News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Spot Gold & Silver Continue to Drop, Bitcoin Crashes; Amazon’s $200 B Capital Expenditure Raises Concerns; U.S. Job Openings Fall to 2020 Lows — Feb 6, 2026 (English Translation)2Weekend Trading Playbook: High-Impact Macro Events & Earnings for Feb 9-15, 2026 – Tech & Crypto Volatility Plays3 Is the “Perfect Storm” Here? Liquidations Explode as Bitcoin Bleeds Below $70K & DXY Rises

DeFi Protocol Makina Suffers Devastating $5M Flash Loan Hack, Exposing Critical Oracle Vulnerability

Bitcoinworld·2026/01/20 10:36

Bitcoin Price Analysis Reveals Crucial Rebound Potential at $86K Amid Prolonged Sideways Trading

Bitcoinworld·2026/01/20 10:36

A Massive Security Breach Hits Makina Finance: $5 Million Drained in Flash Loan Attack

Cointurk·2026/01/20 10:36

Dollar Drops to Lowest Level in Two Weeks Amid Increased Volatility from Tariff Concerns

101 finance·2026/01/20 10:30

Mercantile Bank: Fourth Quarter Earnings Overview

101 finance·2026/01/20 10:27

Eurozone ZEW Survey rises to 40.8 in January, surpassing the forecast of 35.2

101 finance·2026/01/20 10:24

JPY: MUFG notes Japan’s ultra-long bond yields jump 27bps on fiscal worries

101 finance·2026/01/20 10:24

Copper climbs near $13,000 as Dollar softens – ING

101 finance·2026/01/20 10:24

Trump's "Greenland Ambition" Sparks Safe-Haven Frenzy! Gold Price Soars Past $4,730

金十数据·2026/01/20 10:20

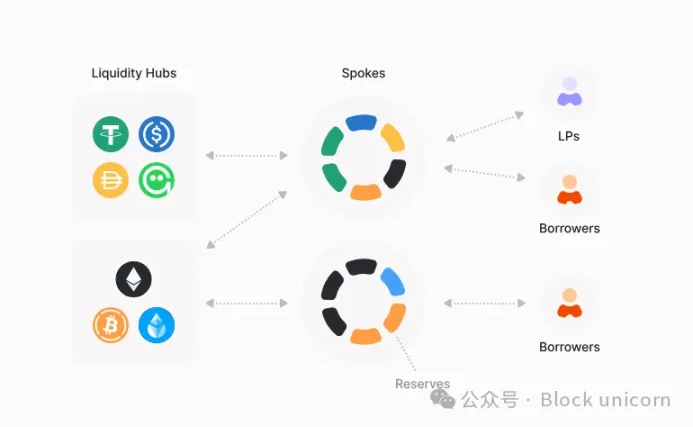

Aave v4 and Capital Efficiency

Block unicorn·2026/01/20 10:18

Flash

01:37

Illinois proposes bill to establish state-level Bitcoin reservesAccording to Odaily, Bitcoin.com News posted on X that Illinois introduced the "Community Bitcoin Reserve Act" earlier this week. The bill aims to establish a state-run program to hold Bitcoin using multi-signature cold storage, with the initial creation of the Altgeld Bitcoin Reserve. Under the bill, the reserved Bitcoin can only be traded or sold with new legislative authorization.

01:31

FWDI expresses long-term optimism for Solana and will take proactive action when competitors go on the defensive.BlockBeats News, February 8, Ryan Navi, Chief Information Officer of the largest Solana treasury company Forward Industries (FWDI), stated that market mispricing is creating opportunities. Forward has no debt, and if the industry faces a liquidity crunch, it will adopt an aggressive strategy and consolidate other SOL treasury companies. Forward Industries currently holds nearly 7 million SOL, more than the combined total of its next three competitors. Ryan Navi reiterated, "A non-leveraged balance sheet is the real advantage in the crypto treasury market. When others are on the defensive, Forward Industries will take the initiative. In the future, we will also remain unleveraged and debt-free, and view Solana as a long-term investment in strategic infrastructure, not as a short-term speculation."

01:28

A certain exchange's Layer plan will integrate with Espresso to enhance performance, and Espresso will launch an airdrop for users of the exchange's Layer.Foresight News reported that blockchain infrastructure Espresso has announced that a certain exchange Layer plans to integrate with Espresso. This collaboration aims to provide the exchange Layer with rapid finality confirmation and scalable data availability (DA) support through Espresso's technical architecture. Espresso will launch an airdrop for users of the exchange Layer.The exchange Layer is a high-performance, EVM-compatible L2 built by the exchange using OP Stack. Unlike most L2s that settle on Ethereum, the exchange Layer settles on the exchange Chain (the exchange's own L1) and is secured by it. Espresso stated that this integration reflects its network's "chain-agnostic" design philosophy. This means that regardless of whether Rollups networks ultimately choose to settle on Ethereum or other networks, they can access Espresso's infrastructure to enhance performance.

News