News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Bitcoin needs just a 1.26% move to liquidate $3B in shorts, setting the stage for a major short squeeze.Bitcoin on the Brink of Massive Short SqueezeWhat’s Behind the $3B in Shorts?What Traders Should Expect Next

Vanguard may launch crypto ETFs, including Bitcoin, signaling a major shift in traditional finance's view on digital assets.TradFi Titan Vanguard Eyes Crypto ETF LaunchWhy Vanguard’s Move MattersWill This Push Other TradFi Giants Further Into Crypto?

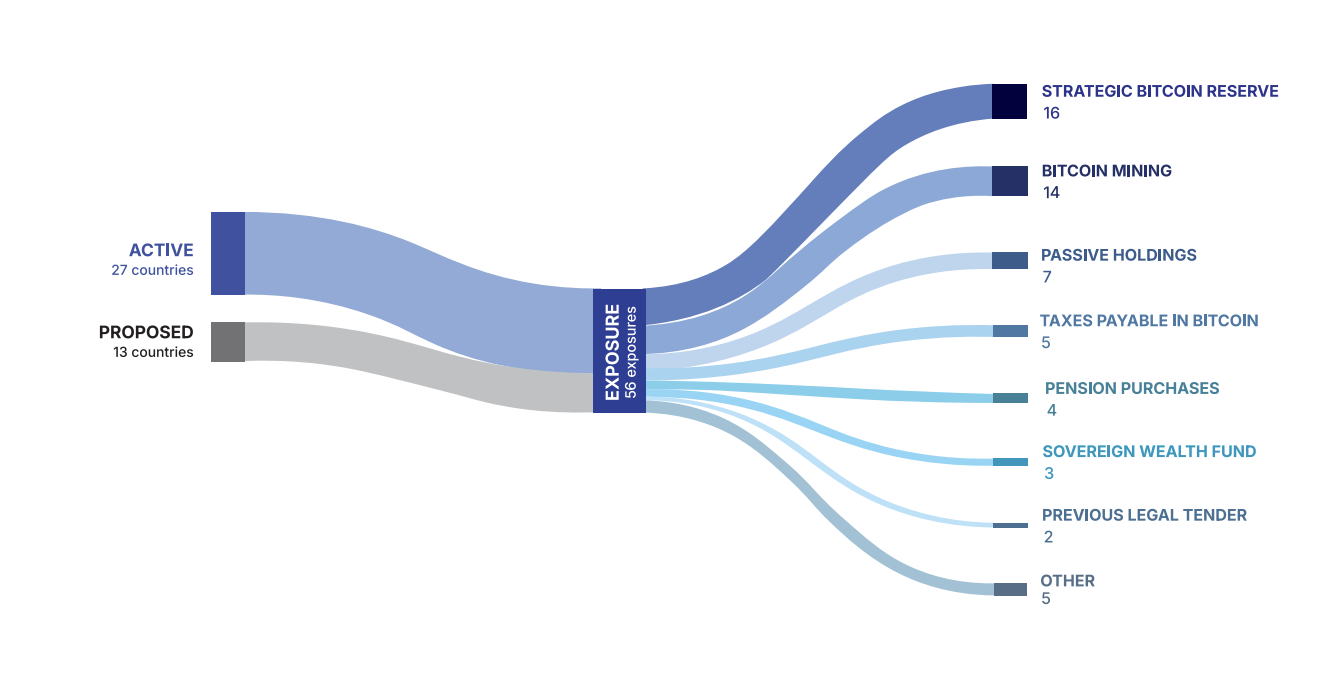

PUSD is designed to reduce reliance on USDT and USDC. It would enable on-chain payments, savings, and borrowing while strengthening Polkadot’s DeFi ecosystem.

Quick Take Summary is AI generated, newsroom reviewed. Ripple CEO Brad Garlinghouse highlighted XRP's ability to settle transactions in approximately 3 seconds, positioning it as a superior alternative to traditional financial networks. Garlinghouse stressed that XRP's long-term value is driven by its utility in solving a big problem, particularly streamlining cross-border payments and asset tokenization. Ripple is focusing on XRP to tokenize and transfer real-world assets like real estate, facilitating ef

Quick Take Summary is AI generated, newsroom reviewed. BitMine added 264,400 ETH, bringing total holdings to 2.42 million. Mid-August purchases spiked with 317,100 ETH, showing an aggressive accumulation strategy. Late August acquisition added 269,300 ETH, strengthening BitMine’s ETH treasury. The company now controls Ethereum worth approximately $9.72 billion in total. Chairman Tom Lee envisions Ethereum’s growth amid rising institutional adoption trends.References UPDATE: Bitmine added another 264K $ETH

- 00:29Data: Jeffrey Huang deposits nearly 300,000 USDC into Hyperliquid again to increase his ETH long positionChainCatcher News, according to market sources, Huang Licheng (@machibigbrother) has once again deposited 299,842 USDC into Hyperliquid and increased his ETH (25x leverage) long position. Current position details: Quantity: 6,900 ETH; Entry average price: $3,240.93; Liquidation price: $3,130.95.

- 00:11Data: A new wallet has once again received 700 BTC worth $64.8 million from Galaxy DigitalAccording to ChainCatcher, Onchain Lens monitoring shows that a new wallet has once again received 700 BTC from Galaxy Digital, valued at 64.8 million US dollars. Currently, this wallet holds a total of 1,900 BTC, with a total value of 176 million US dollars.

- 00:02ether.fi: LiquidUSD Repayment Feature Now LiveJinse Finance reported that ether.fi announced on X platform that repayments using LiquidUSD are now available. Users can directly use their LiquidUSD balance to instantly repay debts without the need for additional deposits.