News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

Nasdaq-listed biotech firm Sonnet BioTherapeutics is making a bold move into the digital asset space, unveiling plans to launch an $888 million Hyperliquid (HYPE) token treasury under a newly formed entity.

Quick Take Standard Chartered says stablecoins surprisingly drew more attention than bitcoin during recent U.S. meetings, despite bitcoin hitting record highs. A $750 billion stablecoin market size could influence Treasury issuance and emerging market stability, according to the bank.

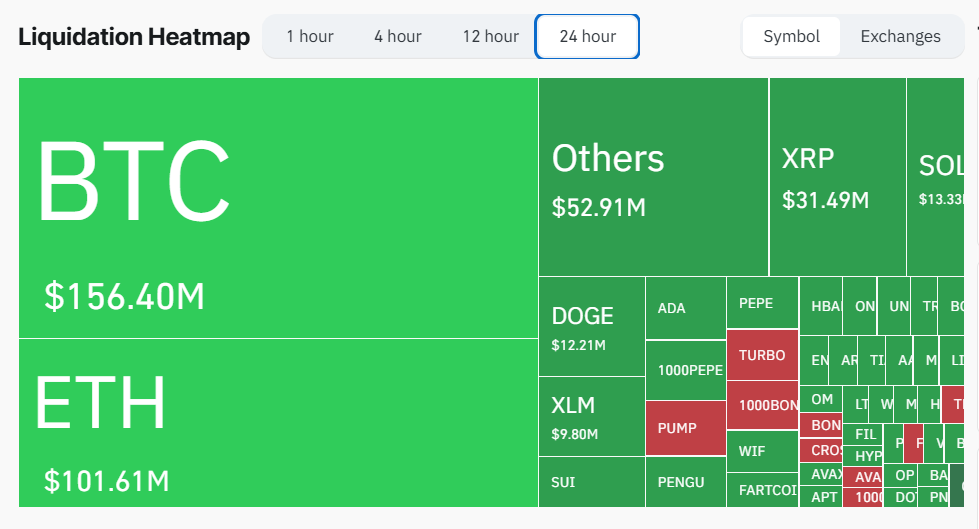

Crypto liquidations totaled $469 million, with 125,578 traders affected as Bitcoin, Ethereum, Solana, and Dogecoin entered the spotlight.

Ahead of the June CPI report, the crypto market is showing volatility, with Bitcoin retreating 5% from its $123,000 all-time high.

Solana’s RWA ecosystem has surged 140% year-to-date, with Ondo’s USDY capturing nearly 42% of the market.

Quick Take On the House floor on Tuesday, lawmakers voted 196 to 223 against moving ahead with voting on three bills that were headed to votes this week. A House aide told The Block that they will try again later at 5 p.m. ET.

The Fed, FDIC, and OCC clarify how banks can offer crypto custody services under existing rules without new policies.

- 04:01Data: Bitcoin Spot ETFs Saw a Total Net Outflow of $333 Million Yesterday, Marking Three Consecutive Days of Net OutflowsAccording to ChainCatcher, data from SoSoValue shows that the total net outflow from Bitcoin spot ETFs yesterday (August 4, Eastern Time) was $333 million. The Bitcoin spot ETF with the highest single-day net inflow yesterday was the Bitwise ETF BITB, with a single-day net inflow of $18.7428 million. The historical total net inflow for BITB has now reached $2.278 billion. The Bitcoin spot ETF with the highest single-day net outflow yesterday was BlackRock’s ETF IBIT, with a single-day net outflow of $292 million. The historical total net inflow for IBIT has now reached $57.305 billion. As of press time, the total net asset value of Bitcoin spot ETFs stands at $147.955 billion, with the ETF net asset ratio (market value as a percentage of total Bitcoin market cap) at 6.46%. The historical cumulative net inflow has reached $53.847 billion.

- 03:56Grok Imagine Now Available on the Grok iOS AppAccording to Jinse Finance, Elon Musk tweeted that Grok Imagine has been launched on the iOS Grok app and will soon be available on the Grok Android app. New features of Grok Imagine include: text-to-video generation (users can quickly create short videos with sound through text prompts, with a maximum length of 6 seconds), and image-to-video conversion (static images can be transformed into dynamic videos, supporting animated artworks, sculptures, or other pictures), among others.

- 03:53Trader Eugene has closed his ETH long position for a profitAccording to ChainCatcher, on-chain analyst Ai Yi (@ai_9684xtpa) revealed that trader Eugene has taken profits on his ETH long positions. Although he remains optimistic that ETH will rise to $3,800–$4,000 in the short term, he chose to secure his gains during this rapid rebound. Analyst Ai Yi noted that, based on the timing of the position opening and closing, the estimated return over less than four days was approximately 6.14%.