News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(October 28)|S. today. Trump nominates Michael Selig as CFTC Chairman. Stablecoin USD1 enters partnership with Enso.2Research Report|In-Depth Analysis and Market Cap of Common Protocol (COMMON)3Is Monero (XMR) Gearing Up for a Bullish Breakout? This Key Pattern Formation Suggest So!

UK Trade Groups Push for Blockchain in US Tech Deal

UK trade bodies urge the government to include blockchain in the UK-US Tech Bridge to avoid falling behind in innovation.Warning Against Falling Behind the USStrengthening Transatlantic Blockchain Ties

Coinomedia·2025/09/12 14:42

Maple Finance Fees Surge 238% to $3M in a Week

Maple Finance sees a 238% rise in fees over 7 days, hitting $3M and ranking 2nd in growth among major crypto protocols.What’s Driving Maple Finance’s Growth?Maple Finance’s Position in DeFi

Coinomedia·2025/09/12 14:42

Crypto Fear & Greed Index Hits 57: Greed Zone

The Crypto Fear & Greed Index rises to 57, signaling market greed. What does this mean for Bitcoin and altcoins?What Does Greed Mean for Crypto Markets?Staying Smart in Greedy Times

Coinomedia·2025/09/12 14:42

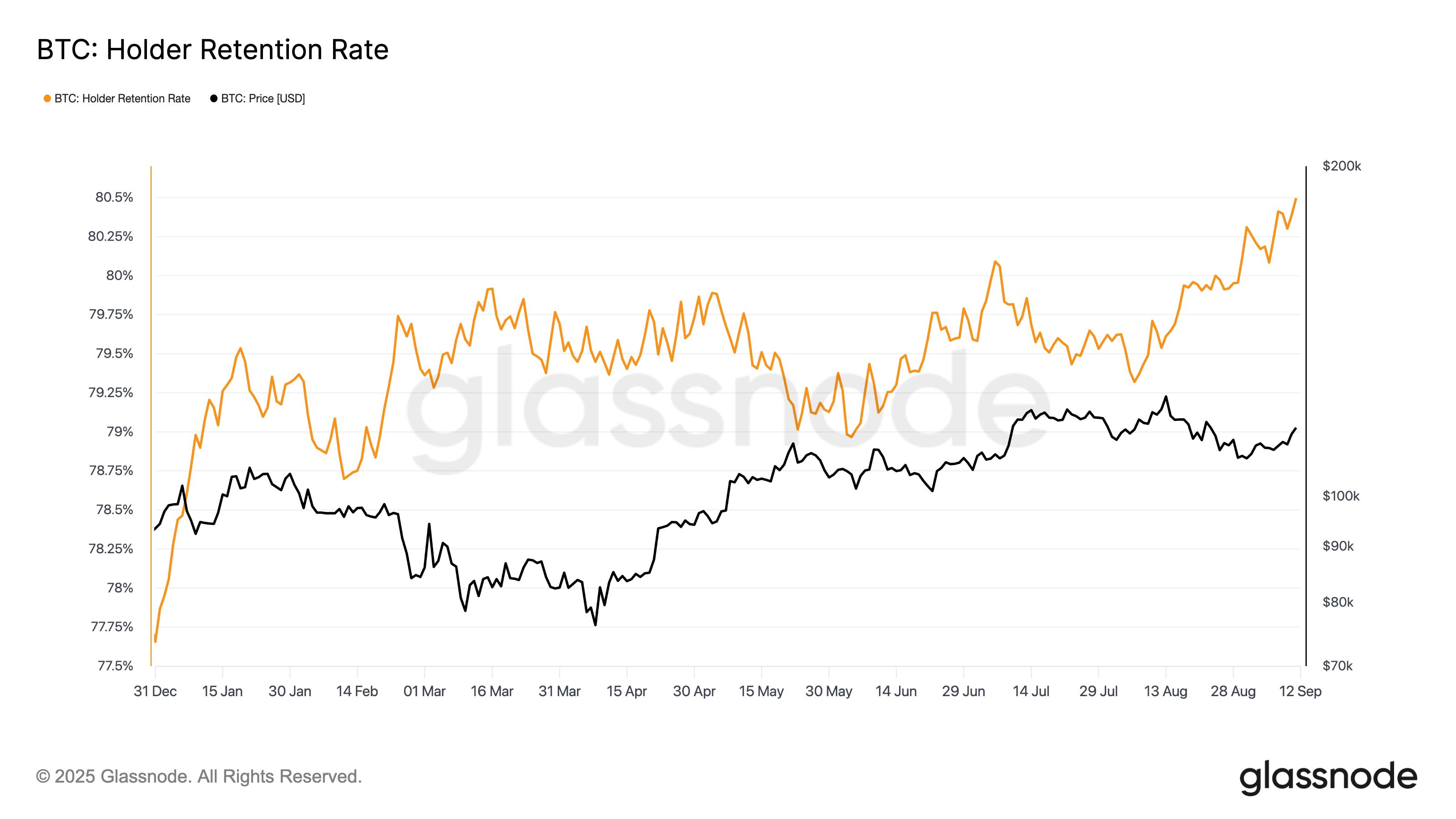

Bitcoin Clears $112,000 Wall, Eyes Return to $120,000 as Hodlers Double Down

CryptoNewsNet·2025/09/12 14:39

Not Just Another Marketplace: How Afrikabal Is Building the ‘SWIFT of Agriculture’ on Lisk

CryptoNewsNet·2025/09/12 14:39

Hedera’s HBAR Climbs 15%, But Diverging Flows Suggest Bulls May Tire Soon

CryptoNewsNet·2025/09/12 14:39

Traders Load Up on Nine-Figure Bullish Bitcoin Bets, Raising Liquidation Risks

CryptoNewsNet·2025/09/12 14:39

US spot Bitcoin ETFs record $552.8M inflows as prices rebound

Coinjournal·2025/09/12 14:36

Nasdaq-listed Safety Shot launches BONK memecoin treasury-focused subsidiary

Coinjournal·2025/09/12 14:36

REX-Osprey Solana ETF crosses $200M milestone as SOL hits seven-month high

CryptoSlate·2025/09/12 14:30

Flash

- 01:17Bitwise Spot Solana ETF sees $69.5 million net inflow on its first dayAccording to Jinse Finance, SolanaFloor reported that the Bitwise spot Solana exchange-traded fund (ETF) BSOL recorded a net capital inflow of $69.5 million on its first day, nearly 480% higher than the $12 million inflow of SSK on its first day.

- 01:07Machi Big Brother deposits 644,000 USDC into HyperLiquid, increasing long positions in ETH and HYPEAccording to Jinse Finance, Onchain Lens monitoring shows that "Machi Big Brother" Huang Licheng (@machibigbrother) deposited $643,939 USDC into HyperLiquid in the past 17 hours to further increase his long positions in ETH (25x leverage) and HYPE (10x leverage).

- 01:07Grayscale GSOL does not have the same regulatory oversight and protections as ETFs and mutual funds registered under the 40 Act.Jinse Finance reported that Grayscale stated on its official website that the Grayscale Solana Trust ETF ("GSOL" or "the Fund") is an Exchange Traded Product (ETP) and is not registered under the Investment Company Act of 1940 ("40 Act"), and therefore does not enjoy the same regulatory oversight and protections as ETFs and mutual funds registered under the 40 Act. Investing involves risks, including the possible loss of principal. Investment in GSOL carries a high degree of risk and volatility. GSOL is not suitable for investors who cannot bear the loss of their entire investment.