News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Wall Street financing costs are rising, highlighting signs of liquidity tightening. Although the Federal Reserve will stop quantitative tightening in December, institutions believe this is not enough and are calling on the Fed to resume bond purchases or increase short-term lending to ease the pressure.

As the yen exchange rate hits a nine-month low, investors are pulling back from long positions. With a 300 basis point interest rate differential between the US and Japan, carry trades are dominating the market, putting the yen at further risk of depreciation.

U.S. sanctions have dealt a heavy blow to Russia’s oil giants, and the IEA says this could have the most profound impact on the global oil market so far. Although Russian oil exports have not yet seen a significant decline, supply chain risks are spreading across borders.

Uniswap's new proposal reduces LP earnings, while Aero integrates LPs into the entire protocol's cash flow.

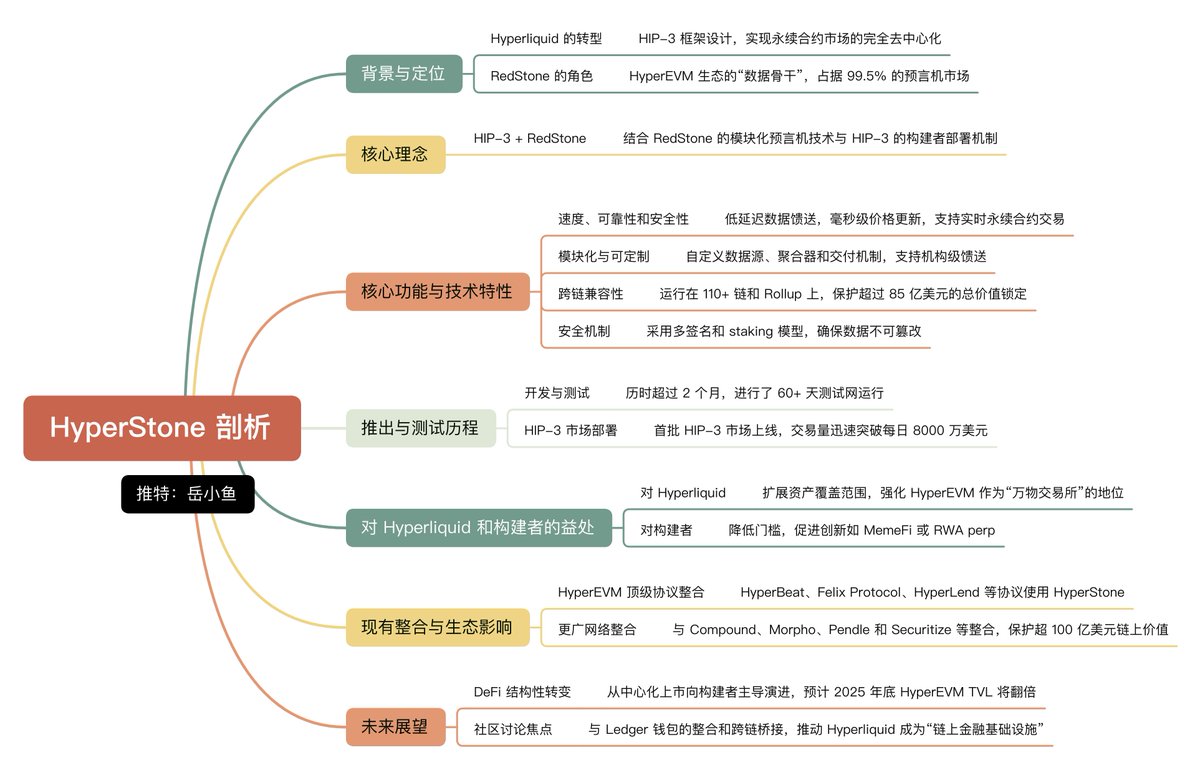

The future of Hyperliquid lies in HIP-3, and the foundation of HIP-3 is HyperStone.

Asset issuance in the crypto industry is entering a new era of compliance.

- 19:20Luxor expands hardware business to GPUs, helping bitcoin mining companies transition to AI infrastructureJinse Finance reported that Luxor, a company focused on mining infrastructure, has announced the expansion of its hardware business to cover GPUs, servers, storage, and networking equipment, in order to support bitcoin mining companies transitioning to AI and high-performance computing (HPC). Luxor is extending its experience in ASIC procurement to AI hardware, offering end-to-end services from equipment procurement and financing to deployment, and has established direct supply relationships with manufacturers such as Dell and Lenovo. The company stated that global bitcoin mining already has nearly 20GW of data center capacity, providing a natural resource advantage for AI hosting. Luxor also supports instant monetization of computing power through its cloud platform Tenki.

- 19:08The US Federal Reserve's overnight reverse repurchase agreement (RRP) usage on Tuesday was $3.211 billion.Jinse Finance reported that the Federal Reserve's overnight reverse repurchase agreement (RRP) usage on Tuesday was $321.1 million, compared to $170.3 million in the previous trading day.

- 18:46Octra to launch $20 million token sale on Sonar at a $200 million valuationChainCatcher reported that the team behind the privacy blockchain project Octra, Octra Labs, will hold a public token sale on the Sonar platform on December 18. Sonar is a token launch platform introduced by ICO platform Echo, which was created by Jordan “Cobie” Fish and recently acquired by an exchange. This week-long token sale aims to raise $20 million by selling 10% of the total OCT token supply, corresponding to a fully diluted valuation (FDV) of $200 million, according to Octra on Tuesday. The sale will use a fixed price plus commitment-style allocation model, allowing any number of participants to deposit funds and receive tokens proportionally, designed to maximize decentralization. Octra stated that if demand is strong, the sale allocation may increase; any unsold tokens will be burned. All sold tokens will be fully unlocked and distributed shortly after the sale ends. The $200 million valuation is double Octra’s previous fundraising valuation on Echo earlier this year, when it raised $4 million. In addition, Octra previously completed a $4 million pre-seed round with investors including Big Brain Holdings, Finality Capital Partners, Karatage, and Presto Labs. In terms of token allocation: early investors hold 18% of OCT, Octra Labs holds 15%, and 67% is allocated to the community, including early users, validators, grants, Echo participants, and ICO buyers. Octra stated that no investor holds more than 3% of the tokens.