News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitcoin ETFs rebound with $166.5M inflows despite BTC price dip2Crypto Allocation in Asia: BlackRock’s Stunning $2 Trillion Prediction Reveals Institutional Shift3Solana Extends Losses Below $88 as Crypto Market Downturn Deepens

Why is Bitcoin falling? Global tension, withdrawals, and a banking crisis explain BTC's price drop

Portalcripto·2025/10/18 21:18

SEC Approves 21Shares Spot Solana ETF: Traders Point to $SOL Price Directions

Portalcripto·2025/10/18 21:18

Is Altseason 2025 Dead? Analyst Points to Three Signs of Altcoin Season's Return

Portalcripto·2025/10/18 21:18

Solana Blockchain Gets Faster with Alpenglow Update with SIP SIMD-0337

Portalcripto·2025/10/18 21:18

Cardano (ADA) Cryptocurrency Tests Key Supports, Investors Bet on Recovery

Portalcripto·2025/10/18 21:18

Crypto market price predictions: Zcash, Shiba Inu, Morpho

CryptoNewsNet·2025/10/18 21:15

Ethereum Price Outlook: Asian Investors Unite for $1B ETH Treasury

CryptoNewsNet·2025/10/18 21:15

Dogecoin Price Set To Go On A 2,000% Cyclical Surge To $4

CryptoNewsNet·2025/10/18 21:15

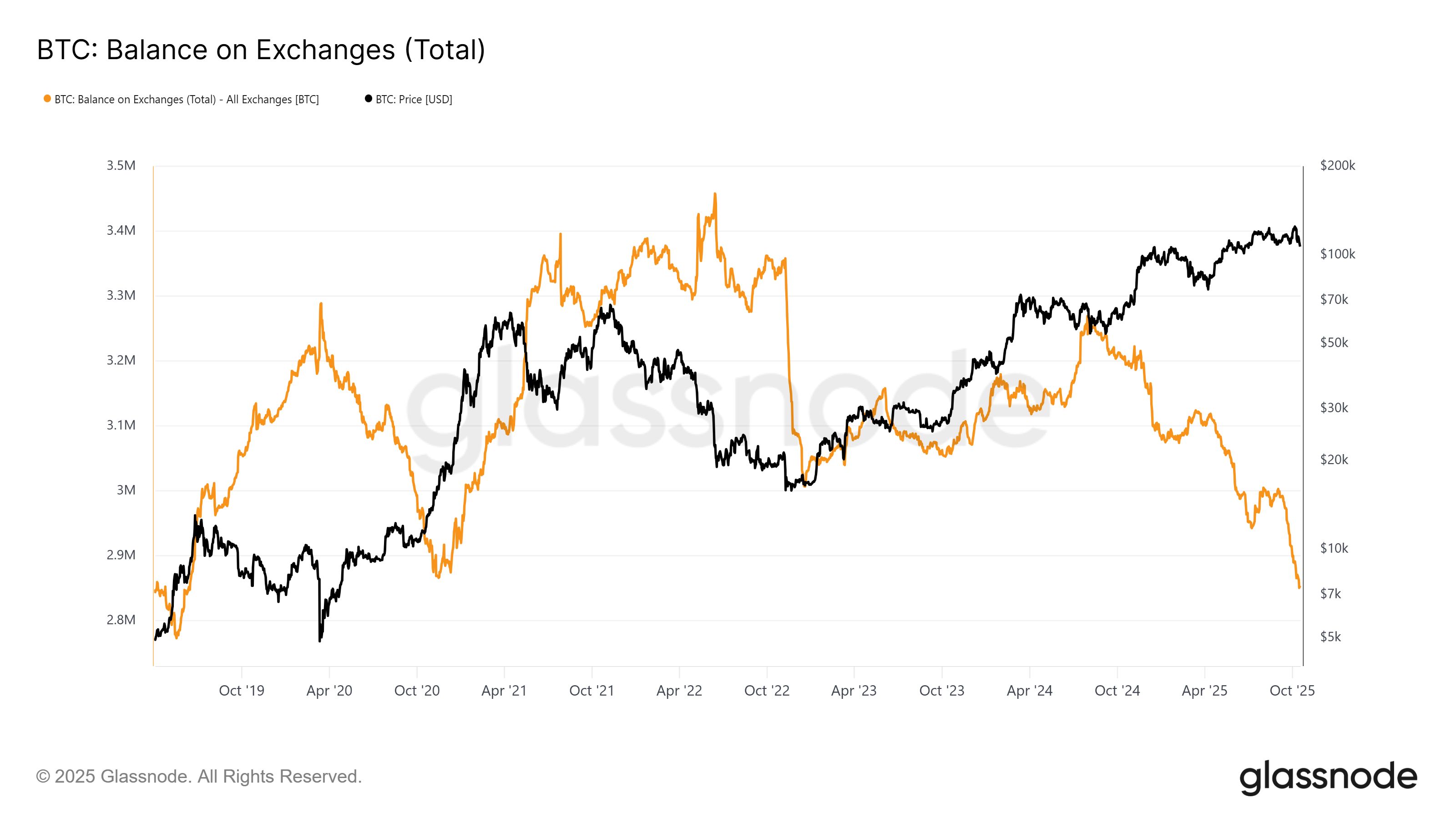

Bitcoin Exchange Supply Falls To 6-Year Low — A Signal To Buy The Dip?

CryptoNewsNet·2025/10/18 21:15

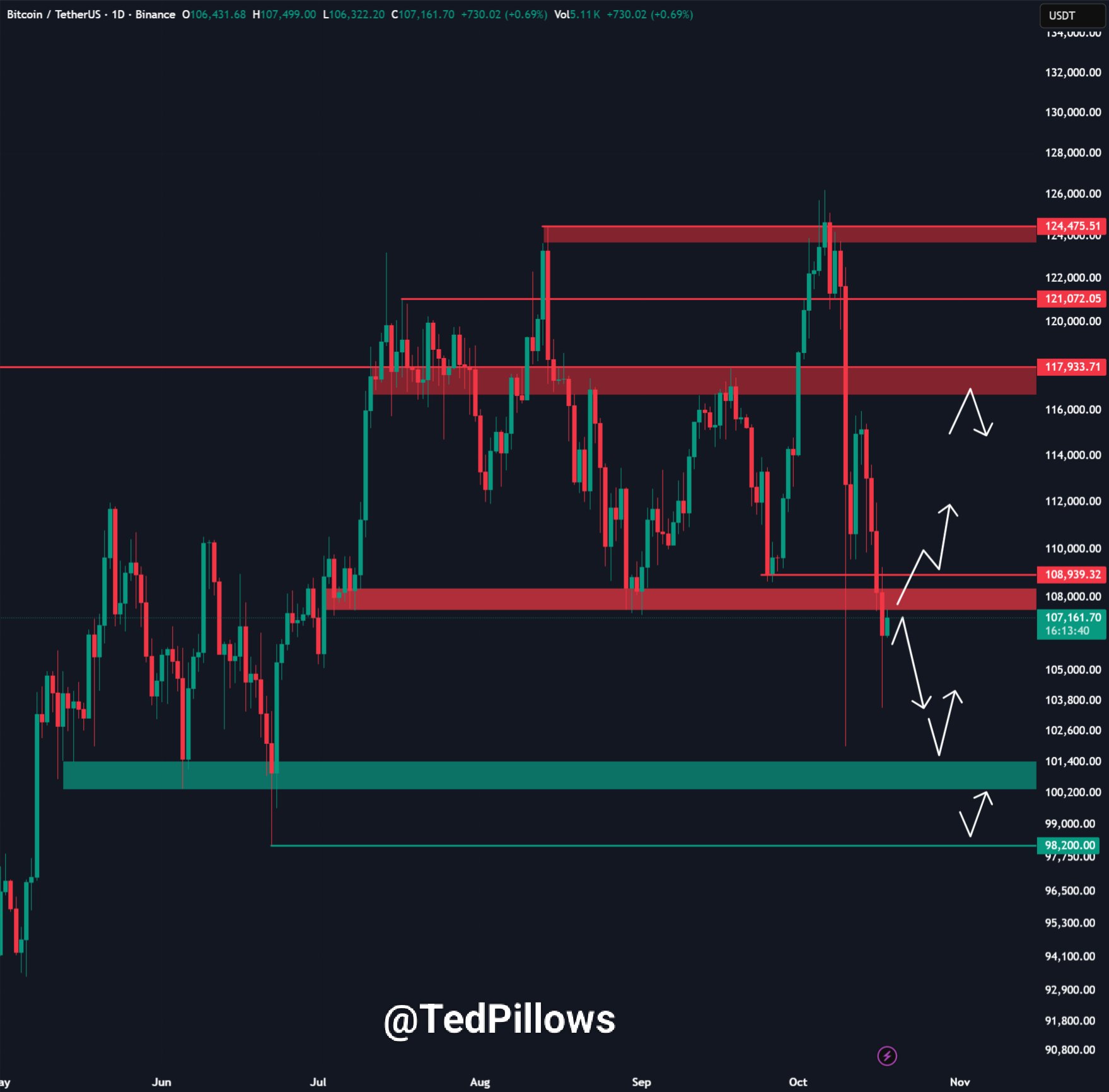

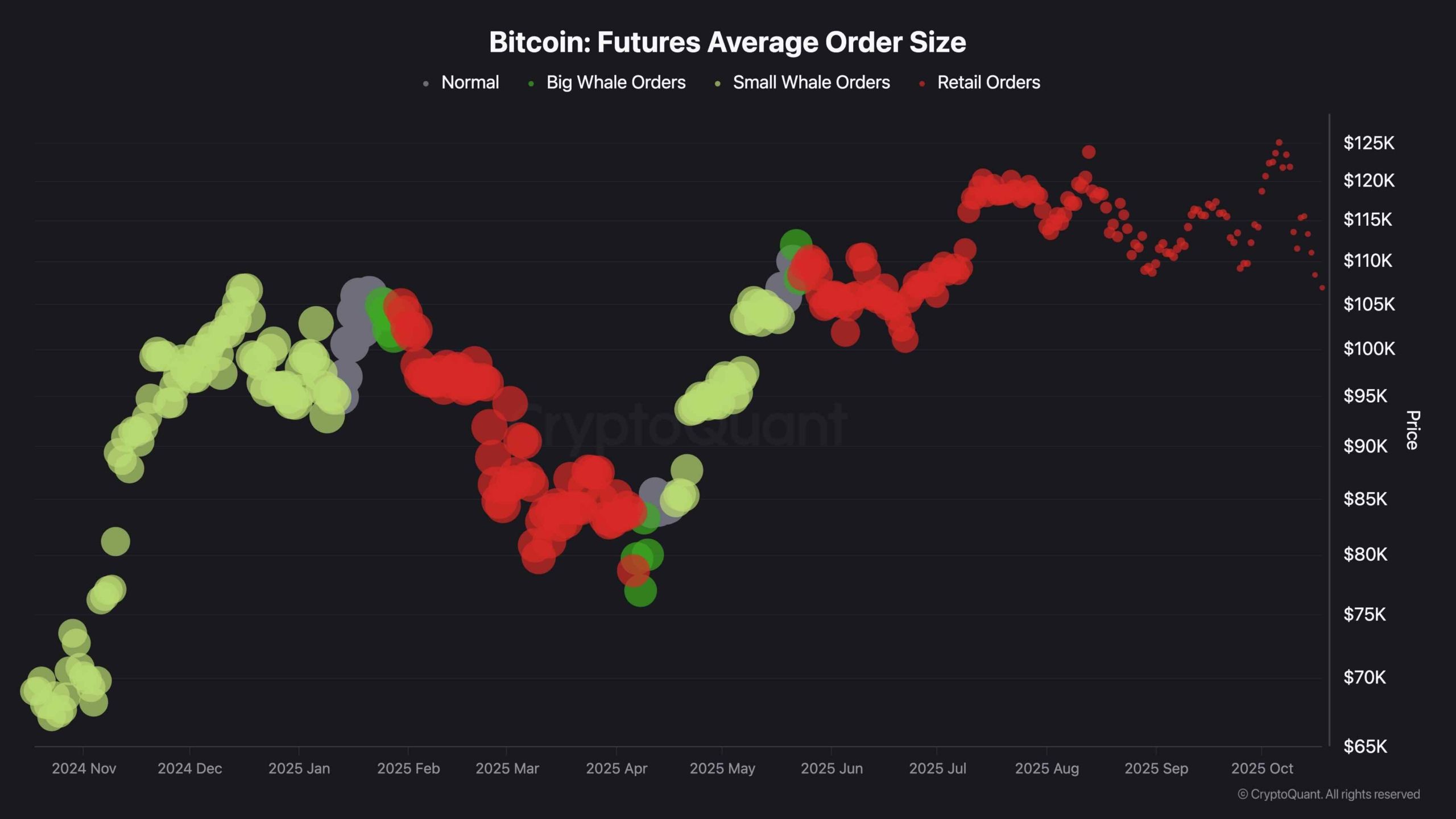

Bitcoin Price Analysis: First Bearish Signs Appear as BTC Falls by $20K From ATH

CryptoNewsNet·2025/10/18 21:15

Flash

05:05

On-chain indicators suggest bitcoin may be approaching a bear market bottomCryptoQuant data shows that the cost basis of long-term bitcoin holders is approaching the breakeven line, a level that has historically appeared before the bottom of bear markets. After the release of strong non-farm payroll data, traders are now focusing on the delayed January inflation data. Expectations of prolonged high interest rates may lead to further declines in coin prices. Some believe that panic selling may be nearing its end, market sentiment is in the extreme fear zone, and there has been significant accumulation activity near the $60,000 support level.

05:01

Indian software stocks continue to decline amid concerns over AI disruptionGlonghui, February 13th|Due to investors' concerns that artificial intelligence may disrupt their business models, and continued avoidance of this sector, Indian software company stocks fell on Friday. This month, Indian software service providers and their global peers (including IBM, Accenture, and Cognizant Technology) have all experienced significant sell-offs due to worries about AI disruption. In a report dated February 12, Citigroup analyst Scott T Chronert wrote: “We believe the recent performance of the software services sector reflects the market’s concerns over AI disruption, leading to a compression in terminal valuation multiples.” Although short-term fundamentals remain solid, the market is already pricing in a decline in future profit margins and lower terminal values. India’s two largest software exporters—Tata Consultancy Services (TCS) and Infosys—led the decline, both dropping more than 6% at one point before recovering some losses. The India Nifty IT Index fell 5.2%, hitting its lowest intraday level since April 7 last year; the index has plunged 16% this year, erasing all of its approximately 13% gains for 2025.

05:01

Optimism will collaborate with Succinct to introduce zero-knowledge proof technology to SuperchainForesight News reported that Optimism will collaborate with ZK proof software Succinct to introduce zero-knowledge proof technology to Superchain. OP Succinct will become the preferred zero-knowledge proof solution for OP Stack Rollups. As part of the collaboration, the OP mainnet will integrate OP Succinct, expanding Succinct's coverage to 90% of the Rollup market.

News