News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Gumi reported a sharp Q1 profit rebound fueled by cryptocurrency gains, while mobile game revenue dropped significantly amid restructuring and a shift toward blockchain projects and third-party IP titles.

Crypto markets saw a welcome rally last week as cooling inflation data fueled hopes of a Fed rate cut. The positive sentiment was led by altcoins like Solana and Ethereum.

Mantle cryptocurrency gained 5% on September 15 while most top cryptocurrencies declined, boosted by announcements of upcoming community events in Seoul from September 22-25.

Ripple maintains price stability above $3 despite market uncertainty over Federal Reserve decisions, while boosting community sentiment through a major $25 million RLUSD charitable commitment.

Digital asset investment funds pulled in $3.3 billion last week, led by $2.4 billion in Bitcoin inflows, pushing assets under management to $239 billion.

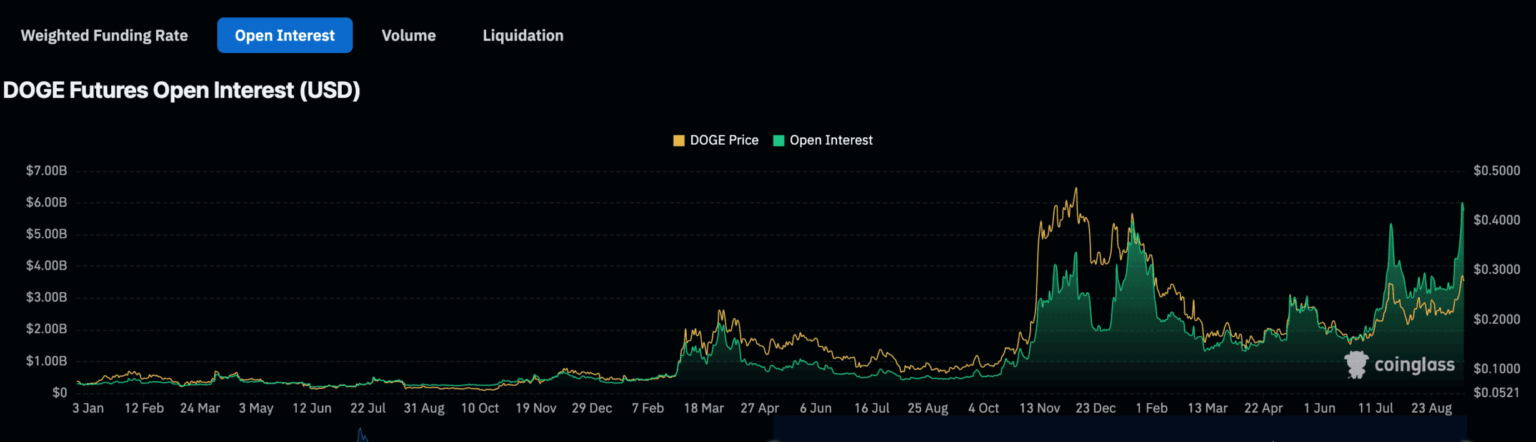

Dogecoin price dropped 9% to $0.26 amid a broader crypto selloff, but analysts view the pullback as a buy-the-dip opportunity.

The Ethereum Foundation established a dedicated AI team called dAI Team to position Ethereum as the preferred settlement layer for AI agents and machine economy, focusing on decentralized infrastructure.

- 02:02Former SEC Chairman Gensler says he is "proud" of taking enforcement actions to regulate cryptocurrenciesChainCatcher news, according to Cointelegraph, former US SEC Chairman Gary Gensler admitted in an interview on Wednesday that he has no regrets about the way cryptocurrency enforcement was handled during his tenure at the agency. Gensler said he is "proud" of the right decisions he made regarding digital asset regulation during his time at the SEC, and reiterated his view that cryptocurrency is a "highly speculative and extremely risky asset." When talking about enforcement actions against cryptocurrency companies, Gensler stated: "We have always worked to ensure investor protection. However, during this period, we have also encountered many fraudsters: look at Sam Bankman-Fried, he is not the only one."

- 01:29Falcon Finance releases FF tokenomics: total supply of 10 billions, with 8.3% allocated for community airdrop and Launchpad sales.ChainCatcher news, Falcon Finance has released the FF tokenomics. The total supply is 10 billion tokens, managed by an independent foundation. The distribution is as follows: 35% allocated to the ecosystem, 32.2% to the foundation, 20% to the core team and early contributors, 8.3% for community airdrops and Launchpad sales, and 4.5% allocated to investors.

- 00:48The whale/institution that has already made a profit of 76.05 million from ETH swing trading bought another 16,569 ETH today.According to Jinse Finance, on-chain analyst Yujin has monitored that a whale/institution, who has already made a profit of $76.05 million through ETH swing trading, bought 18,000 ETH at an average price of $4,487 the day before yesterday, sold 10,000 ETH at $4,600 yesterday, and bought another 16,569 ETH at an average price of $4,484 (worth $74.29 million) early this morning. Through swing trading ETH, they have made an additional profit of $1.13 million, bringing the total profit to $76.05 million.