News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

This article will explore how Coinbase's diversified businesses work together to achieve its vision.

Bitcoin price has seen a significant pivot from its historic 4-year cycle that is supported by halving events.

Former Binance CEO Changpeng Zhao has made a soft jab at gold advocate Peter Schiff about the verifiability of the asset.

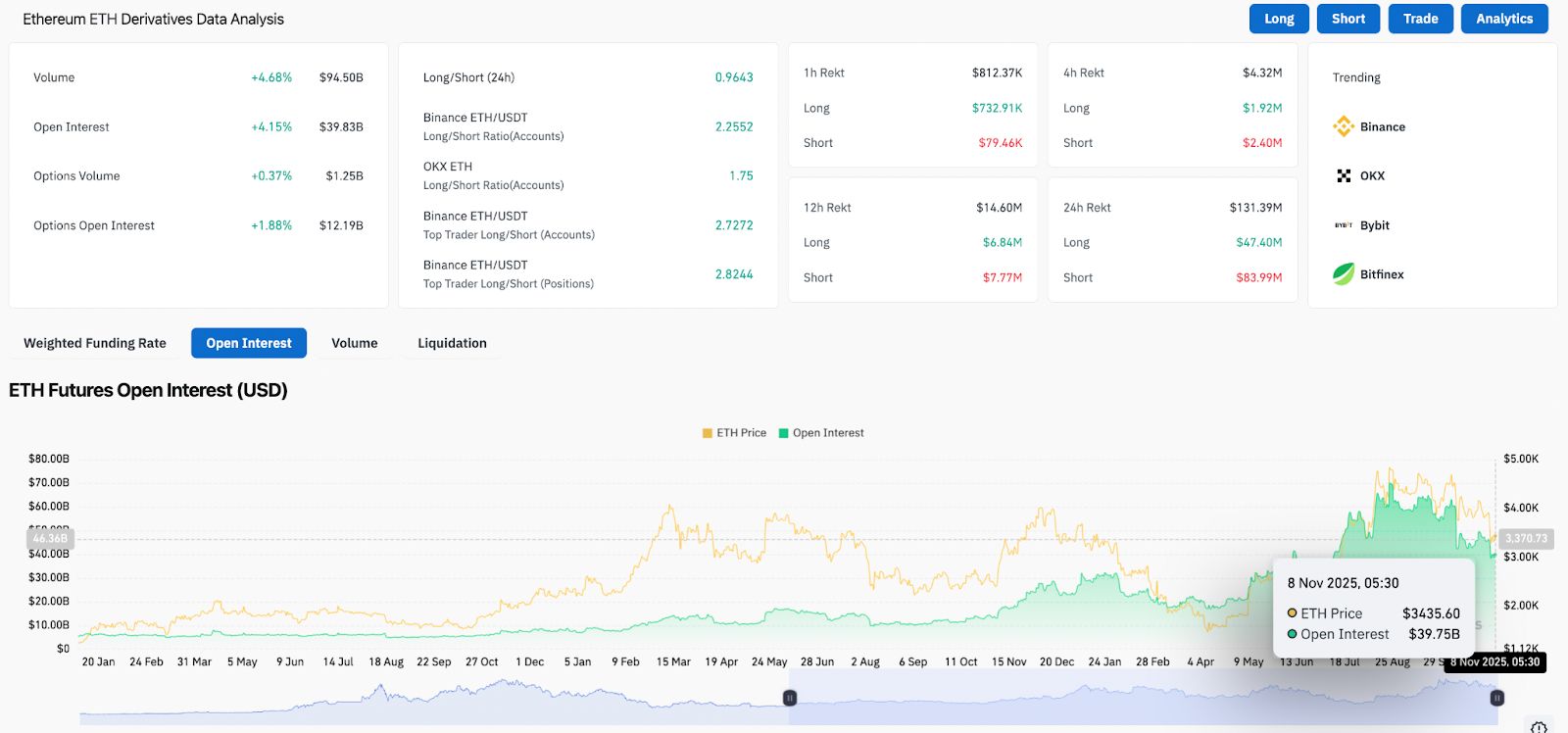

Ethereum trades near $3,446, struggling to reclaim the former rising trendline that had supported every higher low since April. Derivatives data show renewed long exposure, with open interest up 4.15% as traders cautiously re-enter after the breakdown. A daily close above $3,935 would flip Supertrend bullish and confirm breakout toward $4,400–$4,800.

RaveDAO is not just about organizing events; it is creating a Web3-native cultural ecosystem by integrating entertainment, technology, and community.

If x402 is the “currency” of the machine economy, then what ERC-8004 provides is the “passport” and “credit report.”