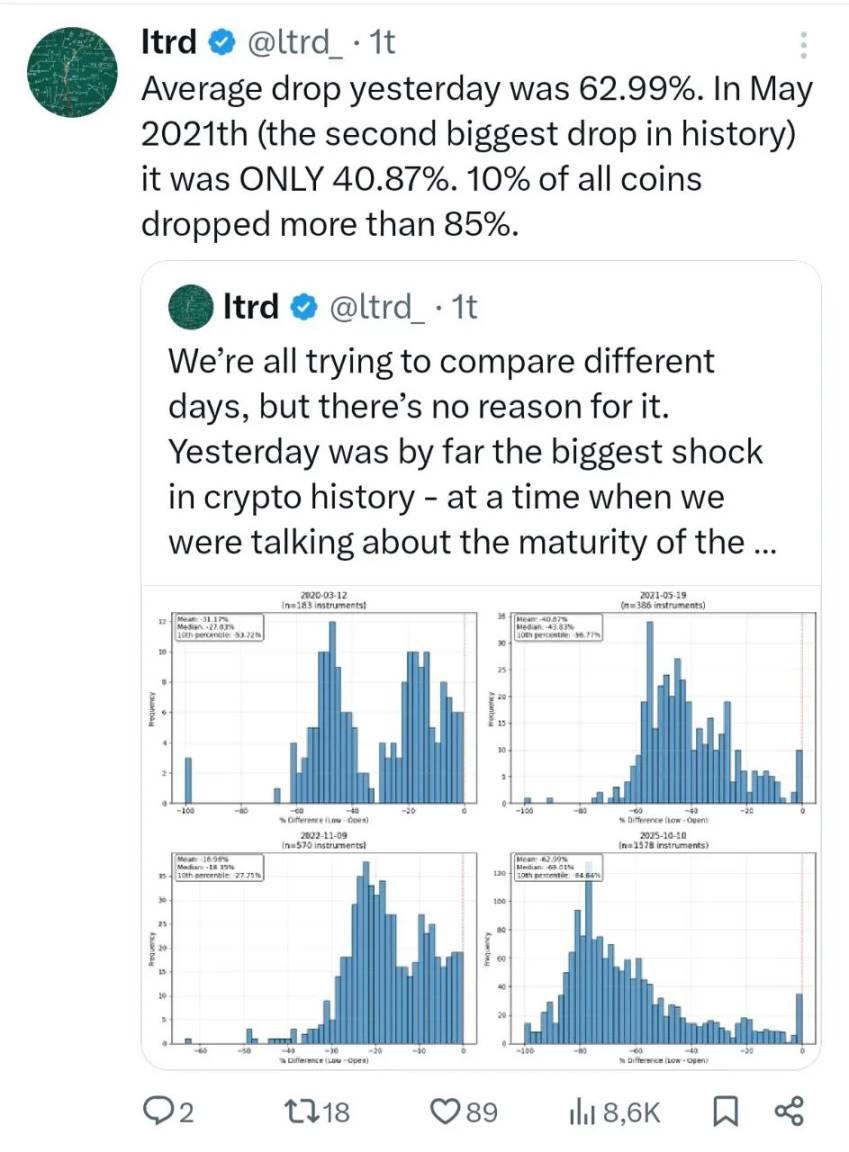

In the post-crash era, where should cryptocurrency investment go from here?

AINFT aims to build a decentralized AI application aggregation ecosystem, allowing users to freely explore and utilize various AI Agent digital assistants just like using an "App Store."

This article reports on the largest operation to date by US and UK law enforcement targeting the Cambodian Prince Group transnational crime organization and its leader, Chen Zhi. The US Department of Justice (DOJ) seized nearly 130,000 bitcoins (worth approximately $15 billion at the time), marking the largest asset seizure in US history. The operation aims to crack down on "pig-butchering" scam networks and modern slavery scam compounds spread across Southeast Asia.