News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 12)|World launches a “super app” featuring payments and chat; US initial jobless claims reach 236,000; Satoshi Nakamoto statue installed at the NYSE2Ether vs. Bitcoin: ETH price poised for 80% rally in 20263Prediction markets bet Bitcoin won’t reach $100K before year’s end

LINK ETF confirmed for 2025? XRP and SOL launches move up Chainlink timeline

CryptoSlate·2025/11/13 11:30

Hedera integrates ERC-3643 standard to enhance asset tokenization compliance capabilities

PANews·2025/11/13 11:02

Key Market Intelligence on November 13th, how much did you miss out on?

1. On-chain Volume: $82.2M inflow to Arbitrum today; $71.9M outflow from BNB Chain 2. Largest Price Swing: $11.11, $ALLO 3. Top News: Trump Signs Bill, U.S. Government Shutdown Declared Over

BlockBeats·2025/11/13 10:50

In the DeFi Buyback Wave: Uniswap, Lido Caught in "Centralization" Controversy

On the backdrop of increasing centralization concerns as platforms like Uniswap and Lido are adopting token buyback programs, protocols are facing questions related to governance and sustainability.

BlockBeats·2025/11/13 10:30

Rethinking Sideways Trading: Major Cryptocurrencies Are Undergoing a Massive Whale Shakeout

Ignas also pays special attention to lending protocols that generate fees.

Chaincatcher·2025/11/13 10:11

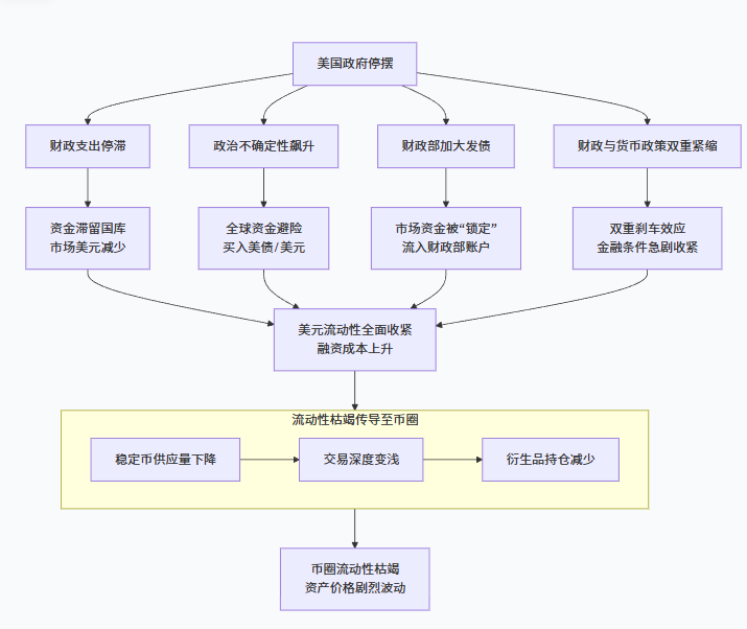

How could a U.S. government shutdown strangle crypto market liquidity?

AICoin·2025/11/13 10:06

Unexpected Change! The Independence of the Federal Reserve Faces Unprecedented Challenge

AICoin·2025/11/13 10:06

The Graph Delivers Production-Ready Data Infrastructure for TRON Enterprise Applications

CryptoSlate·2025/11/13 10:00

The Leading Stablecoin Issuer Circle Releases Q3 Financial Report: What are the Key Highlights?

As of the end of the third quarter, USDC's circulation has reached $73.7 billion, representing a staggering 108% year-over-year growth.

BlockBeats·2025/11/13 09:35

Flash

- 19:01Trump: Will soon select a new Federal Reserve Chair, and the new Chair may be inclined to push for interest rate cutsJinse Finance reported that U.S. President Trump stated: A new Federal Reserve Chair will be selected soon, and the new Chair may be inclined to push for interest rate cuts. Inflation has been completely contained, and we do not want to see deflation. In many ways, deflation is worse than inflation.

- 18:54Aave governance forum sparks heated debate over CoW Swap fee issueJinse Finance reported that the Aave DAO, which manages the Aave protocol, and Aave Labs, the core development company behind the Aave product suite, have had disagreements over the distribution of fees generated from the recently announced integration with decentralized exchange aggregator CoW Swap. The related controversy continues to escalate. The issue was raised by EzR3aL, an anonymous member of the Aave DAO. He pointed out that the fees generated from crypto asset swaps via CoW Swap have not entered the Aave DAO treasury, but instead have flowed to a designated on-chain address. In fact, these fees ultimately went to a private address controlled by Aave Labs. EzR3aL raised several questions about this, including why the DAO was not consulted before the adjustment of the fee flow, and asserted that the ownership of these fees should belong to the DAO. EzR3aL stated: "At least $200,000 worth of ETH flows into the pocket of some entity every week, instead of AaveDAO." He added that this means the DAO is potentially missing out on up to $10 million in annual revenue. Aave Labs responded by stating that the rights to the website frontend components and application interfaces have always been legally owned by them.

- 18:35Data: If ETH breaks through $3,241, the cumulative short liquidation intensity on major CEXs will reach $1.274 billions.According to ChainCatcher, citing data from Coinglass, if ETH breaks through $3,241, the cumulative short liquidation intensity on major CEXs will reach $1.274 billions. Conversely, if ETH falls below $2,937, the cumulative long liquidation intensity on major CEXs will reach $994 millions.

News