News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

- Alex Spiro, Elon Musk’s lawyer, leads a $200M Dogecoin treasury via Miami-based House of Doge, aiming to offer institutional-grade exposure to the meme coin through a publicly traded vehicle. - The initiative triggered a 2% DOGE price surge to $0.22 and signals growing institutional adoption in the memecoin sector, with competitors like Bit Origin planning similar $500M treasuries. - Regulatory risks and operational opacity, including unconfirmed launch dates, challenge the project’s appeal to risk-avers

Share link:In this post: The S&P 500 to Commodity Index ratio has tripled since 2022 and just hit a new all-time high. Wells Fargo is advising investors to cut stock exposure and shift into bonds ahead of expected volatility. Paul Christopher is trimming small-caps and communication stocks while adding financials and sticking with large-cap tech.

Share link:In this post: New US homes have shrunk to 2,404 sq ft, the smallest average in 20 years. Median new home prices rose to $403,800, pushing cost per square foot to $168. Only 28% of homes are affordable for median-income buyers due to high mortgage rates.

Share link:In this post: Ripple has launched a demo that shows how its payment system works using RLUSD and XRP. XRP acts as a bridge, helping money move quickly and cheaply across borders. Ripple wants to win over banks and businesses as it competes with Circle, Stripe, and other big players.

The initial unlock will be WLFI's starting point to enter the real market game.

- IOST plunged 50.6% in 24 hours, marking its largest drop in 24 months amid a 1-year bearish trend. - The cryptocurrency lost over 95% from its 2021 peak, with technical indicators showing no reversal potential. - Analysts cite liquidity drying up and no clear catalysts, predicting continued decline without major on-chain developments. - A proposed backtest aims to analyze historical patterns after extreme -50.6% drops to identify potential recovery signals.

- Little Pepe (LILPEPE), a new meme coin, is in presale at $0.0021 with 2025 price forecasts up to $2, outpacing DOGE and SHIB. - Unlike community-driven SHIB/DOGE, LILPEPE operates on a Layer 2 blockchain with low fees, dApp support, and a meme coin launchpad. - Presale Stage 12 raised $22M with 90% sold, while CertiK audit (95.49% score) and $777K giveaways boost trust and adoption. - Influential crypto figures compare LILPEPE to early DOGE and MATIC, citing its cultural appeal and technical infrastructu

- HAEDAL surged 15.16% in 24 hours to $0.1433 despite sharp long-term declines (7D -1056%, 1M -690%). - Technical indicators show overbought RSI and broken support levels amid volatile short-term trading patterns. - Analysts highlight lack of fundamental drivers, suggesting price swings depend on algorithmic trading or market sentiment shifts. - Backtesting strategies are proposed to evaluate 15%+ moves, emphasizing need for clear entry/exit rules amid uncertain trends.

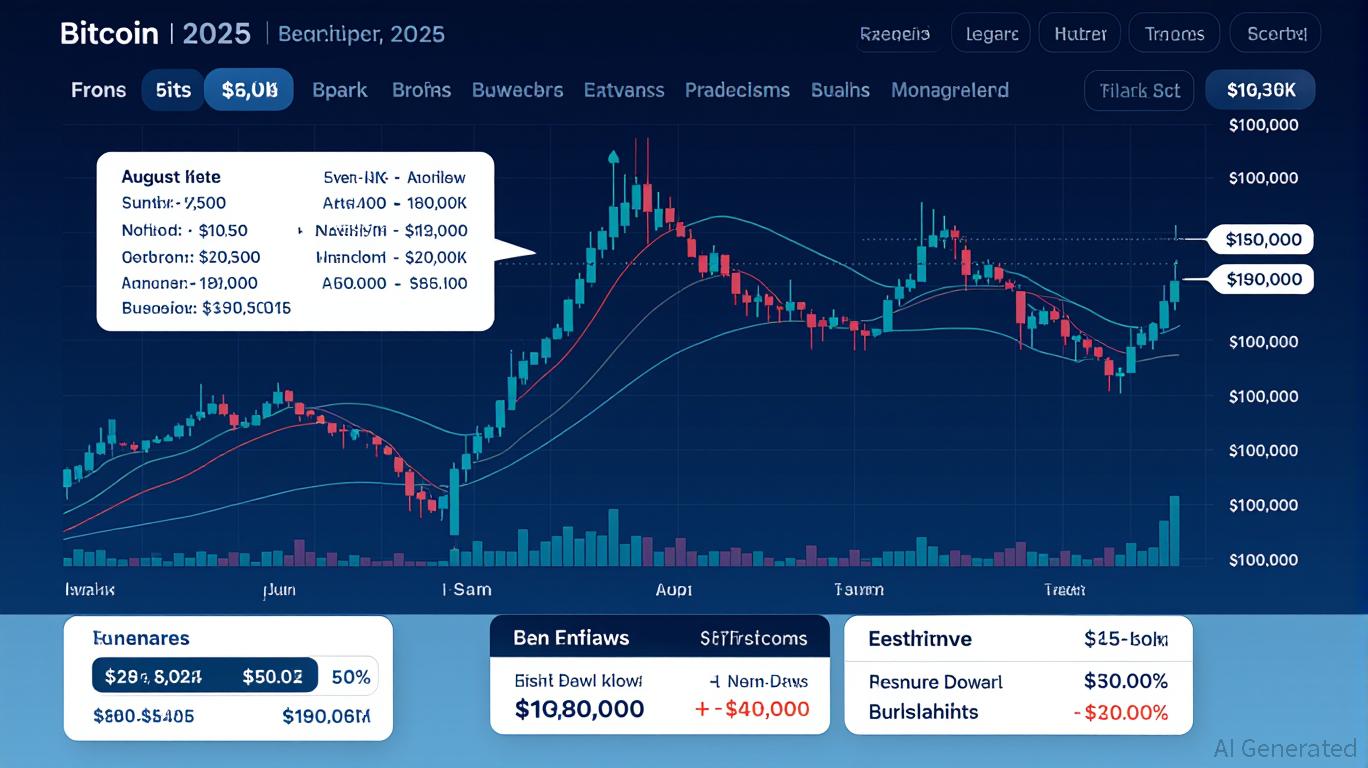

- Bitcoin fell to a 50-day low of $108,645.99 in August 2025, triggering a "death cross" technical signal amid bearish short-term pressure. - Long-term holders control 60% of supply, with stable accumulation patterns and historical support levels suggesting potential recovery. - Dovish Fed policy, rising liquidity, and $14.6B in ETF inflows reinforce Bitcoin's institutional adoption and long-term value proposition. - Risks include regulatory scrutiny, ETF outflows, and macroeconomic uncertainty, but strate

- 01:51South Korea's BDACS launches the first Korean won-backed stablecoin KRW1 on AvalancheChainCatcher news, according to Cointelegraph, South Korean crypto asset custody service provider BDACS has launched the first Korean won-backed stablecoin, KRW1, on the Avalanche blockchain after successfully passing proof of concept. This stablecoin is fully collateralized by Korean won held at Woori Bank.

- 01:51After the Federal Reserve's rate cut, an OTC whale spent $112 million to purchase 25,000 ETHAccording to ChainCatcher, monitored by Lookonchain, after the Federal Reserve announced a 25 basis point rate cut, the OTC whale address 0xd8d0 used 112.34 millions USDC to purchase 25,000 ETH, with an average cost of $4,493.

- 01:36Kaisa Capital (00936.HK) opened up 14.5% after the company announced its entry into RWA tokenization business.Jinse Finance reported that at the opening of the Hong Kong stock market, Kaisa Capital (00936.HK) surged by 14.5%. The company is undergoing a strategic transformation and is laying out its business in the field of Real World Asset (RWA) tokenization. (Golden Ten Data)