News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

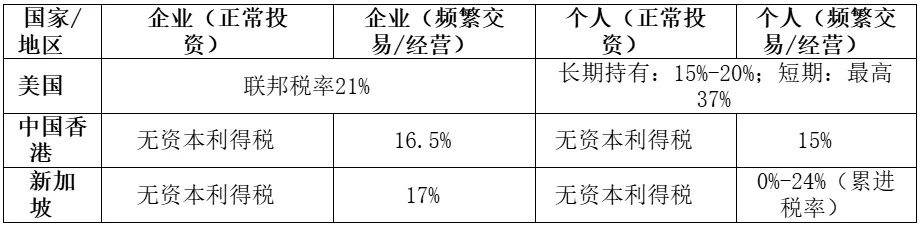

Tax arrangements are not a one-size-fits-all formula but need to be "tailor-made" according to the specific circumstances of each enterprise.

- Ethereum’s price resilience and institutional adoption drive Tom Lee’s $60,000 5-year forecast, supported by $27.6B ETF inflows and 55.5% market dominance. - Regulatory clarity (SEC approval, CLARITY Act) and 29% staked ETH bolster institutional confidence, while Layer 2 upgrades boost scalability and TVS to $16.28B. - Macroeconomic tailwinds (Fed rate cuts) and Ethereum’s role in stablecoins (55% market share) position it as a foundational asset, though competition and volatility pose risks.

- Bitcoin faces critical $110K–$112K resistance as on-chain metrics and institutional dynamics clash over bullish vs. bearish trajectories. - Taker-Buy-Sell ratio (-0.945) signals bearish pressure, while MVRV compression (1.0) suggests potential bull market rebalancing. - Institutional buyers accumulate during dips, offsetting whale-driven selling and ETF outflows amid $30.3B futures open interest. - Fed rate cut expectations and geopolitical risks create macro uncertainty, with 200-day SMA ($100K–$107K) a

- XRP faces a $3.08 breakout threshold, with technical indicators and institutional buying signaling potential for a $5.85 surge. - Post-SEC settlement, 60+ institutions now use XRP for cross-border payments, processing $1.3T via Ripple's ODL in Q2 2025. - $1.1B in institutional XRP purchases and seven ETF providers targeting $4.3B-$8.4B inflows by October 2025 reinforce bullish momentum. - A $3.65 price break would invalidate bearish patterns, while $50M+ weekly institutional inflows could validate the $5

Compared to the treasuries of Ethereum or Bitcoin, the SOL treasury is more efficient in absorbing the current trading supply.

Bitcoin and Ethereum face $14.6 billion in expiring options today, with prices expected to test max pain levels amid Nvidia-driven uncertainty.

- XRP faces a critical juncture with $3.7B CME futures open interest, reflecting institutional confidence post-SEC commodity reclassification in August 2025. - Seven ETF providers filed XRP ETF applications, potentially unlocking $4.3B-$8.4B in inflows if approved by October 2025, mirroring Bitcoin/Ethereum ETF success. - Technical analysis shows XRP consolidating in a $2.85-$3.10 triangle with $3.05 key resistance; analysts project $3.40+ breakout if volume sustains above this level. - Whale accumulation

- ABTC and Gryphon merged via reverse merger to accelerate growth, preserving 98% ownership and avoiding IPO dilution. - Trump family endorsements bolster ABTC's pro-crypto narrative, enhancing political credibility and regulatory influence. - AI-driven HPC and energy-efficient mining position the merged entity to optimize costs in a post-halving market. - Global expansion plans target Hong Kong and Japan, leveraging AI tech to diversify into cloud computing and blockchain solutions. - The merger aligns ca

- 00:27Data: A certain whale withdrew WLFI and BLOCK worth $2.868 million from CEXChainCatcher news, according to monitoring by Onchain Lens, a whale (0x8c4...6cad) withdrew 10.25 million WLFI (worth $2,340,000) and 5.67 million BLOCK (worth $528,000) from CEX. Currently, this whale holds a total of 72.83 million WLFI (worth $1,639,000) and 17.23 million BLOCK (worth $1,200,000).

- 00:27Six major South Korean banks "actively considering participation in testing," plan to digitize treasury subsidies into cryptocurrencyJinse Finance reported that South Korea's six major banks (KB Kookmin, Shinhan, Hana, Woori, NH Nonghyup, and IBK) have expressed to the Bank of Korea their active consideration to participate in tests related to treasury subsidies. It is reported that since the end of August, the Bank of Korea's digital currency department has contacted the relevant personnel in charge of virtual assets and digital currency at these banks one by one by phone to inquire about their willingness to participate. The focus of this test is to examine whether the current subsidies or vouchers (government-guaranteed coupons) paid by the government from the treasury can be issued and used in the form of digital currency by beneficiaries. The Bank of Korea and the Ministry of Economy and Finance are expected to hold a briefing as early as mid-month to introduce the test schedule and main test content to the banks that have expressed interest in participating. If preparations go smoothly, the actual test may take place in the first half of next year.

- 00:21European stock futures generally rise, with Euro Stoxx 50 index futures up 0.5%ChainCatcher News, according to Golden Ten Data, European stock index futures rose, with Euro Stoxx 50 index futures up 0.5%, German DAX index futures up 0.5%, and UK FTSE 100 index futures up 0.3%.