News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Spot Gold & Silver Continue to Drop, Bitcoin Crashes; Amazon’s $200 B Capital Expenditure Raises Concerns; U.S. Job Openings Fall to 2020 Lows — Feb 6, 2026 (English Translation)2Weekend Trading Playbook: High-Impact Macro Events & Earnings for Feb 9-15, 2026 – Tech & Crypto Volatility Plays3 Is the “Perfect Storm” Here? Liquidations Explode as Bitcoin Bleeds Below $70K & DXY Rises

China to Pay Interest on Digital Yuan From 2026, Challenging Alipay, WeChat Pay

Coinpedia·2025/12/29 13:03

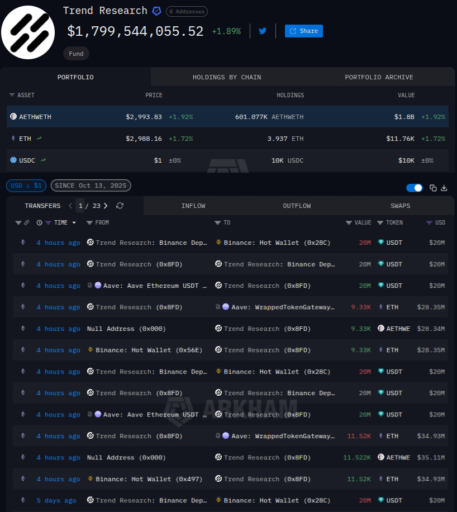

Big Ethereum News: Trend Research Accumulates Over 600K ETH Despite Market Slide

BlockchainReporter·2025/12/29 13:00

China Digital Yuan Shifts to Interest-Paying Bank Money

Cryptotale·2025/12/29 12:36

Investment Firm Borrows $1B in Stablecoins on Aave to Buy Ethereum

Coinspeaker·2025/12/29 12:24

China Unveils Plan for Banks to Pay Interest Rate on Digital Yuan

Coinspeaker·2025/12/29 12:00

Bitcoin Breaks New Price Levels Under Unforeseen Factors

Cointurk·2025/12/29 11:42

Ghana Introduces State Regulation of Crypto Market

Coinspaidmedia·2025/12/29 11:21

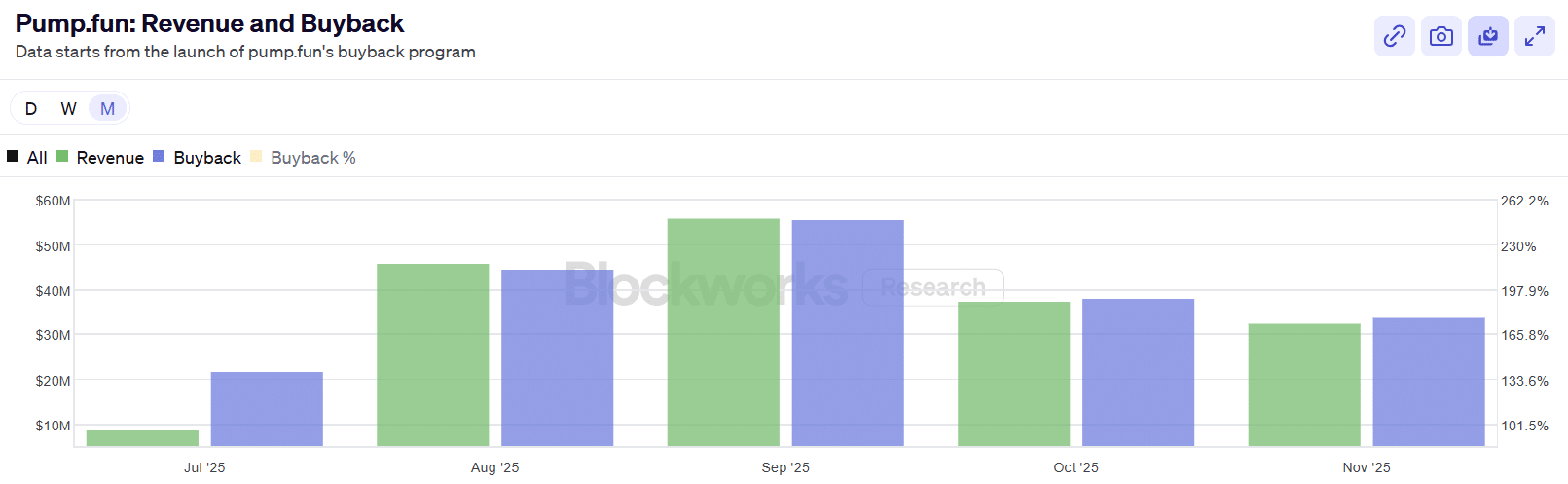

PUMP’s $615 mln cashout and a 60% drop: The story investors can’t ignore

AMBCrypto·2025/12/29 11:03

Bitcoin Faces Liquidation Risk at $88,000 as AI Detects Rising Leverage

The Bitcoin News·2025/12/29 11:00

Tokenized Silver Market Soars with Unprecedented Volume Growth

Cointurk·2025/12/29 10:52

Flash

17:08

Analyst: Ethereum MVRV price range falls below 0.80 again, possibly signaling a market bottomJinse Finance reported that analyst Ali stated on the X platform that the previous three times Ethereum's MVRV pricing range fell below 0.80, it marked a market bottom. Now, as the price drops below $1,959, this signal has appeared once again.

16:24

Goldman Sachs trader says selling pressure on US stocks persistsGoldman Sachs' trading division stated that the U.S. stock market may face additional selling pressure from trend-following algorithmic funds this week. The S&P 500 index has already triggered a short-term sell point, and Commodity Trading Advisors (CTAs) are expected to remain net sellers over the coming week. Goldman Sachs predicts that if the stock market declines, approximately $33 billion in sell-offs could be triggered this week. If the S&P 500 index falls below 6,707 points, up to $80 billion in systematic selling could occur over the next month. Under stable market conditions, CTAs are expected to sell about $15.4 billion in U.S. stocks this week; even if the market rises, they may still sell around $8.7 billion.

16:21

Tom Lee: Crypto Market May Be Forming a Bottom, Ethereum Has Seen 7 Occasions of >60% Drawdown in Past 8 Years with V-Shaped RecoveryBlockBeats News, February 9th, Tom Lee, Chairman of Ethereum Treasury Company Bitmine, stated in a CNBC interview, "In just the past eight years, Ethereum has experienced 7 drawdowns of over 60%. The good news is that all 7 of these have seen a V-shaped recovery. This means that there was a waterfall decline first, followed by a rapid recovery."

"If the crypto market is currently bottoming, which seems possible from the current signs, especially considering MicroStrategy's approximately 25% rebound, then historical experience shows that this type of rebound often takes on a V-shaped structure. This means that as fast as we fall, we often recover at a similar speed."

News