News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | U.S. Shutdown Crisis Averted; Iran Tensions Boost Oil; Gold Rebounds Amid Microsoft Earnings Split (January 30, 2026)2Bitcoin Plunge Could Get Much Worse as Death Cross Gains Power3 Crypto Market Today Turns Red But LTH Data Signals Structural Stability

U.S. Moves Toward Joining Global Crypto Reporting Network as CARF Review Reaches White House

Cointribune·2025/11/19 01:09

Crypto: Trump Prepares a Global Tax Hunt

Cointribune·2025/11/19 01:09

Arweave Price Prediction 2025, 2026 - 2030: Will AR Price Hit $50?

Coinpedia·2025/11/19 00:54

Mastercard Partners With Polygon to Expand Crypto Credential to Self-Custody Wallets

Coinpedia·2025/11/19 00:54

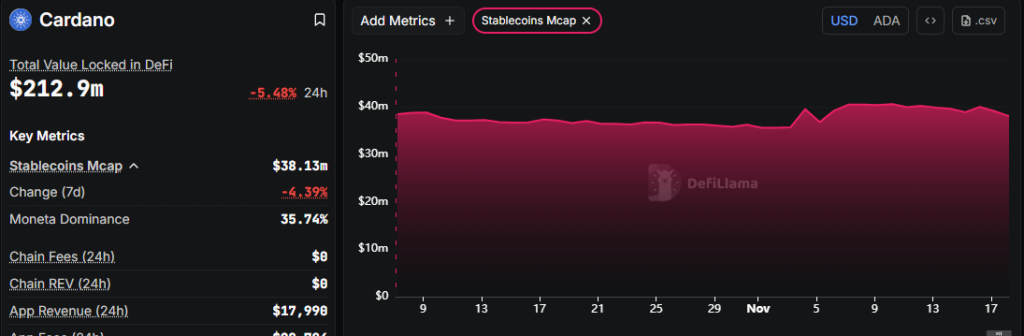

Cardano Price Prediction 2025: Can ADA Hold Its Last Major Support Zone?

Coinpedia·2025/11/19 00:54

Libra Scandal Wallets Quietly Move $4M and Go All-In on Solana

Coinpedia·2025/11/19 00:54

Can LINK Price Falling Wedge Breakout Target Levels Beyond $30?

Coinpedia·2025/11/19 00:54

Bitcoin Dominance Crashes Below 60%, Altcoin Season Coming

Coinpedia·2025/11/19 00:54

SharpLink and Upexi: Each Has Its Own Advantages in DAT

Upexi and SharpLink have entered a field where the boundaries between corporate financing and cryptocurrency fund management are becoming increasingly blurred.

Block unicorn·2025/11/18 21:43

Flash

17:21

Bitcoin falls below $79,000, with $650 million liquidated in the crypto market in the past hourBitcoin price fell below $79,000, and a total of $650 million in crypto assets were liquidated in the past 60 minutes. (Watcher.Guru)

17:17

Bitcoin falls below key support level as long-term holders accelerate sellingBitcoin price dropped by 7.3%, falling to $82,700, while the CoinDesk 20 Index saw a 10.3% decline over seven days. According to Santiment data, market panic sentiment has reached an extreme, and negative sentiment may become a historical indicator for a potential price rebound. Long-term Bitcoin holders are selling at the fastest pace since August, and some industry observers believe the market may be approaching a bear market bottom.

17:15

BTC falls below $79,000Jinse Finance reported that according to market data, BTC has fallen below $79,000, currently quoted at $78,993.78, with a 24-hour decline of 4.71%. The market is experiencing significant volatility, please ensure proper risk control.

News