News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Jan.9)|Zcash team mass resignations trigger ZEC oversold conditions; approx. $2.22B worth of BTC and ETH options expire today; U.S. initial jobless claims for the week ending Jan 3 came in at 208K2Bitget UEX Daily | Non-Farm Eve Market Split; Trump Picks Fed Chair; CME Hikes Precious Metals Margins (Jan 08, 2026)3Hyperliquid: How whale transfers have stressed HYPE’s fragile price structure

Interest Rate Cut Expectations Shift Dramatically! Has Bitcoin Already Bottomed Out?

Bitpush·2025/11/27 07:11

Wall Street's "most optimistic bull" JPMorgan: Driven by the AI supercycle, the S&P 500 Index is expected to break through 8,000 points by 2026

The core driving force behind this optimistic outlook is the AI supercycle and the resilient US economy.

ForesightNews·2025/11/27 06:22

The most profitable application in the crypto world starts to slack off

Why is pump.fun being questioned for "rug pulling"?

BlockBeats·2025/11/27 05:42

Interpretation of the Five Winning Projects from Solana's Latest x402 Hackathon

The Solana x402 hackathon showcased cutting-edge applications such as AI autonomous payments, model trading, and the Internet of Things economy, indicating a new direction for on-chain business models.

BlockBeats·2025/11/27 05:42

The crypto market takes a breather as Bitcoin rebounds to $91,000—can it continue?

金色财经·2025/11/27 05:33

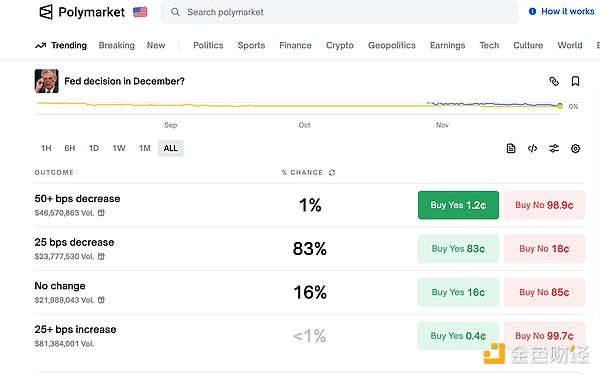

With three major positive factors, can the crypto market shake off its slump in December?

Ethereum upgrade, Federal Reserve rate cuts, and the confirmation of a dovish Federal Reserve candidate.

ForesightNews 速递·2025/11/27 05:33

70% of traders suffer from insomnia? Bitcoin's nighttime volatility is to blame

70% of traders believe that lack of sleep is the main cause of mistakes in trading decisions.

ForesightNews 速递·2025/11/27 05:32

Bitcoin’s path back to $112K and higher depends on four key factors

Cointelegraph·2025/11/27 05:21

Bearish Bitcoin mining data may be counter signal that encourages spot-driven BTC rally

Cointelegraph·2025/11/27 05:21

Flash

02:37

Trump: I know nothing about Powell being investigated; his work at the Federal Reserve has not been outstanding.Foresight News reported, citing NBC, that Trump stated in a phone interview that he knew nothing about the Department of Justice investigation and once again criticized Powell. "I know nothing about this matter, but he is obviously not doing a good job at the Federal Reserve, nor is he doing a good job with the building project." When asked how he would respond to Powell's claim that the subpoena was government pressure on the Federal Reserve to cut interest rates, Trump said, "No, I wouldn't even consider doing it that way. The real pressure on him should be the reality of interest rates being too high. That's the only pressure he faces." Previously, according to The New York Times, U.S. federal prosecutors have launched an investigation into Powell regarding the renovation project at the Federal Reserve headquarters.

02:37

Polymarket and Kalshi Founders Make Forbes Under 30 Self-Made Wealthy ListBlockBeats News, January 12, Forbes released the 2025 Under 30 Self-Made Billionaires List, according to which, among the top 13, 9 are from the artificial intelligence industry, while the remaining 4 are involved in the prediction market.

The young billionaires who started in the prediction market include the 27-year-old founder of Polymarket and 2 co-founders of Kalshi who are 29 years old, as well as the 29-year-old co-founder of Stake.

02:36

Trump: DOJ Investigation of Powell Unrelated to Interest Rates and Not InvolvedAccording to Odaily, citing NBC reports, Trump stated that the Department of Justice's investigation into Powell is unrelated to interest rates. In addition, Trump denied involvement in the subpoena issued by the Department of Justice to the Federal Reserve.

News

![[Bitpush Daily News Highlights] JPMorgan expects the Federal Reserve to cut rates in December, overturning last week's forecast; Bloomberg analyst: Nasdaq ISE proposes to raise IBIT options position limit to 1 million contracts; the US extends some China tariff exemptions until November 10, 2026; Opinion: Gold price to approach $5,000 in 2026, will break another historic milestone in 2027](https://img.bgstatic.com/multiLang/image/social/36cf6fca0c010535f81683c20d2ea6141764227343223.png)