News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Despite gearing up for its version 23 upgrade, Pi Network’s PI token trades flat at $0.34. Weak inflows and bearish momentum raise the risk of a dip to $0.32 unless demand rebounds.

Bitcoin charts flash bullish reversal signs, hinting at a breakout towards $120K as momentum builds rapidly.The Bullish Crossover ExplainedTrendline Break Could Be the Trigger

Christian Rau says Mastercard views crypto as a payment method, not a revolution—focusing on safety and compliance.Stablecoins: A Step Forward, But Not a Replacement

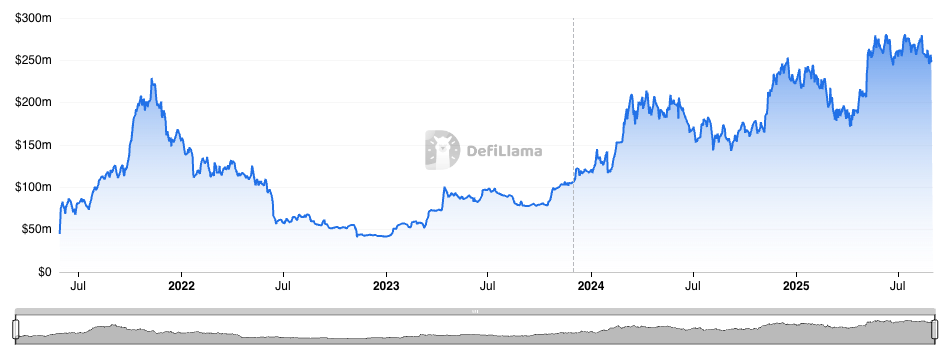

Solana's DEX volume soared to $144B in August, regaining its momentum and matching May’s bullish activity.Why the Spike in Solana DEX Volume?What This Means for Solana and DeFi

The Philippines files SB 1330 to place the national budget on blockchain, boosting transparency and accountability.How Blockchain Will Revolutionize Budget ManagementGlobal Implications and the Future of Public Finance

- 03:29OpenSea releases the top tokens with the highest price increases in the past 24 hours, with ACE surging by 540.6%Jinse Finance reported that OpenSea released the tokens with the highest price increases in the past 24 hours: Ace Data Cloud (ACE), current price $0.007972, up 540.6%; Dragon Origin Realm (DOR), current price $0.2627, up 200.1%; Card Strategy (CSTRAT), current price $0.07382, up 115.5%; VPay by Virtuals (VPAY), current price $0.02272, up 78.2%; (Unnamed project), current price $0.01046, up 65.3%.

- 03:21Bitwise: A large-scale transfer of BTC from retail to institutional investors is currently underwayJinse Finance reported that André Dragosch, Head of Research Europe at Bitwise, stated on the 28th that bitcoin is currently being distributed from early retail investors to institutional investors such as funds/ETPs, corporations, and governments. Unlike other traditional asset classes in history, the adoption of bitcoin was initially driven by retail investors such as cypherpunks and early adopters, with family offices, fund managers, and ETF institutional investors only making their first investments in bitcoin later on. Even today, individual investors still hold about 66% of BTC. This means the vast majority of bitcoin is still controlled by non-institutional investors, and “we are still in the early stages” in terms of institutional adoption. Nevertheless, a large-scale transfer of BTC from retail to institutional investors is currently underway. At present, institutional investors (ETPs and treasury companies) hold about 12.5% of the BTC supply, and this figure is growing rapidly. This transfer is not something that can be achieved overnight; it is a long-term trend. Ultimately, this “great transfer” means that the price of BTC will need to be higher to incentivize BTC to move from early retail investors to institutional investors.

- 03:21Perp DEX platform StandX announces the launch of a Market Making program, distributing 5 million StandX tokens as rewards each month.Jinse Finance reported, according to official sources, that the Perp DEX platform StandX has announced the launch of its Market Making Program. The application form for this program is now open, aiming to provide preferential fee rates and token rewards to eligible market makers. Each month, StandX will distribute 5 million StandX tokens as rewards to qualified market makers based on the number of market makers and their trading performance. Each market maker's reward share = market maker's effective trading volume / total effective trading volume x reward pool.