News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | U.S.-Iran Conflict Escalates Driving Oil Prices Surge; Private Credit Redemption Pressure Intensifies; Tesla Approved for Indirect Stake in SpaceX (March 13, 2026)2Asian stocks slide as Iran war keeps oil near $100, dents rate-cut bets3BlackRock’s staked Ethereum ETF sees $15.5M volume on debut

Meta's 0.39% Rally on $8.6B Volume Ranks 10th as Ackman's Stake and AI Pact Fuel Investor Optimism

101 finance·2026/03/09 22:22

Amazon Rises 0.13% with $11.38B in Volume as Brazil's Amazon Fuels Seventh-Highest Trading Day

101 finance·2026/03/09 22:22

Microsoft's AI Copilot Strategy Boosts Stock 0.11% Despite 15% YTD Drop $12.2B Volume Ranks Fifth

101 finance·2026/03/09 22:22

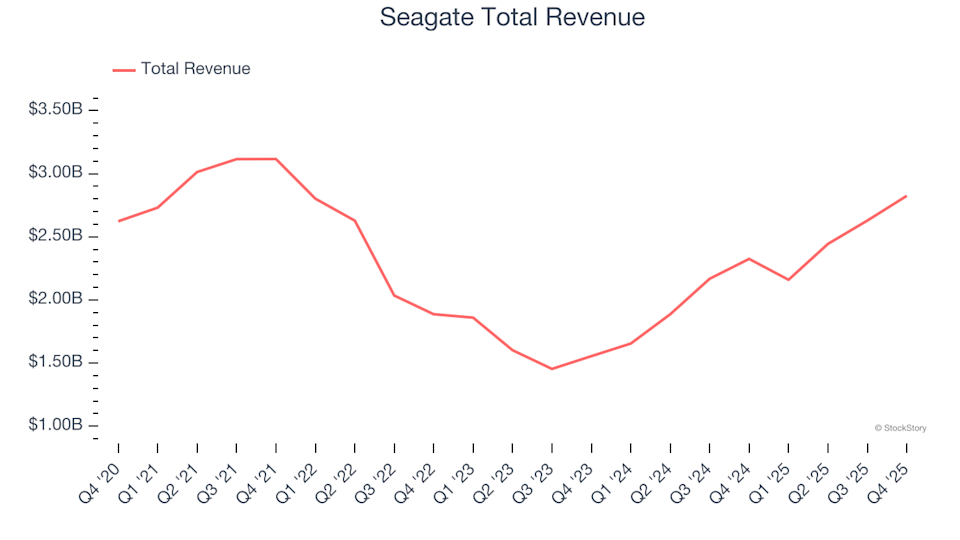

Q4 Financial Overview: Comparing Seagate (NASDAQ:STX) With Other Semiconductor Companies

101 finance·2026/03/09 22:21

US Dollar and USD/JPY Gains Falter as Optimism Grows for Iran Conflict Easing

101 finance·2026/03/09 22:21

Beta Technologies Nears Milestone: MV250’s Maiden Flight This Year May Confirm $1.7B Military Investment

101 finance·2026/03/09 22:15

This year's surge in defense stocks has mostly lost momentum as conflict continues in the Middle East.

101 finance·2026/03/09 22:12

Top Equity Analyses for Visa, Chevron & Toyota Motor

101 finance·2026/03/09 22:09

Flash

03:06

A user lost over $50 million in a single-coin trade due to high slippage, calling it only the "second worst trade."Odaily reported that on-chain analyst Ai Yi posted on the X platform, stating that the individual who lost over $50 million due to high slippage in single-token trading has surfaced. The individual said that they saw the slippage warning during the transaction but believed it would not have serious consequences and still chose to execute the trade. This transaction was described by them as "the second worst trade."

03:02

The Federal Reserve will launch a 90-day consultation period for the Basel III proposal, with bitcoin facing a 1250% risk weight.PANews, March 13 — According to Bitcoin.com, Michelle Bowman, Vice Chair for Supervision at the Federal Reserve, stated that U.S. regulators will propose rules for implementing the final phase of Basel III in the coming weeks, expected to be released during the week of March 17–21, followed by a 90-day public comment period. The proposal is being coordinated by the Federal Reserve, the Office of the Comptroller of the Currency, and the Federal Deposit Insurance Corporation. According to the global crypto framework finalized by the Basel Committee in 2022, bitcoin is classified as a Group 2b asset, which regulators consider difficult to hedge and inherently volatile, facing a 1250% risk weight. This means that a bank holding a $100 million bitcoin exposure would be treated as having $1.25 billion in risk-weighted assets and would need to hold approximately $100 million in capital against it. Compared to the zero risk weight for cash, gold, and U.S. Treasury bonds, and the 20%-100% range for corporate loans, bitcoin’s capital treatment is extremely stringent. Crypto industry institutions have criticized the framework for misclassifying bitcoin and preventing banks from offering related services.

03:02

RootData: LISTA will unlock tokens worth approximately $3.43 million in one weekChainCatcher news, according to token unlock data from Web3 asset data platform RootData, Lista DAO (LISTA) will unlock approximately 38.44 million tokens, worth about 3.43 million US dollars, at 0:00 on March 20 (UTC+8).

News