News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

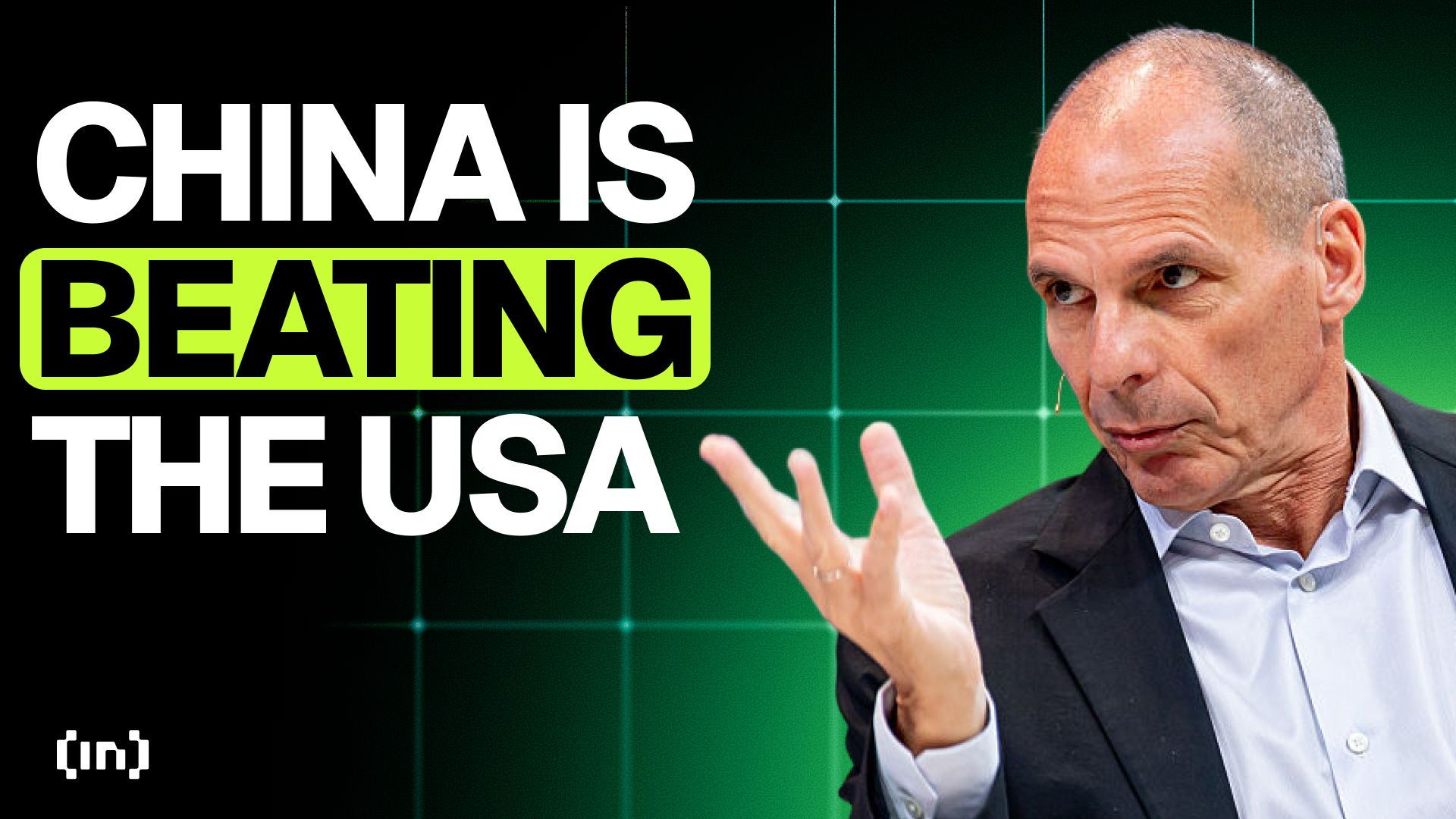

Yanis Varoufakis cautions that America’s push to dominate digital finance through stablecoins may backfire, destabilizing global markets while China’s disciplined, state-led model gains strength.

The key issue in this attack lies in the protocol’s logic for handling small transactions.

Long-standing issues surrounding leverage, oracle infrastructure, and PoR transparency have resurfaced.

Investors speculate that, with the "suspense" of high inflation gone, ZEC may follow a trajectory similar to early Bitcoin.

Spot bitcoin ETFs, which have long been regarded as "automatic absorbers of new supply," are also showing similar signs of weakness.

A single vulnerability exposes the conflict between DeFi security and decentralization.

Is Bitcoin's decline due to institutions not buying?

比特币下跌,是因为机构不买了吗?

Kraster’s team of blockchain engineers, fintech specialists, and cybersecurity experts is currently showcasing the new Kraster Wallet at SiGMA Europe 2025 in Rome (November 3–6). Visitors to the booth can see live demonstrations of the wallet, explore its technical design, and learn how it manages the balance between convenience and self-custody in digital asset management.

Investors speculate that, after the suspense of high inflation is lifted, ZEC may follow in the footsteps of Bitcoin's early days.