News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Trump Imposes 25% Tariffs on Iran's Trade Partners; Google Market Cap Breaks $4 Trillion for the First Time; Gold Surpasses $4600 Threshold (Jan,13, 2026)2Bitget Daily Digest (Jan.13)|Market Risk-Off Triggered by Fed Independence Dispute; Meta Plans to Cut Metaverse Investment; Strategy Added 13,627 BTC Last Week

Bitcoin stalls below $92,000 as privacy coins rally; crypto miners surge on Meta AI news

101 finance·2026/01/13 01:15

Bitcoin price eyes $100K, yet breakout signals are missing

AMBCrypto·2026/01/13 01:03

BlackRock Lays Off Several Hundred Employees, Reducing Workforce by Approximately 1%

101 finance·2026/01/13 01:00

A $107 Million Motive to Invest in This Soaring Penny Stock Today

101 finance·2026/01/13 00:39

China Moves to Support Alibaba During Intense Price Competition. Is Now the Right Time to Invest in BABA Shares?

101 finance·2026/01/13 00:39

OpenAI acquires small health records company Torch in a deal reportedly worth $100 million

101 finance·2026/01/13 00:33

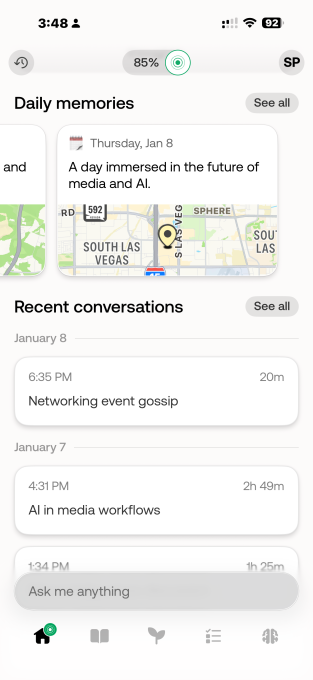

Hands-on Experience with Bee: Amazon's Newest AI Wearable

101 finance·2026/01/13 00:27

Bitcoin Price Plummets: BTC Falls Below $91,000 in Sudden Market Shift

Bitcoinworld·2026/01/13 00:21

Venezuela Bitcoin Reserves: Former SEC Official’s Cryptic Stance on Potential $60 Billion Seizure

Bitcoinworld·2026/01/13 00:21

Flash

02:55

A certain whale spent 820,000 USDC to buy 6.98 million NYC in the past 4 hours. according to Onchain Lens monitoring, cryptocurrency KOL @old (account has been banned) spent 820,000 USDC to purchase 6.98 million NYC in the past 4 hours. Currently still holding 203,000 USDC and may continue to buy.

02:49

Tether Freezes 182 Million USDT from 5 Addresses on the Tron NetworkBlockBeats News, January 13th, according to Whale monitoring, Tether froze 5 distinct addresses on the Tron network on January 11th, totaling 182 million USDT. The affected addresses held between 12 million and 50 million USDT. This action is in line with Tether's wallet freeze protocol introduced in December 2023, designed to comply with the sanction requirements of the U.S. Department of the Treasury's Office of Foreign Assets Control (OFAC). As of mid-2025, Tether has cumulatively frozen over $3 billion USDT and collaborated with over 310 law enforcement agencies in more than 62 countries.

02:48

The US spot XRP ETF saw a net inflow of $15.04 million yesterday. according to SoSoValue data, yesterday (January 12, Eastern Time) the spot XRP ETF had a net inflow of 15.04 million USD.

News