News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Share link:In this post: Santiment has stated that the increase in social media chatter surrounding the Fed and interest rates could pose risks to digital assets. More than 75% of market participants are predicting a rate cut in September after Powell’s speech. Analysts are divided over the short and long-term effects on digital assets if a rate cut happens in September.

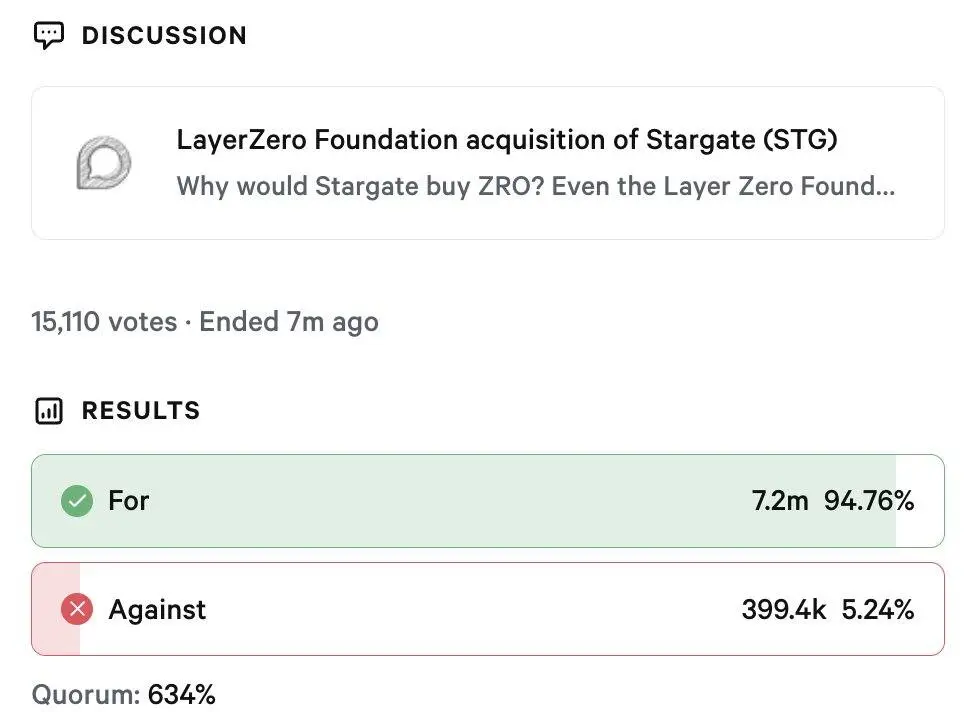

Share link:In this post: LayerZero announced its acquisition of Stargate Finance in a $120 million deal. The deal will bring Stargate under LayerZero’s ecosystem, with ZRO becoming the sole token. ZRO and STG are down today despite the deal, as holders hope for a resurgence.

Share link:In this post: Emerging markets are projected to outperform developed economies due to looser U.S. monetary policy, tighter fiscal control in EMs, and increasing investor flows. Fed rate cut expectations are boosting EM appeal, with funds like iShares Core MSCI EM ETF attracting billions since April. Strong fundamentals support EM assets, including lower inflation surprises, attractive equity valuations, and selective currency strength like the Brazilian real.

- 04:48Grayscale increased its holdings by approximately 8,874 ETH this morning, worth about $40 million.According to Jinse Finance, Arkham monitoring data shows that approximately 12 hours ago, Grayscale increased its holdings by a total of 8,874.401 ETH, worth about $40 million, through its Ethereum Mini Trust. In addition, Grayscale also increased its holdings by 48.701 BTC, worth $5.59 million, through its Bitcoin Mini Trust.

- 04:41Israel seizes 187 wallets suspected to be linked to the Iranian Revolutionary Guard, holding approximately $1.5 million.Jinse Finance reported that the Israeli Ministry of Defense has ordered the seizure of 187 cryptocurrency wallets, accusing them of being used by the Iranian Islamic Revolutionary Guard Corps (IRGC). The Israeli National Bureau for Counter Terror Financing and Defense Minister Israel Katz announced the seizure order under the 2016 Anti-Terrorism Law. Officials stated that these wallets had processed USDT transactions worth 1.5 billions USD and currently hold about 1.5 millions USD. Blockchain analytics company Elliptic has integrated the seized addresses into its monitoring system, but noted that not all wallets are directly controlled by the IRGC, and some may belong to cryptocurrency infrastructure serving multiple clients.

- 04:29OpenAI Hires Former xAI CFO, Intensifying Competition Between Altman and MuskJinse Finance reported, citing CNBC, that OpenAI has hired Mike Liberatore, the former finance chief of Elon Musk’s xAI, as the commercial finance officer of the artificial intelligence startup, responsible for overseeing its large-scale infrastructure spending. A company spokesperson stated that Liberatore left xAI in July this year after serving only three months and officially joined OpenAI this Tuesday. He will report to Chief Financial Officer Sarah Friar and collaborate with Greg Brockman’s team, which manages the contracts and capital operations behind OpenAI’s compute strategy. This personnel appointment marks the latest escalation in the rivalry between OpenAI CEO Sam Altman and Musk. The two co-founded the nonprofit research lab OpenAI in 2015, but as the company transformed into a fast-growing commercial entity primarily backed by Microsoft, they have publicly split and become fierce competitors in recent years.