News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(September 12)|First US Spot XRP ETF Launches Today; Grayscale Applies to Convert Multi-Asset Trusts to ETFs; BTC Longs Face Increasing High Leverage Risk2XRP Loses Nearly 50% of Active On-Chain Accounts; Price Could Be at Risk While Breakout Remains Possible3Bitcoin Clears $112,000 Wall, Eyes Return to $120,000 as Hodlers Double Down

Manta Network (MANTA) To Rally Higher? This Emerging Fractal Setup Saying Yes!

CoinsProbe·2025/08/15 17:10

Massive Crypto Moves: $7.9B in Options Expire, $2B USDT Minted in 24 Hours

Cryptoticker·2025/08/15 17:00

Ethereum Price Nears $4,800 as Institutional Buying Triggers Supply Crunch

Cryptoticker·2025/08/15 17:00

US Sanctions Ruble Stablecoin A7A5: Potential Impact on Tether?

The US Treasury's sanctions against A7A5, a ruble-backed stablecoin, have caused a significant drop in its value. Despite this, Tether remains unaffected, highlighting the resilience of major stablecoins despite regulatory pressures on Russian crypto assets.

BeInCrypto·2025/08/15 17:00

Ark Invest buys $172 million in Bullish, stock soars 83% on NYSE debut

Cointime·2025/08/15 16:45

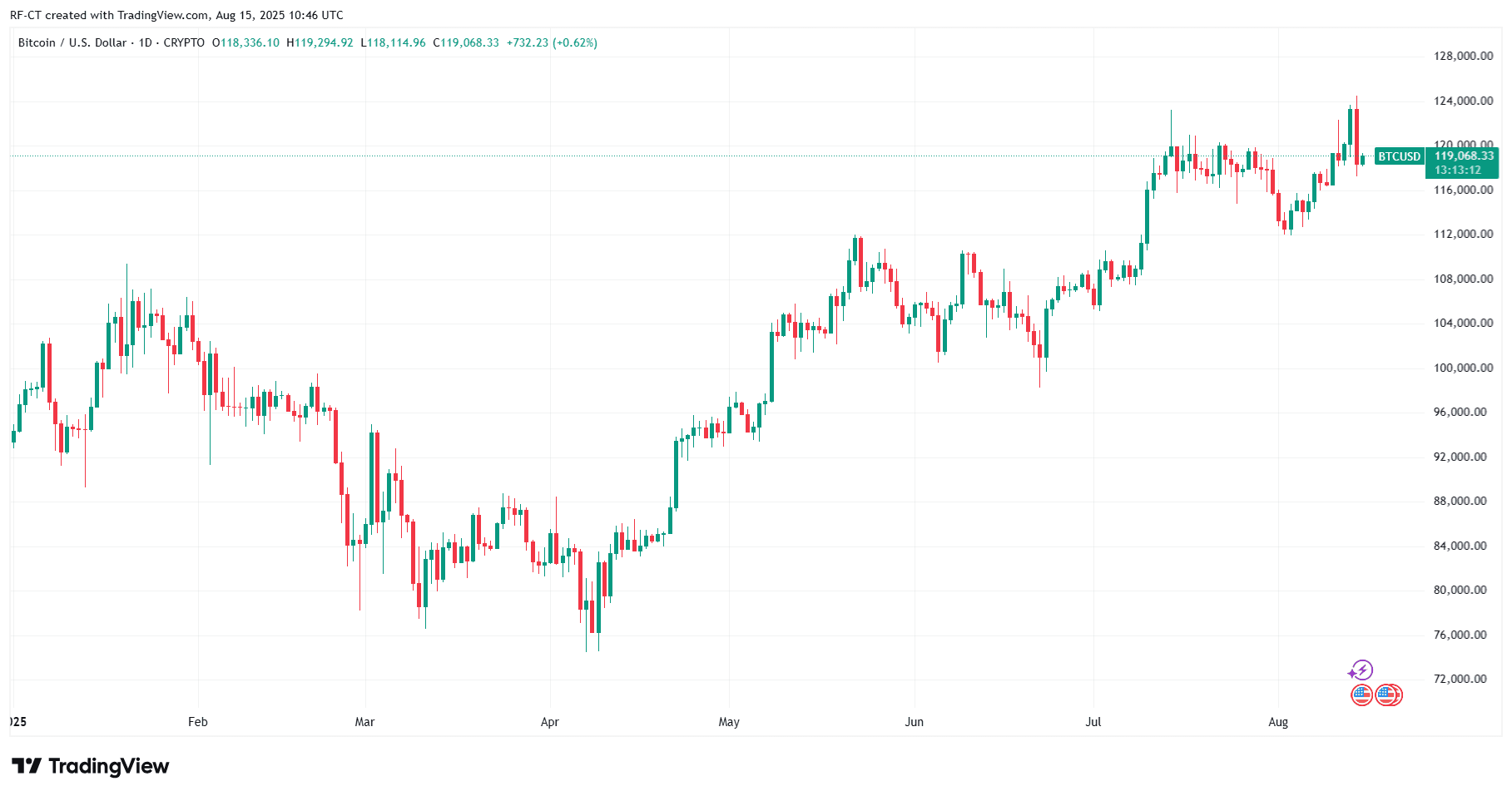

Bitcoin charts are similar to the 2021 top: Will history rhyme?

Cointime·2025/08/15 16:45

Chainlink Whale Activity Hit Seven-Month High — What’s Next for LINK Price?

Despite a recent price pullback, Chainlink’s whale transactions are at a seven-month high, suggesting confidence from large investors. If LINK holds the $22.21 support, it could target a breakout toward $25.55.

BeInCrypto·2025/08/15 16:30

Ethereum’s 2025 Cycle Reflects 2017 Patterns Amid Institutional Support and Growing DeFi Activity

Coinotag·2025/08/15 16:00

AAVE Faces Key Support at $278 Amid Bearish Pressure and Long-Term Growth Potential

Coinotag·2025/08/15 16:00

Flash

- 08:45Kame Aggregator was hacked this morning, and the attacker has returned 185 ETH.According to Jinse Finance, the Sei trading aggregator Kame Aggregator has officially announced that it has successfully reached an agreement with the hacker, who has agreed to return the stolen funds. Through an Ethereum transaction, 185 ETH has already been recovered and returned to the platform. Kame Aggregator stated that it is currently collecting relevant information from affected users and will soon announce a detailed compensation plan.

- 08:33$12.75 billion in new stablecoins minted within 30 daysAccording to Jinse Finance, CoinBureau reports that 12.75 billions USD worth of new stablecoins have been minted in the past 30 days. The additional liquidity from Tether and Circle may become the trigger for the next round of significant cryptocurrency volatility.

- 08:32Galaxy Digital Head of Research: The United States is very likely to establish a strategic bitcoin reserve within this yearChainCatcher news, according to Cointelegraph, Alex Thorn, Head of Research at Galaxy Digital, stated that the U.S. government is very likely to announce the establishment of a Strategic Bitcoin Reserve (SBR) this year and officially hold BTC as a strategic asset. The market is "underestimating" the likelihood of the U.S. forming a Strategic Bitcoin Reserve this year. However, other industry executives are less confident. Dave Weisburger, former chairman of CoinRoutes, said that this is more likely to happen in 2026. "This administration is very smart and will not announce anything before accumulating the initial target."