News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

This document also systematically discloses a large amount of important details such as legal pricing, token release schedule, market-making arrangements, and risk warnings.

The specific disposition of this large amount of Bitcoin will be decided early next year.

Quick Take Bitcoin fell near $103,000 on Tuesday, driven primarily by investor profit-taking and macroeconomic uncertainties. Hopes for a December interest rate cut have dwindled following a report detailing growing internal conflict among Federal Reserve officials over the decision.

With institutions stepping in and volatility cooling down, bitcoin is entering a smoother and more mature cycle.

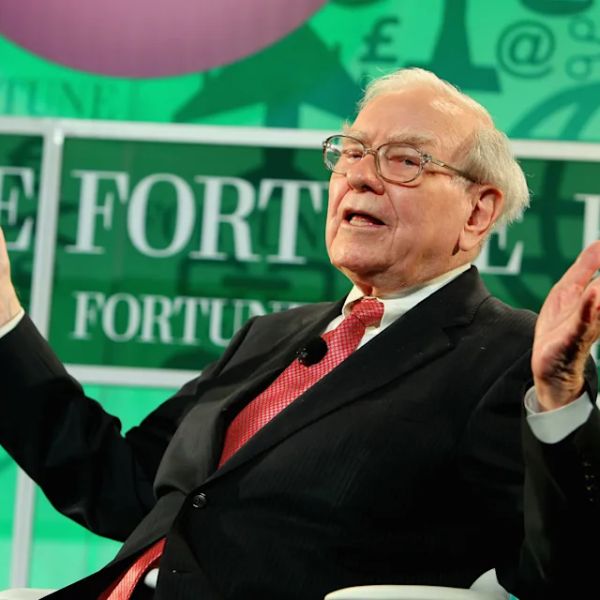

The Oracle of Omaha has written his final letter. What he and Charlie Munger have left for the crypto world is a "negative timeline" spanning a decade.

The Atlas upgrade marks the first time that L2 can directly rely on Ethereum as a real-time liquidity hub, representing not only a technical advancement but also a reshaping of the ecosystem landscape.