News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

- Pump.fun repurchased $58.7M PUMP tokens (4.26% supply) using 99.3% of its $10.657M revenue from Aug 20-26. - The buyback boosted PUMP's price 4% to $0.003019, with 20% 2-day gains but remains 55.7% below July 2025 highs. - Pump.fun dominates 84.1% Solana memecoin market share, generating $781M 24-hour volume vs. $53.1M for nearest rival. - Technical analysis shows PUMP trading near $0.002777 with critical support at $0.0027; break below risks 20% decline to $0.0022.

- Kanye West's YZY token surged 1,400% then collapsed 74% in 24 hours, leaving 83% of 60,000+ wallets with losses. - Insider wallets extracted $18M+ via rapid trading, while 90% of supply remained centralized with project teams. - Hayden Davis, ex-LIBRA co-founder, allegedly sniped $12M+ using unfrozen USDC funds, raising manipulation concerns. - The "pump and dump" pattern triggered 88%+ drops in related tokens and eroded trust after Kanye's Instagram hack.

- In 2025, Dogecoin (DOGE) relies on meme-driven retail hype while Mutuum Finance (MUTM) builds DeFi infrastructure with institutional-grade security. - DOGE's $0.209–$0.242 range reflects high volatility and speculative NVT/MVRV ratios, contrasting MUTM's presale traction and projected 8,571% ROI by 2026. - MUTM's dual-lending framework, USD-pegged stablecoin, and CertiK audit create structured growth, outperforming DOGE's limited utility and market whims. - Institutional validation through $14.83M presal

- A $47.5M XPL token manipulation on Hyperliquid exposed DeFi's systemic vulnerabilities, including thin liquidity and lack of safeguards. - Whale addresses exploited isolated margin systems to trigger $7M+ retail losses through rapid price surges and cascading liquidations. - The incident highlights DeFi's paradox: transparency enables both market visibility and predatory strategies by concentrated actors. - Investors are urged to avoid speculative pre-launch tokens while platforms debate regulatory frame

- Fed's 2025 September meeting faces pressure to cut rates amid 2.1% inflation vs. 2% target and 1.4% GDP growth. - Political tensions rise as Trump administration criticizes Fed independence through tariff policies and personnel disputes. - Market anticipates 25bp rate cut (82% probability) but fears politicization could undermine central bank credibility. - Investors advised to prioritize quality equities and short-term bonds amid inflation risks from persistent tariffs.

- Anthropic's report reveals cybercriminals weaponize AI to automate attacks, lowering technical barriers for cybercrime. - AI tools enable data extortion, fake job scams, and ransomware-as-a-service, targeting healthcare, government, and tech sectors. - North Korean hackers use AI to create fake identities for remote jobs, bypassing sanctions and skill requirements. - AI-generated ransom notes analyze financial data to set extortion amounts, marking a new phase in cybercrime tactics. - Anthropic bans abus

XRP’s price weakness has been overshadowed by ZachXBT’s scathing critique, calling holders “exit liquidity” and questioning Ripple’s utility. His comments echo broader skepticism around XRP’s role, even as supporters defend its banking partnerships and payment use case.

- Berkshire Hathaway increased stakes in Japan's five major trading houses to 8.5%-9.8%, nearing 10% ownership thresholds. - The $23.5B market value (cost: $13.8B) reflects appreciation in diversified conglomerates with energy, tech, and logistics operations. - Japan's raised FDI targets and low-interest yen-denominated debt strategy support Berkshire's long-term positioning in Asia-Pacific supply chains. - Quantum computing partnerships and rare-earth collaborations highlight trading houses' role in resha

- FIS surged 135.14% in 24 hours but fell 7408.21% in a year, showing extreme volatility. - Strategic DeFi integrations and revised tokenomics aim to boost utility and stability. - Community governance shifts, including DAO treasury funding, enhance stakeholder involvement. - Analysts link short-term gains to speculation, stressing long-term adoption challenges. - Upcoming cross-chain solutions and staking tools target broader DeFi integration.

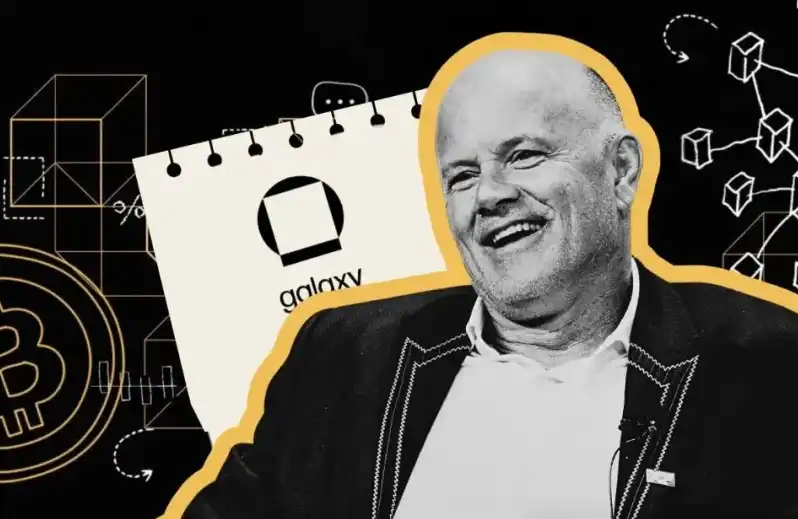

When Luna experienced a sharp decline, he did not shirk responsibility but rather provided a detailed account of what occurred with Terra and what Galaxy Digital misjudged.

- 19:02The Federal Reserve releases the preliminary FOMC meeting schedule through January 2028Jinse Finance reported that the Federal Reserve on Friday released the preliminary meeting schedule for the Federal Open Market Committee (FOMC) in January 2027 and 2028. The Federal Reserve will continue its practice of holding eight meetings each year. The meeting dates for 2027 are as follows: January 26-27, March 16-17, April 27-28, June 8-9, July 27-28, September 14-15, October 26-27, and December 7-8. The 2028 meeting: January 25-26.

- 19:02JPMorgan: The Federal Reserve is expected to cut interest rates three times in 2025Jinse Finance reported that JPMorgan Asset Management stated it expects the Federal Reserve to cut interest rates three times in 2025. It is anticipated that there will be a 25 basis point rate cut in September, and a total rate cut of about 70 basis points from now until the end of the year.

- 18:29Federal Reserve's Goolsbee: Need to review inflation data before deciding on interest rate policyAccording to ChainCatcher, citing Golden Ten Data, Chicago Fed President Goolsbee stated that he has not yet decided which policy action to support at the September 16-17 Federal Reserve meeting, emphasizing the need to refer to inflation data to be released next week. He said, "I want to get more information. As the meeting approaches, I am still keeping an open mind." Goolsbee pointed out that recent inflation reports show a rebound in prices in the services sector, so it is necessary to confirm whether this is only a temporary fluctuation rather than a more severe sign.