News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(October 24)|Ethereum achieves real-time L1 block proof; Solmate surges 40% after $300M financing; Stable’s $825M pre-deposit raises insider concerns2Bitcoin falls below $115,000—is this a delayed reaction to the sale of 80,000 BTC?3Research Report|In-Depth Analysis and Market Cap of aPriori (APR)

Bunni DEX Shuts Down, Cites Recovery Costs After $8.4M Exploit

CryptoNewsNet·2025/10/23 10:39

Revolut Secures MiCA License in Cyprus, Expanding Regulated Crypto Services Across EU

CryptoNewsNet·2025/10/23 10:39

OpenAI Launches ChatGPT Atlas, a Browser With Integrated AI

Cointribune·2025/10/23 10:39

Aave formalizes a massive annual buyback plan financed by DeFi

Cointribune·2025/10/23 10:39

Hyperliquid (HYPE) To Surge Further? Key Harmonic Pattern Signals Potential Upside Move

CoinsProbe·2025/10/23 10:36

Solana Price Eyes Bullish Crossover as New Addresses Hit Monthly High

Solana’s network growth and bullish MACD signal hint at recovery potential. A breakout above $192 may send SOL toward $200, but losing $183 risks deeper losses.

BeInCrypto·2025/10/23 10:30

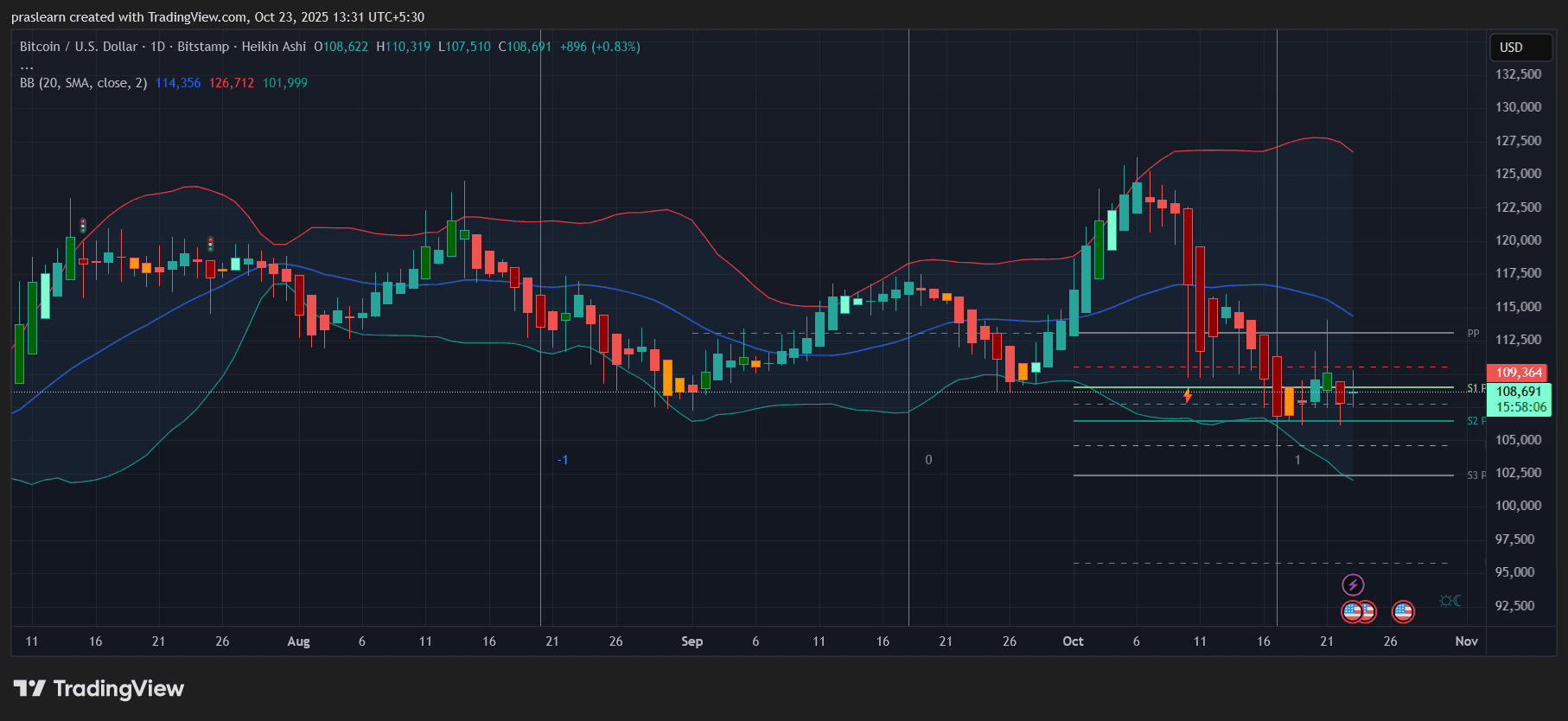

Bitcoin price prediction: BTC reclaims $109k as analysts predict dump

Coinjournal·2025/10/23 10:27

Something Big Is About to Happen to Bitcoin Price

Cryptoticker·2025/10/23 10:15

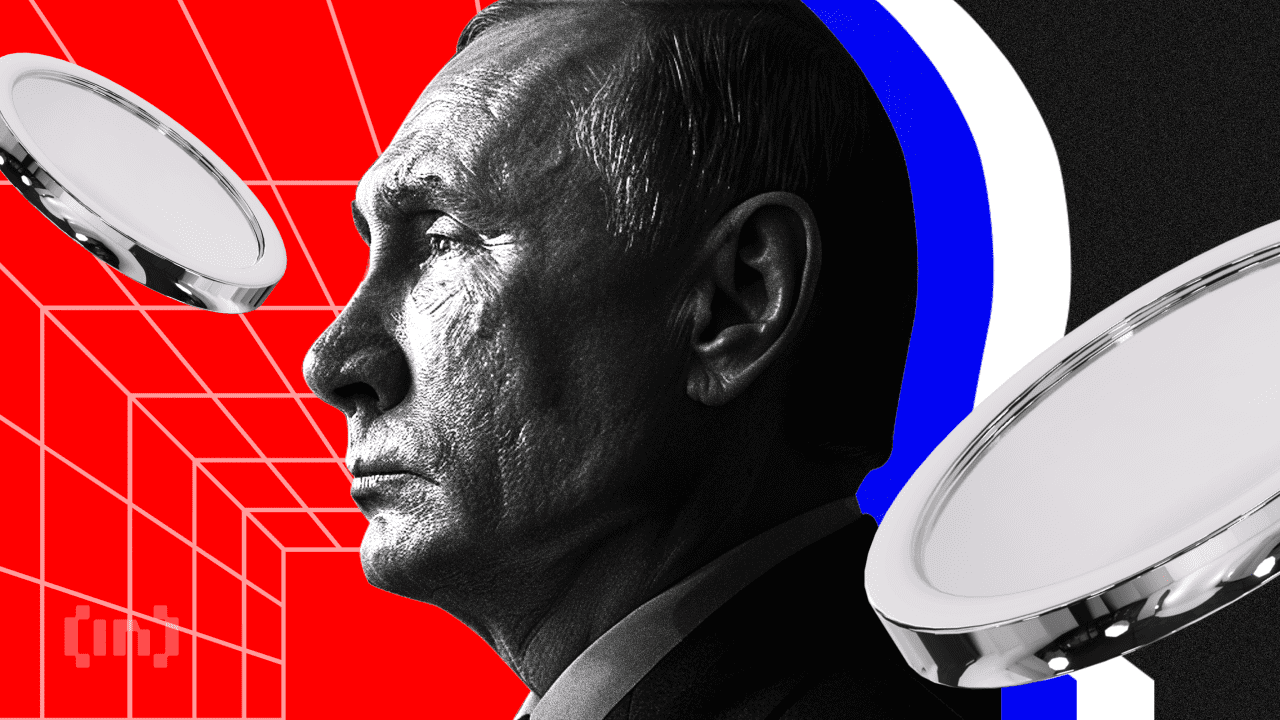

EU Bans Russia-Backed Stablecoin In First Crypto Sanction

Brussels sanctioned a ruble-backed stablecoin used to bypass SWIFT, marking its first crypto-specific penalty on Russia. The EU is now preparing a MiCA-compliant euro token to assert financial sovereignty and counter alternative payment networks.

BeInCrypto·2025/10/23 10:10

Can Google’s 13,000× “quantum echoes” put Bitcoin’s keys on a clock?

CryptoSlate·2025/10/23 10:00

Flash

- 23:05In the past 24 hours, 5,528.82 BTC have flowed out of exchange wallets.According to Jinse Finance, the latest data from coinglass shows that in the past 24 hours, 5,528.82 BTC have flowed out of exchange wallets; in the past 7 days, 3,876.72 BTC have flowed out of exchange wallets; and in the past 30 days, 11,524.18 BTC have flowed into exchange wallets. As of press time, the total balance of exchange wallets is 2,164,264.92 BTC.

- 20:54Galaxy Digital Analyst: Bitcoin Bull Market Structure Remains Solid but Faces Key Price Level RisksJinse Finance reported that Alex Thorn, Head of Research at Galaxy Digital, stated in an interview with Cointelegraph that the bitcoin bull market remains solid, but the market is at a "critical juncture" where sentiment can shift rapidly. He pointed out that if bitcoin falls below 100,000 dollars, it will trigger significant anxiety and could shake the structural bull market. Thorn said that the recent adjustment in bitcoin is not due to a deterioration in fundamentals, but rather influenced by macro sentiment; in the long term, growing institutional demand provides solid support, and the market is entering the "post-100,000-dollar era." He also believes that bitcoin is gradually moving away from its historical four-year cycle and is building a more stable foundation, as evidenced by declining volatility, increased institutional holdings, and a slowdown in passive absorption.

- 20:54U.S. bank deposits last week were $18.505 trillion, compared to $18.437 trillion the previous week.Jinse Finance reported that according to Federal Reserve data, U.S. bank deposits last week reached $18.505 trillion, compared to $18.437 trillion the previous week.