News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 17)|U.S. seasonally adjusted nonfarm payrolls for November increased by 64,000; BlackRock transferred approximately $140 million worth of ETH to a CEX2Bitget US Stock Morning Brief | Fed Independence Reaffirmed; NFP Beats Expectations; Tech Rally Lifts Market (December 17, 2025)

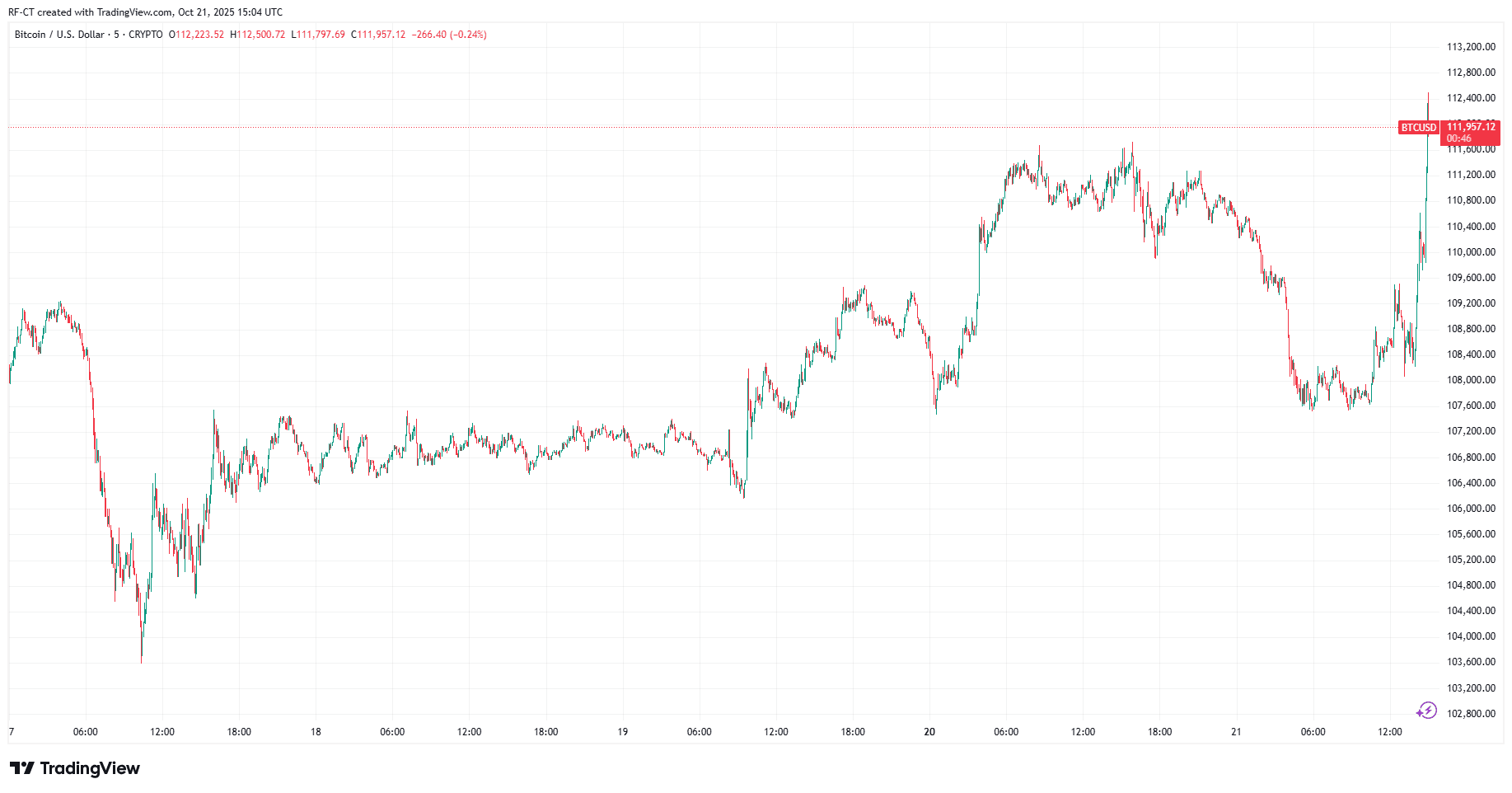

Crypto Crash: Bitcoin Price Falls Back to $107K Dragging Altcoins

Cryptoticker·2025/10/21 18:24

Bitcoin Surges Past $112,000 as the Fed Opens Doors to Crypto: What’s Next?

Cryptoticker·2025/10/21 18:24

Sonic DeFi leader Shadow: Superior "LP Protection + Fee Capture" during the crash

With the x(3,3) model as its core innovation, Shadow Exchange is building a robust DeFi ecosystem centered around liquidity incentives, featuring self-driven and self-evolving capabilities.

深潮·2025/10/21 18:04

Pharos Network announces the official launch of the AtlanticOcean testnet: expanding global access to RWA assets

Since launching its first testnet in May, Pharos has recorded nearly 3 billion transactions across 23 million blocks, with a block time of 0.5 seconds.

深潮·2025/10/21 18:02

The Top Cryptos to Watch in 2025: BlockDAG, Cardano, Kaspa, & VeChain Take the Lead

Coinlineup·2025/10/21 17:33

Circle Introduces Bridge Kit for Cross-Chain Applications

Coinlineup·2025/10/21 17:33

Ethereum developers bring their talents to private enterprises

The open-source community cannot rely solely on passion to sustain itself.

Chaincatcher·2025/10/21 17:06

Solana's Crisis of Faith: Fundamentals Are Unbeatable, So Why Is the Price "Flat"?

Solana always seems to be one step behind others when it comes to catching up with trends.

Chaincatcher·2025/10/21 17:06

Flash

14:13

Harbor completes $4.2 million strategic round financing, led by Susquehanna Crypto and Triton CapitalPANews reported on December 17 that Michael Oved, founder of AirSwap, announced the official launch of Harbor, a next-generation decentralized trading platform co-founded with former THORChain core engineer Pluto. Harbor focuses on native asset cross-chain trading and is positioned as a high-performance, chain-neutral DeFi liquidity infrastructure, dedicated to providing professional-grade matching and scalability for wallets and applications. The project has completed a $4.2 million strategic funding round led by Susquehanna Crypto and Triton Capital, with additional support from market makers such as Auros, Kronos, and Selini.

14:07

IR, THQ listed on Bitget CandyBombAccording to Odaily, Bitget CandyBomb has launched projects IR and THQ, with a total prize pool of 133,333 IR and 133,333 THQ. By completing specific contract trading volume tasks, an individual can receive up to 666 IR or 666 THQ. Detailed rules have been published on the official Bitget platform, and the event will end on December 24, 2025.

14:07

Jito announces that its foundation's core operations will be relocated to the United States.According to Odaily, Solana MEV infrastructure developer Jito Labs has announced that it will transfer the core operations of the Jito Foundation to the United States. It is reported that Jito will establish the headquarters of the Jito Foundation in the US in January next year to support the growth of the network.

News