News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 8)|The median stock price of DAT companies listed in the U.S. and Canada has fallen 43% this year; Trump proposes replacing the current personal income tax system with tariff revenue2Bitcoin price dips below 88K as analysis blames FOMC nerves3Stablecoin : Western Union plans to launch anti-inflation "stable cards"

Cantor Fitzgerald Discloses Major Stake in Solana ETF, Signalling Institutional Embrace

DeFi Planet·2025/12/02 19:03

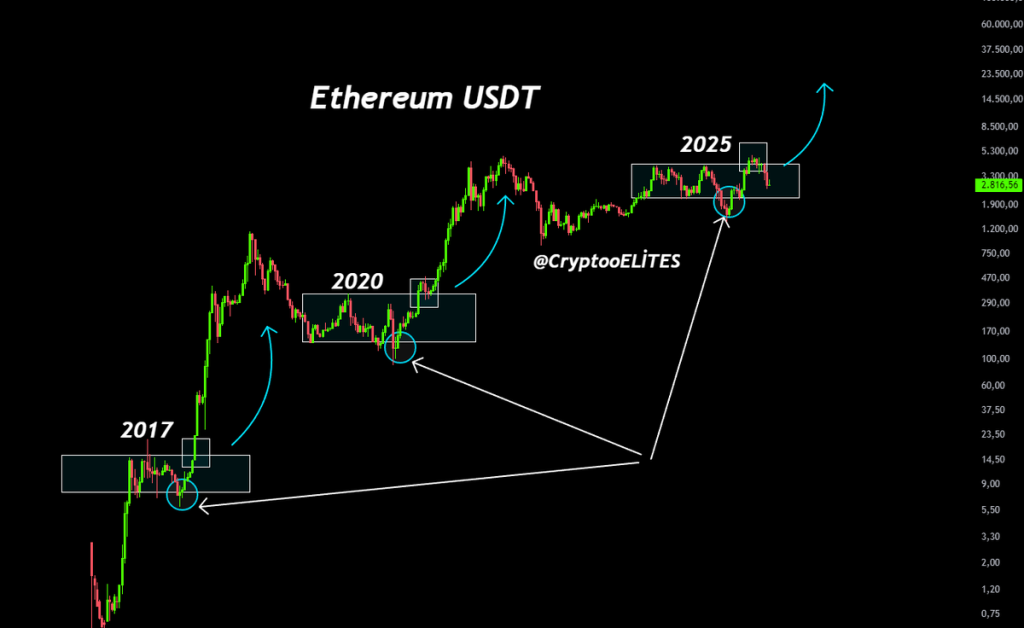

Ethereum (ETH) Price Slides; Mirrors 2017 & 2020 Patterns—Is a Breakout Ahead?

Coinpedia·2025/12/02 18:57

RootData launches exchange transparency evaluation system to promote new standards for information disclosure and compliance in the industry

Transparency has become the new battleground for compliance. RootData is joining forces with exchanges to build a trusted ecosystem, helping investors extend their lifecycle.

Chaincatcher·2025/12/02 17:40

A well-known crypto KOL is embroiled in a "fraudulent donation scandal," accused of forging Hong Kong fire donation receipts, sparking a public outcry.

Using charity for false publicity is not unprecedented in the history of public figures.

Chaincatcher·2025/12/02 17:40

Sample Cases of Crypto Losses: A Map of Wealth Traps from Exchange Runaways to Hacker Attacks

Bitpush·2025/12/02 17:32

Musk calls Bitcoin an energy-based "physics currency"

Bitpush·2025/12/02 17:31

EU Banks Launch Coordinated Push for Euro-Pegged Stablecoin by 2026

Kriptoworld·2025/12/02 16:00

Best Crypto to Stock Up On Ahead of the Santa Rally 2025: REACT, SUI, and LINK

Cryptodaily·2025/12/02 16:00

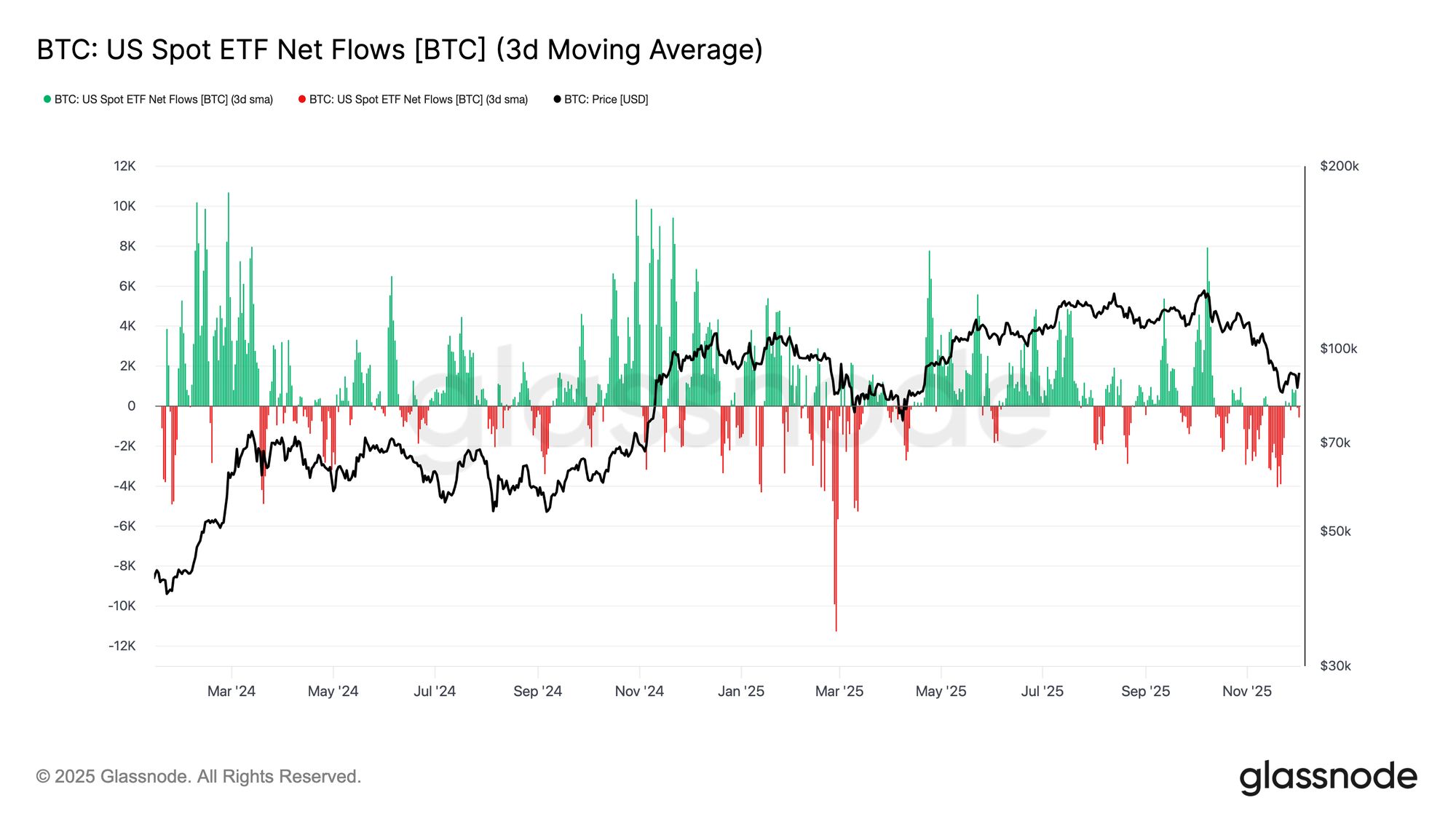

Echoes of Early 2022

Bitcoin stabilizes above the True Market Mean, but market structure now mirrors Q1 2022 with over 25% of supply underwater. Demand is weakening across ETFs, spot, and futures, while options show compressed volatility and cautious positioning. Holding $96K–$106K is critical to avoid further downside.

Glassnode·2025/12/02 16:00

Flash

- 06:58The US spot Solana ETF saw a net inflow of $19.2 million over the past week.According to Jinse Finance, as disclosed by SolanaFloor, US spot Solana ETFs recorded a net inflow of $19.2 million over the past week, bringing the total cumulative inflow to $638 million. Among them, Bitwise BSOL performed the best, with an inflow as high as $55.1 million, surpassing the combined total of all other Solana ETFs.

- 06:58Korean media: Due to regulatory delays, South Korea's plan to allow spot cryptocurrency ETF trading within the year has basically fallen throughJinse Finance reported, citing Korean media naver, that due to delays in the revision of South Korea's Capital Markets Act, the country's plan to allow spot cryptocurrency ETF trading within the year has basically fallen through. Currently, there are four pending amendments related to the approval of spot cryptocurrency ETFs, but some analysts point out that, as a result of the institutional restructuring of the Financial Services Commission and the Financial Supervisory Service, as well as government measures to stimulate the stock market consuming a large amount of policy resources, the institutionalization process of crypto assets may have been relegated to a secondary position.

- 06:55Uniswap founder: Uniswap CCA's first auction has ended, with bids reaching $59 millionChainCatcher news, Uniswap founder Hayden Adams posted on X that the first Uniswap CCA auction initiated by Aztec Network has ended, with a total bid amount reaching $59 million. There was no sniping, bundling, or timing games during the auction process; instead, it was a slow and fair price discovery, ultimately closing at a price 59% higher than the reserve price. Part of the auction proceeds and token reserves will be used to launch the Uniswap v4 liquidity pool, which will become the largest source of secondary market liquidity.

News