News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec.23)|Michael Selig Appointed as the 16th Chair of the CFTC; Powell Has Secured Three Rate Cuts; Strategy Adds $748M to Its Reserves2Bitget US Stock Daily Report | Gold Breaks $4,460; Tesla Approaches $500; Novo Nordisk Oral Drug Approved (December 23, 2025)3Bridgewater founder: Enormous risks from huge bubbles and vast wealth gaps

Is Aevo (AEVO) Poised for a Breakout? This Key Pattern Formation Suggests So!

CoinsProbe·2025/11/03 22:12

Near Protocol (NEAR) Dips to Test Key Support — Could This Pattern Trigger a Bounce Back?

CoinsProbe·2025/11/03 22:12

Hyperliquid (HYPE) Dips to Retest Key Breakout – Will It Bounce Back?

CoinsProbe·2025/11/03 22:12

BitMine doubles down on Ethereum as ETH holdings hit 3.4 million

Coinjournal·2025/11/03 21:57

Balancer Faces Massive $110M Breach — One of the Largest DeFi Exploits of 2025

CryptoNewsFlash·2025/11/03 21:57

Solana Just Had Its ‘Ethereum Moment’ — ETFs, $417M Inflows, and Wall Street Cheers

CryptoNewsFlash·2025/11/03 21:57

XRP ETF Approval Looms as November Kicks Off XRP’s Historically Strongest Month

CryptoNewsFlash·2025/11/03 21:57

Zcash Is Back — and Some Experts Think It Could Replace Bitcoin

CryptoNewsFlash·2025/11/03 21:57

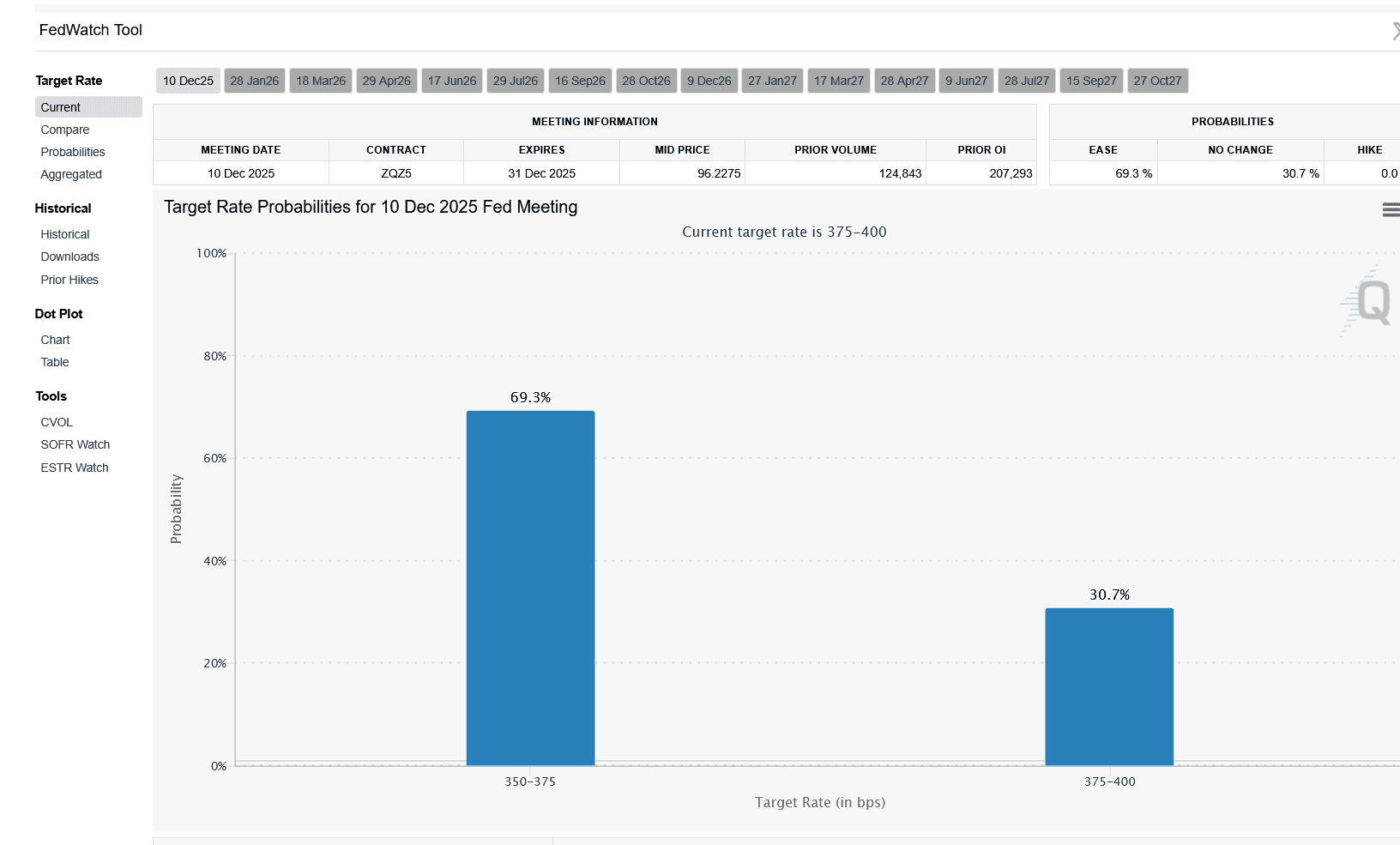

Fed Uncertainty Slams Dogecoin Price

Cryptoticker·2025/11/03 21:51

Bitcoin Price Below 100K: Is This the Start of a Deeper Crash?

Cryptoticker·2025/11/03 21:51

Flash

18:15

Data: 4.1811 million MORPHO transferred out from Ethena, worth approximately $4.89 millionAccording to ChainCatcher, Arkham data shows that at 02:03 (UTC+8), 4,181,099.9999999995 MORPHO (worth approximately $4,891,887) were transferred from Ethena to an anonymous address (starting with 0x6930...).

18:07

Whale sell-offs slow down, new whales' realized losses stabilizeThe whale selling trend appears to be slowing down, and the realized losses of new whales have stabilized, after previously driving the price down from $124,000 to $84,000. (Cointelegraph)

18:01

Trump: Opponents Will Never Get the Federal Reserve Chair PositionAccording to ChainCatcher, citing Golden Ten Data, U.S. President Trump stated that anyone who opposes him will never get the position of Federal Reserve Chairman. He also mentioned that if the market performs well, he hopes the new Federal Reserve Chairman will lower interest rates.

News