News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitcoin adoption ‘booming’ while price chops: Which metrics matter most?2Bitget UEX Daily |US-Iran Conflict Escalates, Shaking Markets; Oil Prices, Gold and Silver Surge, Stock Index Futures Fall; Tech Stocks Show Mixed Performance (March 02, 2026)3SEC approval sought for JitoSOL Solana-based liquid staking token ETF

Warsh suggests that AI might enable the Fed to reduce interest rates. However, debates are already emerging.

101 finance·2026/02/17 19:24

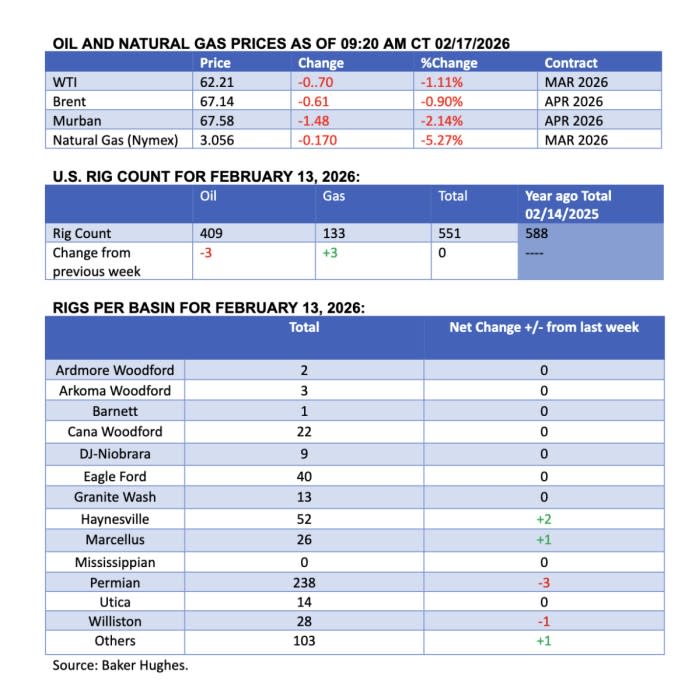

Oil Prices Dip: Impact of Iran Negotiations, Ukraine Shipping Halt, and VLCC Shortage on Market Trends

101 finance·2026/02/17 19:21

Should You Pursue the Massive Memory Stock Surge in Kioxia Shares?

101 finance·2026/02/17 19:18

Why Are Donnelley Financial Solutions (DFIN) Stocks Surging Right Now

101 finance·2026/02/17 19:18

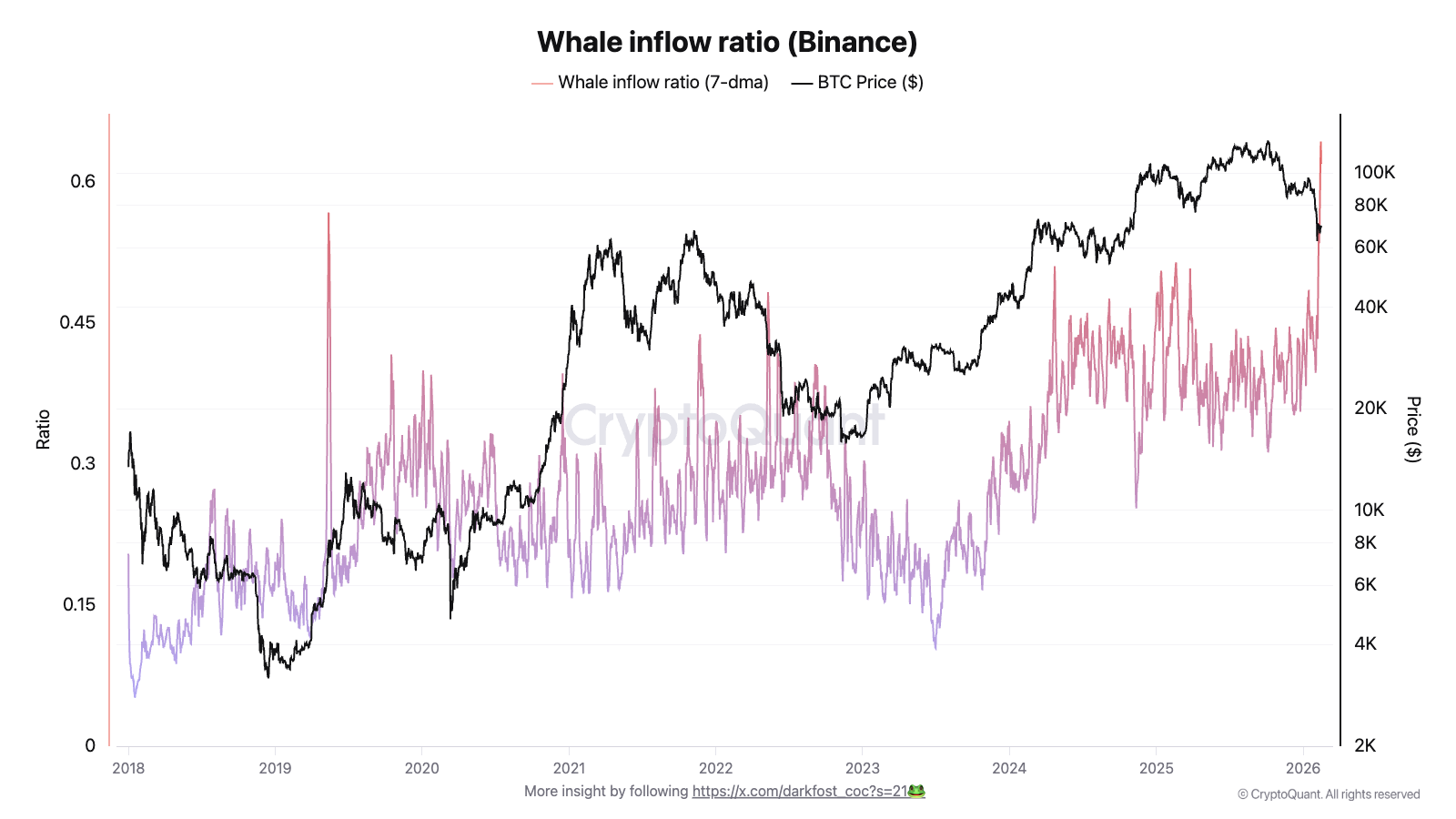

Bitcoin chart pattern, whale activity warn of another 20% price drop

Cointelegraph·2026/02/17 19:18

Lowe's Teams Up With Affirm For 0% Interest Home Renovation Plans

Finviz·2026/02/17 19:18

Xerox Monetizes Intellectual Property In $450 Million JV With TPG

Finviz·2026/02/17 19:15

What's Going On With Palo Alto Stock On Tuesday?

Finviz·2026/02/17 19:15

Upstart (UPST) Stock Trades Up, Here Is Why

Finviz·2026/02/17 19:15

Why AeroVironment (AVAV) Stock Is Up Today

Finviz·2026/02/17 19:15

Flash

16:47

The Nasdaq 100 Index and S&P 500 Index have turned positive, with the Nasdaq up 0.3% and the Philadelphia Bank Index up 0.8%.The Dow Jones has also almost completely recovered the losses from earlier in the day.

16:45

Jaguar Uranium announced that its key Environmental Impact Assessment (EIA) for the Laguna Salada uranium project in Argentina has been approved ahead of schedule.This important milestone paves the way for subsequent project development and marks a substantial progress for the company in advancing uranium resource extraction.

16:40

Financing costs in France, Italy, Spain, and Greece rise by up to about 9 basis pointsTwo-year French government bond yields rose by 8.5 basis points to 2.208%; 30-year French government bond yields rose by 5.5 basis points to 4.227%. Italian 10-year government bond yields rose by 8.9 basis points to 3.359%. Spanish 10-year government bond yields rose by 7.5 basis points to 3.137%. Greek 10-year government bond yields rose by 9.2 basis points to 3.362%.

News