News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Which new-generation projects are attempting to break away from the old path of "speculative games"?

On October 14, the U.S. Department of Justice announced criminal charges against Chen Zhi, founder of Cambodia's Prince Group, and successfully seized 127,271 BTC under his control, with a market value of approximately $15 billion. This event marks not only the largest judicial seizure of virtual assets in history, but also a public demonstration of state power directly exercising control over on-chain assets.

What drives the market is not only cold economic data, but also greed, fear, and the unpredictable nature of human behavior.

Overview of key market events on October 15th.

The U.S. Department of Justice has seized 127,271 BTC controlled by Chen Zhi, the founder of Cambodia's Prince Group, with a market value of approximately $15 billion, making it the largest judicial seizure of Bitcoin in the world. The case involves fraud, money laundering, and hacking, demonstrating the state's judicial control over on-chain assets. Summary generated by Mars AI. This summary is produced by the Mars AI model, and its accuracy and completeness are still being iteratively improved.

DL Holdings and Antalpha announced a $200M dual-track strategy: $100M for Tether Gold distribution and $100M for Bitcoin mining expansion in Asia.

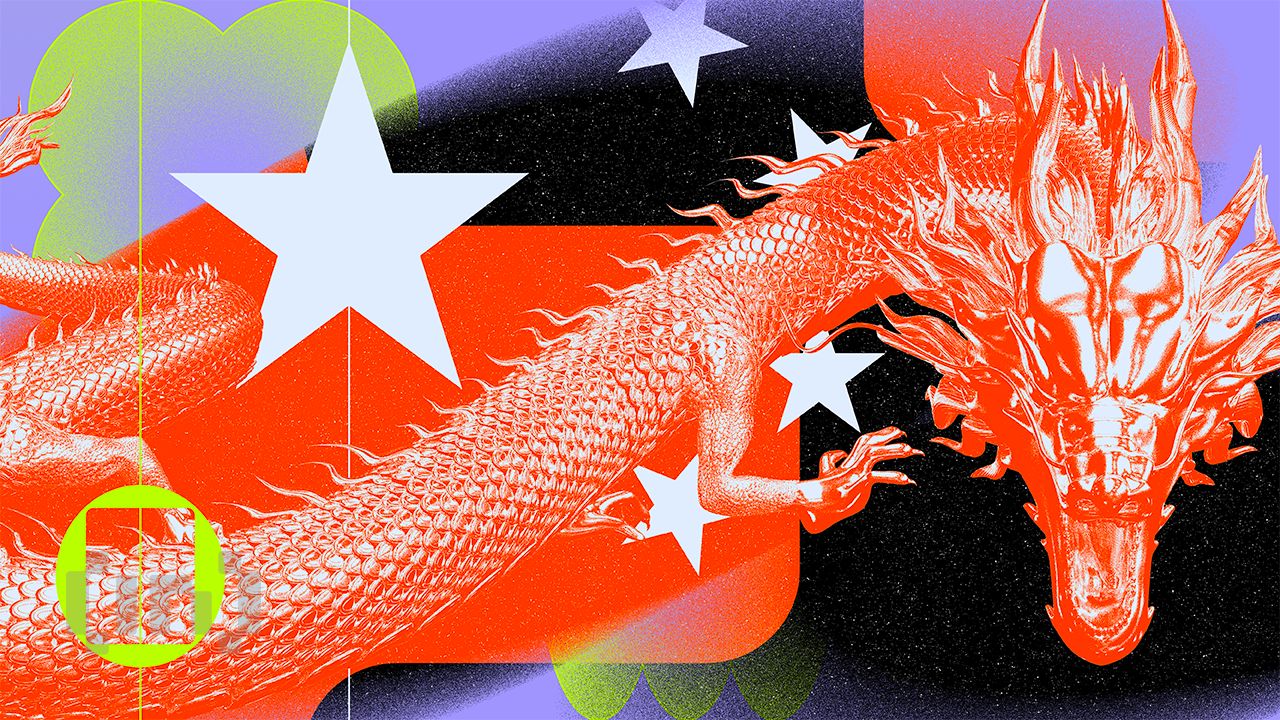

Bitcoin’s price slump may find relief from an unexpected source: China. With the nation’s liquidity expanding rapidly, analysts believe Chinese capital flows could soon drive Bitcoin’s next structural rally, redefining how global liquidity shapes crypto markets.

The Crypto Fear & Greed Index dropped to “extreme fear” for the first time in six months, echoing past market bottoms. Analysts suggest Bitcoin’s stability could signal opportunity, though macro fears still cloud short-term sentiment.