News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Spot Gold & Silver Continue to Drop, Bitcoin Crashes; Amazon’s $200 B Capital Expenditure Raises Concerns; U.S. Job Openings Fall to 2020 Lows — Feb 6, 2026 (English Translation)2Weekend Trading Playbook: High-Impact Macro Events & Earnings for Feb 9-15, 2026 – Tech & Crypto Volatility Plays3 Is the “Perfect Storm” Here? Liquidations Explode as Bitcoin Bleeds Below $70K & DXY Rises

Australian Dollar Surges After Trump Calms Tariff Concerns, Wall Street Recovers

101 finance·2026/01/21 23:33

Phillips Connect unveils partnership with McLeod Software

101 finance·2026/01/21 23:21

BlackRock: Ethereum Becomes the Foundation of Wall Street's Tokenization Competition

101 finance·2026/01/21 23:06

Has Trump truly 'conquered' inflation in the US, as he asserted during Davos?

101 finance·2026/01/21 23:03

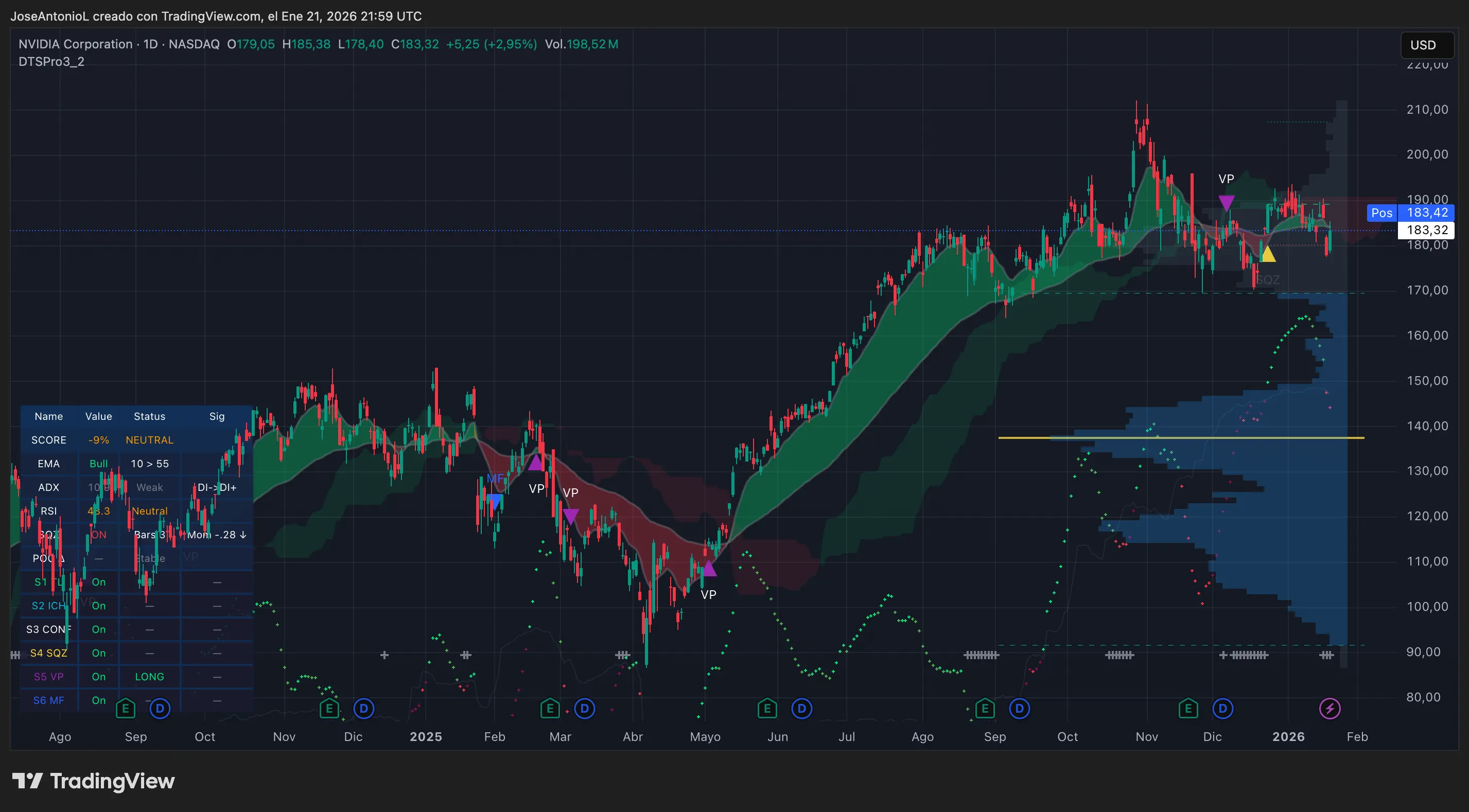

What Bubble? Nvidia CEO Says AI Needs Trillions More in Investments

Decrypt·2026/01/21 22:58

A chronological overview of the US semiconductor industry for 2025

101 finance·2026/01/21 22:54

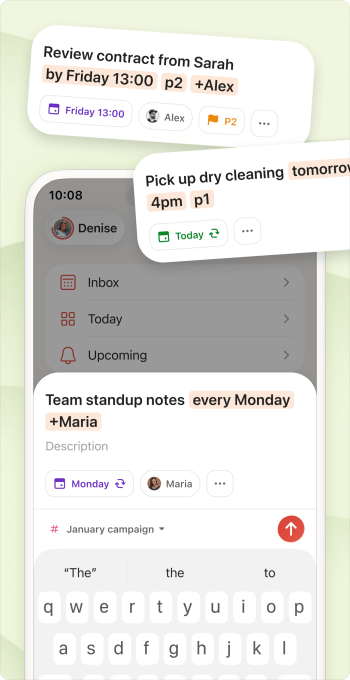

Todoist’s application now enables you to create tasks for your to-do list simply by talking to its AI assistant

101 finance·2026/01/21 22:33

Knight-Swift Transportation (NYSE:KNX) Falls Short of Q4 CY2025 Revenue Projections

101 finance·2026/01/21 22:15

Wall Street Is Bearish on Software Shares. According to This Specialist, That's 'Completely Incorrect'

101 finance·2026/01/21 22:09

Ethereum Outlook Turns Negative as Investors Prepare for Potential Fall to $2,500

101 finance·2026/01/21 22:03

Flash

19:24

In the past 7 days, only 7 public blockchains had fee revenues exceeding $1 million.Jinse Finance reported that, according to Nansen data, only 11 public blockchains generated more than $100,000 in fee revenue over the past 7 days, with only 7 public blockchains earning over $1 million in fees. The Ethereum network topped the list with $10 million in fee revenue, followed by Tron ($7.3 million), Base ($6.47 million), Solana ($5.86 million), BNB Chain ($3.18 million), Bitcoin ($2.02 million), and Polygon ($1.38 million).

18:32

Data: If BTC breaks through $72,700, the cumulative short liquidation intensity on major CEXs will reach $1.252 billions.According to ChainCatcher, citing Coinglass data, if BTC breaks above $72,700, the cumulative short liquidation intensity on major CEXs will reach $1.252 billion. Conversely, if BTC falls below $65,860, the cumulative long liquidation intensity on major CEXs will reach $1.117 billion.

18:24

USDC Treasury mints 250 million USDC on Solana chainWhale monitoring shows that at 01:45 today (UTC+8), USDC Treasury minted 250 million USDC on the Solana blockchain.

News