News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 11)|The Federal Reserve announced a 25 bps cut to the benchmark rate; Bitmine purchased 33,504 ETH; CBOE has approved the listing and registration of the 21Shares XRP ETF2Conflicted Fed cuts rates but Bitcoin’s ‘fragile range’ pins BTC under $100K3Full text of the Federal Reserve decision: 25 basis point rate cut, purchase of $4 billion in Treasury bills within 30 days

Crypto Ratio Breaks 0.35 as 2025 Projection Targets 1.20 Resistance

Cryptonewsland·2025/09/30 03:54

PEPE Chart Targets 401% Rally With Price Projection at $0.00003083

Cryptonewsland·2025/09/30 03:54

Pakistan PM Backs Crypto and AI as Future Tools

Pakistan's Prime Minister says crypto and AI are key tools for the country’s digital future.Crypto and AI Recognized at the TopA New Digital Vision for PakistanWhat It Means for Crypto in the Region

Coinomedia·2025/09/30 03:51

Powell is about to step down. Who will be the next "money-printing chief"?

From "Estée Lauder's son-in-law" to "Trump loyalist," how might the crypto stance of potential successors impact the market?

Chaincatcher·2025/09/30 03:37

Weekly News Preview | US to Release September Seasonally Adjusted Nonfarm Payrolls and Unemployment Rate Data

This week's key news highlights from September 29 to October 5.

Chaincatcher·2025/09/30 03:36

Institutional Demand and Firedancer Upgrade Fuel Solana Rally: Can SOL Hold $207 Support?

CryptoNewsNet·2025/09/30 03:36

SEC clears DePIN tokens as ‘fundamentally’ outside jurisdiction

CryptoNewsNet·2025/09/30 03:36

BitMine’s Lee calls ETH a ‘discount to the future,’ Bit Digital eyes $100M

CryptoNewsNet·2025/09/30 03:36

SEC Willing to Engage with Tokenized Asset Issuers, SEC’s Hester Peirce Says

CryptoNewsNet·2025/09/30 03:36

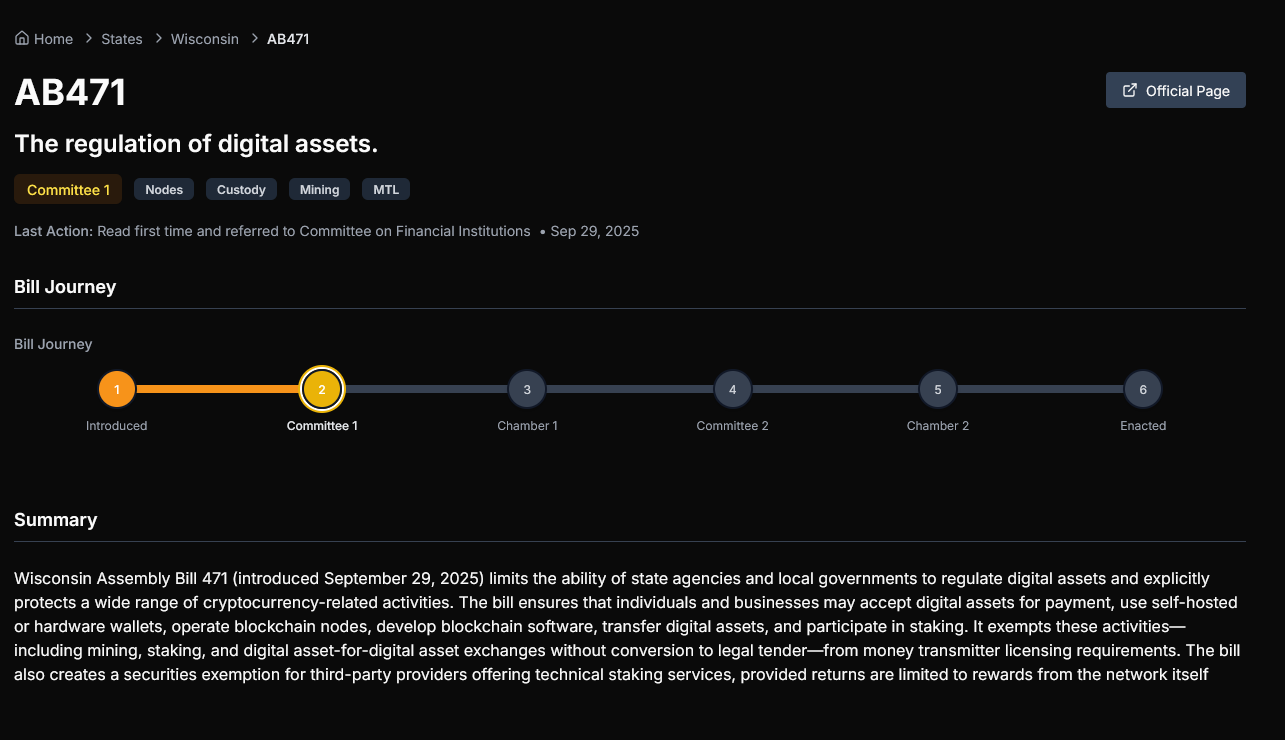

Wisconsin bill to exempt crypto businesses from money licenses

CryptoNewsNet·2025/09/30 03:36

Flash

- 21:01"Maji" deposited $100,000 an hour ago to increase positions, adding to Ethereum long positionsBlockBeats News, December 12, according to monitoring by HyperInsight, "Maji" deposited another $100,000 in margin to Hyperliquid one hour ago, lowering the liquidation price to $3,130. In addition, "Maji" once again increased their long position in Ethereum, with the current position rising to 5,300 ETH, valued at approximately $16.756 millions. Previous reports stated that "Maji"'s Ethereum long position was partially liquidated again tonight, with a liquidation size of 1,200 ETH.

- 21:01Spot silver rises above $63/oz, hitting a new high, gold climbs simultaneouslyBlockBeats News, December 11, spot silver has reached $63 per ounce, hitting a new high, with an intraday increase of over 2%. New York silver futures surged 4.00% during the day, currently quoted at $63.48 per ounce. In addition, spot gold rose sharply by $18 in the short term, now quoted at $4,256 per ounce, up 0.51% on the day. (Golden Ten Data)

- 20:56US money market fund assets hit a record high of $7.655 trillionJinse Finance reported that, according to statistics from the Investment Company Institute (ICI), the asset size of U.S. money market funds has reached a record high of $7.655 trillions.

News