News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Behind the limited rewards lies an infinite game. The essence of trading competitions is a collective prisoner's dilemma—whether to achieve a Nash equilibrium or fall short, this uncertain game further excites traders’ nerves.

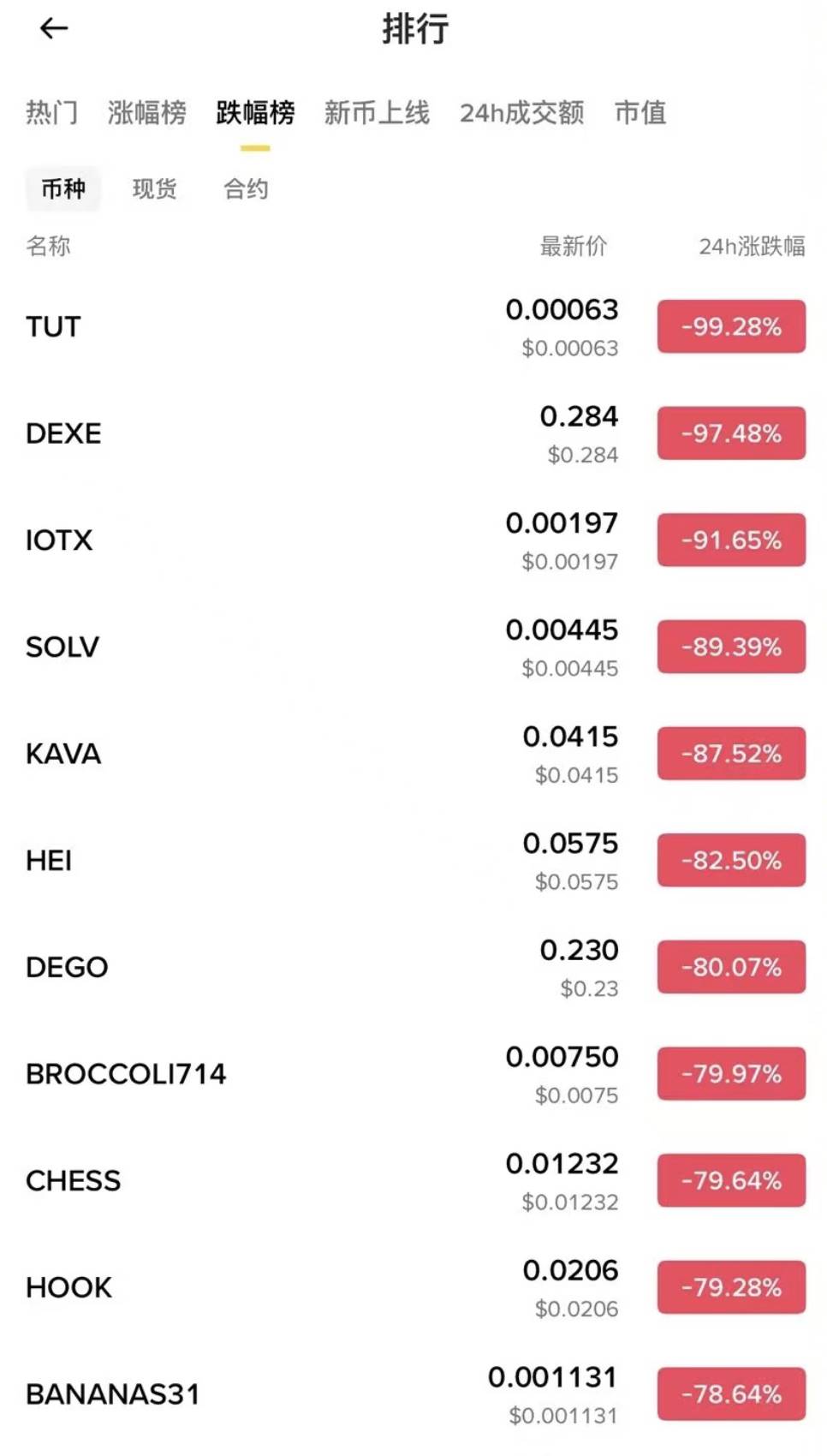

After the sharp drop early this morning, funding rates on major CEX and DEX platforms indicate that the market has clearly turned bearish.

When a wallet address is no longer just an asset credential, but an identity; when a profile picture is no longer just a JPEG, but a community signal; when a joke can spark collective creation and meme propagation, the spirit of decentralization has already taken root culturally. It does not need to be explained, but rather used, imitated, and recreated.

This year, as the popularity of the DePIN sector continues to rise, IoTeX has achieved several key milestones in the third quarter of 2024, attaining impressive results that have further solidified its position as a leader in the DePIN ecosystem.

Accurately shorting for a profit of 80 millions, on-chain data reveals suspicious funds linked to Garrett Jin.

Survival is everything.

- 05:44Crypto startup LI.FI completes $29 million funding roundJinse Finance reported that cryptocurrency startup LI.FI has completed a $29 million financing round, led by Multicoin and CoinFund, bringing its total funding to approximately $52 million. LI.FI plans to expand into various trading sectors, including perpetual futures, yield opportunities, prediction markets, and lending markets, and also intends to use the new funds to hire more employees.

- 05:25Elliptic Report: Banks, Stablecoins, and Asian Financial Hubs Will Lead the Next Phase of Crypto Policy DevelopmentJinse Finance reported that, according to Elliptic's "2025 Global Crypto Regulation Review Report" released on Thursday, the global crypto regulatory landscape is undergoing transformation, with banks, stablecoins, and Asian financial hubs set to lead the next phase of policy development. The annual report points out that this year, governments around the world are shifting their regulatory focus from an "enforcement-led approach" to building a comprehensive regulatory framework that prioritizes innovation, marking a sharp contrast to the strict and confrontational regulatory attitudes of recent years. This shift is particularly evident in the United States. Former U.S. President Donald Trump has made "seizing leadership in the crypto sector" one of his core policy priorities and has promoted the formal passage of the "Cryptocurrency Innovation and Cybersecurity Enhancement Act" (GENIUS Act), which has also become the first federal-level stablecoin regulatory framework in the United States.

- 05:06Yilihua: Three Factors Including Strengthened Wall Street Consensus Drive Bullish Outlook for EthereumChainCatcher news, Liquid Capital (formerly LD Capital) founder Yi Lihua stated on social media that he remains firmly bullish on Ethereum. The reasons are as follows: First, the strengthening of Wall Street consensus: SEC Chairman's latest statement that "finance is migrating on-chain," and American political and economic elites are jointly promoting the tokenization of US Treasury bonds, with Ethereum as the core carrier. Second, the Fusaka upgrade is reshaping value: Blob fees have surged, with over 1,500 ETH burned in a single day, accounting for 98%. The prosperity of L2 is strongly feeding back to the mainnet, and deflation is imminent. Third, extreme technical cleansing: speculative leverage has dropped to a historical low of 4%, and CEX holdings are only 10%. ETH/BTC is consolidating and resisting declines, shorts are exhausted, and a short squeeze is imminent. In the rate-cutting cycle, capital is rotating from BTC to ETH, which has practical utility.