News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Ethereum is not perfect, but it is the optimal solution.

At least four Chinese-funded financial institutions and their branches, including Guotai Junan International, have withdrawn from applying for a Hong Kong stablecoin license or have suspended related attempts in the RWA sector.

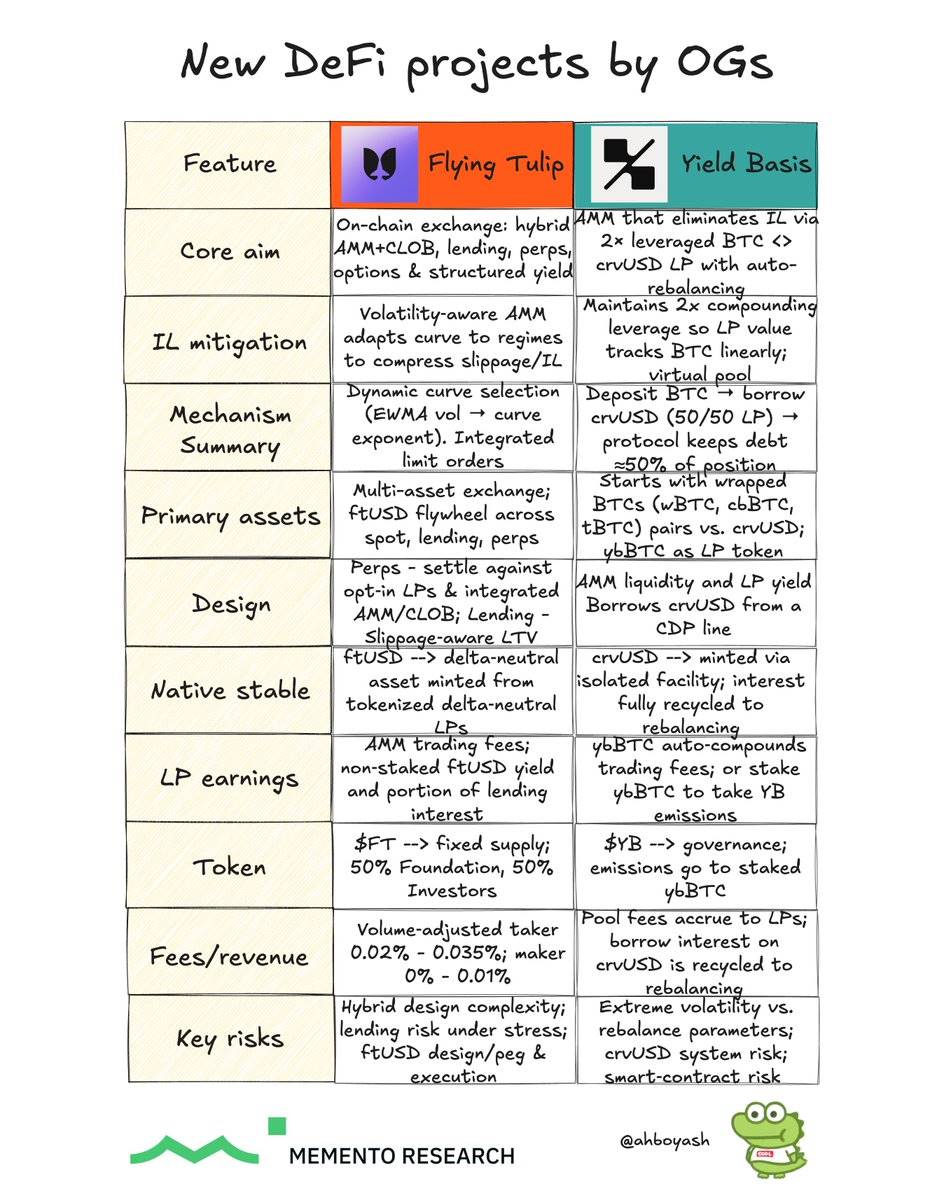

All primary market participants will have on-chain redemption rights, allowing them to burn $FT at any time and redeem up to the equivalent value of their original principal.

All primary market participants will have on-chain redemption rights, allowing them to burn $FT at any time and redeem up to the equivalent of the original principal.

Aiming to address the challenges of on-chain liquidity.

- 17:34Aster cancels stock perpetual contract feesForesight News reports that Aster has announced the complete removal of trading fees for stock perpetual contracts, with all orders now subject to 0% trading fees (including both Maker and Taker). Supported assets include a certain exchange. When trading stock perpetual contracts, Makers will receive point rewards, while Takers will not be charged any fees.

- 17:33ETHZilla acquires 15% stake in digital lending platform Zippy for $21.1 millionForesight News reported that Ethereum treasury company ETHZilla announced an agreement with institutional-grade digital lending platform Zippy to acquire a total of approximately $21.1 million for a 15% equity stake in the company. The deal includes $5 million in cash, $14 million worth of common stock paid to Zippy, and $2.1 million worth of common stock issued to specific Zippy shareholders. Zippy will assist ETHZilla in building an institutional-grade credit infrastructure layer to support its exploration of the mortgage market.

- 17:33TenX Protocols to be listed on TSX Venture Exchange, raising over 33 million Canadian dollarsForesight News: According to CoinDesk, blockchain infrastructure company TenX Protocols announced that it will be listed on an exchange on December 10, with the stock code "TNX." The company has completed over 33 million Canadian dollars (approximately 24 million US dollars) in financing this year, including 29.9 million Canadian dollars in subscription receipt financing related to the listing and 3.5 million Canadian dollars in seed round financing. TenX stated that it will use these funds to purchase tokens of high-throughput blockchain networks such as Solana, Sui, and Sei, and participate in staking, while also investing in its own infrastructure products and services. Part of the financing was conducted through digital assets (including SOL, SEI, and USDC) at a price of 0.75 Canadian dollars per subscription receipt.