News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 8)|The median stock price of DAT companies listed in the U.S. and Canada has fallen 43% this year; Trump proposes replacing the current personal income tax system with tariff revenue2Bitcoin price dips below 88K as analysis blames FOMC nerves3Stablecoin : Western Union plans to launch anti-inflation "stable cards"

Former BlackRock Executive Joseph Chalom: Why Ethereum Will Reshape Global Finance

Could Ethereum become one of the most strategic assets of the next decade? Why do DATs offer a smarter, higher-yield, and more transparent way to invest in Ethereum?

Chaincatcher·2025/09/17 15:29

Elizabeth Warren raises ethics concerns over White House crypto czar David Sacks’ tenure

CryptoSlate·2025/09/17 15:07

CME Group to launch Solana and XRP options amid surging futures demand

CryptoSlate·2025/09/17 13:56

Bitcoin price gains 8% as September 2025 on track for best in 13 years

Cointelegraph·2025/09/17 13:33

Ethereum unstaking queue goes ‘parabolic’: What does it mean for price?

Cointelegraph·2025/09/17 13:33

Solana Price Eyes Next Leg Up Amid Growing Social Interest and New Demand

Solana holds steady after a recent surge, but rising demand and stronger social buzz suggest momentum could soon lift prices higher.

BeInCrypto·2025/09/17 13:00

ETH’s run vs. BTC: Finished, or early days?

Any indication the FOMC is less dovish than anticipated could weigh on crypto, industry watcher says

Blockworks·2025/09/17 12:39

Pump.funs Viral Livestreams and Creator Capital Markets Surge

TheCryptoUpdates·2025/09/17 12:39

Camp Network brings global digital IP to its newly launched mainnet

Camp is unlocking new use cases for intellectual property (IP), laying the foundation for a future where rights, authorization, and commercial monetization are embedded within the creative process.

深潮·2025/09/17 12:35

Flash

- 07:47Enterprise payment and financial platform Airwallex completes $330 million financing round, led by AdditionJinse Finance reported, citing Bloomberg, that corporate payments and financial platform Airwallex has completed a $330 million financing round at a valuation of $8 billion, led by Addition, with participation from Activant, Lingotto, and TIAA Ventures. In addition, Airwallex announced that San Francisco will become its second global headquarters, and the U.S. team plans to expand to over 400 people in the coming year.

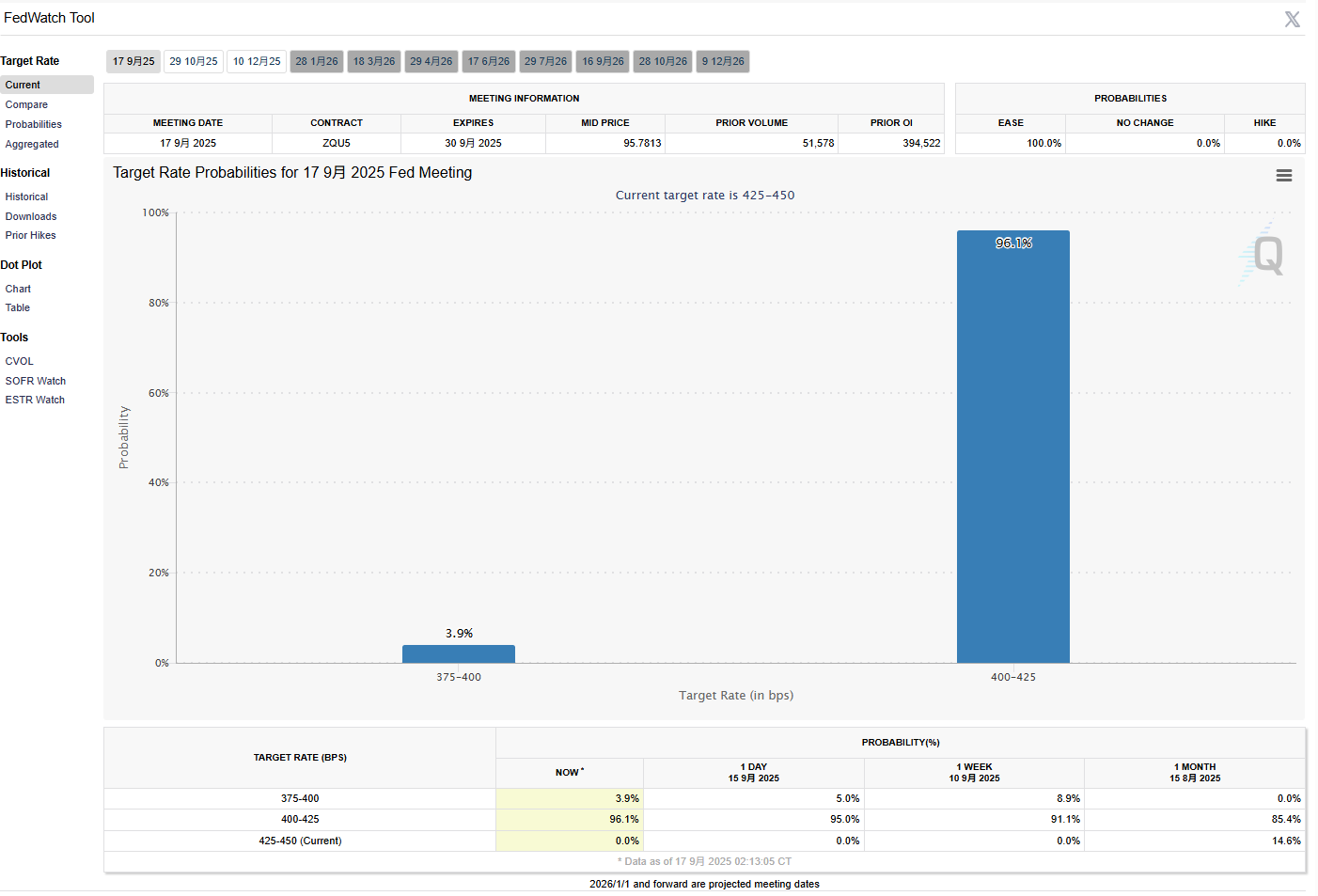

- 07:34Fed Rate Cut Almost Certain; Market Focuses on Voting Divergence and Powell’s WordingJinse Finance reported that this week's Federal Reserve interest rate meeting is expected to be one of the most controversial in years. Investors are focusing on how divided policymakers are regarding rate cuts and the signals Powell will send about the future path. Janus Henderson believes that in the long term, the December meeting will have little impact on the market. There may be some volatility in the short term, but actions in the first half of 2026 are more important than those in December. Wilmington Trust believes that the market has largely priced in the Fed's rate cut actions, and the real key is the Fed's policy guidance. It is expected that they will be very cautious, emphasizing that decisions depend on economic data. Some observers believe that the probability of a Fed rate cut is not as high as the market suggests, and they are more concerned about Powell's statement and how close the policy vote will be. Nomura economists pointed out that nothing is certain yet, and the market is underestimating the risk that the Fed may choose not to cut rates in December. In the event of a rate cut decision, the number of dissenting votes will be very interesting. With the rotation of four regional Fed presidents, their stances will reveal how much independence they intend to maintain and how much pressure they will put on the Fed. (Golden Ten Data)

- 07:28After a hacking incident at a certain exchange, there was a delay of over 6 hours before it was reported to regulatory authorities.ChainCatcher news, according to The Chosun Ilbo, a certain exchange reported to financial regulators more than 6 hours after a hacking incident occurred. The delay in disclosure may be due to its parent company Dunamu currently advancing merger and acquisition talks with tech giant Naver, and the exchange wanted to avoid the impact of the news. The Financial Supervisory Service (FSS) of South Korea reported that the exchange held an emergency meeting 18 minutes after first detecting the hacking attack, suspended Solana network-related asset deposits and withdrawals 27 minutes later, and from 8:55 suspended all digital asset deposits and withdrawals. However, it was not until 10:58 that the FSS was notified for the first time. Despite the delayed reporting, regulators currently lack legal provisions for direct penalties or mandatory compensation.

News