News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Spot Gold & Silver Continue to Drop, Bitcoin Crashes; Amazon’s $200 B Capital Expenditure Raises Concerns; U.S. Job Openings Fall to 2020 Lows — Feb 6, 2026 (English Translation)2Weekend Trading Playbook: High-Impact Macro Events & Earnings for Feb 9-15, 2026 – Tech & Crypto Volatility Plays3 Is the “Perfect Storm” Here? Liquidations Explode as Bitcoin Bleeds Below $70K & DXY Rises

Fed Decision Preview: Balance Sheet Expansion Signals Are More Important Than Rate Cuts

AICoin·2025/12/11 16:41

The Federal Reserve cuts interest rates as expected, what happens next?

AICoin·2025/12/11 16:41

Evolutionary Logic and Ecological Value of the DeFi 2.0 Era Analyzed through IXO Protocol

Is it possible for investment to be risk-free? This is difficult to achieve in both traditional DEX and CEX platforms...

ThePrimedia·2025/12/11 16:23

Terra Founder Do Kwon Gets 15 Years for $40B Fraud

Terra founder Do Kwon sentenced to 15 years in prison for the $40 billion Terra/Luna collapse.

Coinspeaker·2025/12/11 16:00

The End of The Four-Year Bitcoin Cycle? Cathie Wood Knows Why

Kriptoworld·2025/12/11 16:00

Billionaire Ken Griffin Pours $4,700,000 Into Two Assets in New Bet on Future of Quantum Technology

Daily Hodl·2025/12/11 16:00

BNB Price Halts Below $900 as Zerobase Hack Nullifies BNBChain Transaction Record

BNB struggles below $890 after a phishing attack on Zerobase dampened enthusiasm from BNB Chain’s historic throughput record of 8,384 transactions per second.

Coinspeaker·2025/12/11 16:00

Flash

07:52

Arthur Hayes transfers DeFi tokens worth $3.154 million, suspected of sellingAccording to Odaily, monitoring by Lookonchain shows that within the past 15 minutes, Arthur Hayes (@CryptoHayes) transferred 8.57 million ENA (worth $1.06 million), 2.04 million ETHFI (worth $954,000), and 950,000 PENDLE (worth $1.14 million), suspected to be for sale.

07:36

"Moji" added to his ETH long positions, bringing the total to $6.3 million, with an opening price of approximately $2018. according to HyperInsight monitoring, in the past 2 hours, "Maji" Huang Licheng increased his long positions in ETH and HYPE. Currently, the ETH long position is valued at 6.3 million USD, with an average opening price of 2,017.78 USD, and the HYPE long position is valued at 1.41 million USD, with an average opening price of 32 USD.

07:34

Samsung reportedly to begin mass production of HBM4 this month for Nvidia's next-generation AI computing platformGlonghui, February 8th|Samsung Electronics is reportedly set to begin mass production of sixth-generation high-bandwidth memory (HBM4) after the Lunar New Year holiday, which will be used in Nvidia's next-generation artificial intelligence computing platform, Vera Rubin. According to Yonhap News Agency, citing sources in the semiconductor industry, Samsung has decided to start mass production of HBM4 as early as the third week of this month. After passing Nvidia's certification tests, Samsung has comprehensively considered the launch schedule of Vera Rubin and finalized the mass production plan. This will mark the world's first mass production and shipment of HBM4. The industry expects Nvidia to unveil products equipped with Samsung HBM4 for the first time at its annual developer conference (GTC) next month. Samsung's HBM4 offers a data processing speed of up to 11.7Gbps, a significant improvement over the 8Gbps standard set by the JEDEC Solid State Technology Association.

News

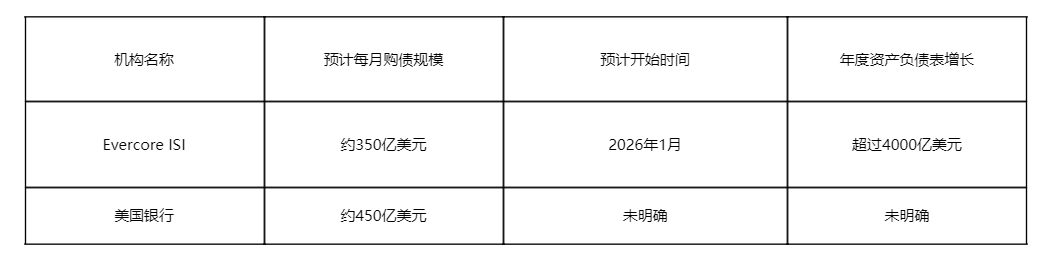

![[Bitpush Daily News Selection] The Federal Reserve cut interest rates by 25 basis points as expected; the Federal Reserve will purchase $40 billions in Treasury securities within 30 days; Gemini received CFTC approval to enter the prediction market; State Street Bank and Galaxy will launch the tokenized liquidity fund SWEEP on Solana in 2026.](https://img.bgstatic.com/multiLang/image/social/87a413b57fb2c702755e8bc5b4385a781765441081405.png)