News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

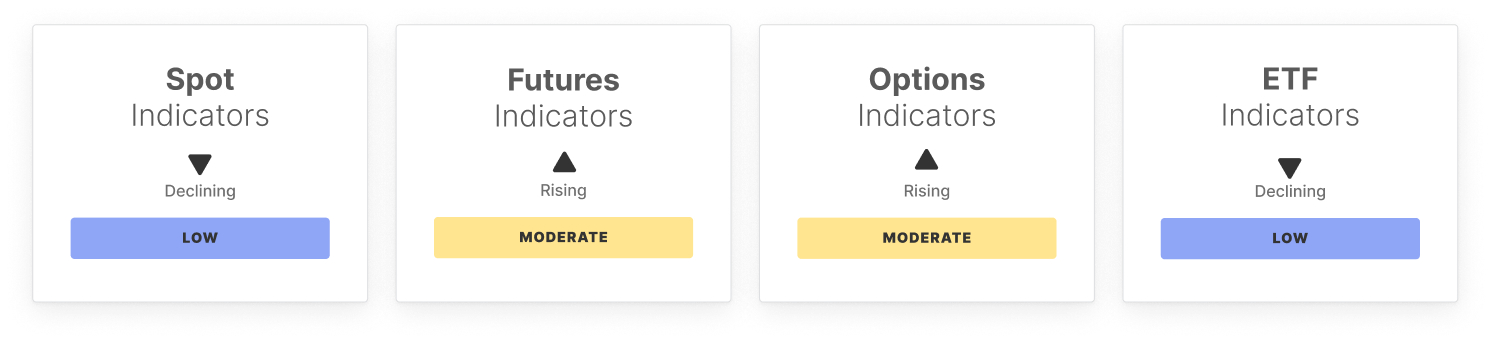

Bitcoin extended its drawdown, trading down to $93K in a continuation of the orderly trend lower that has characterised recent weeks. The move has now carried the asset into a region where historically demand has tended to re-engage.

VanEck’s VSOL begins trading on Cboe BZX as the second US Solana staking ETF, competing with Bitwise’s $497M BSOL fund that launched three weeks earlier.

The new app by Aave offers automatic compounding and balance protection, competing in a DeFi lending market where Morpho protocol offers yields above 10%.

Quick Take Kohaku is a suite of privacy-preserving crypto tools to enhance privacy and security in the Ethereum ecosystem. In recent months, Buterin and the Ethereum Foundation have more explicitly embraced privacy a fundamental right and aim for blockchain developers.

Quick Take The Digital Chamber announced a new State Network to push for digital asset policies in state and local governments. As the 2026 races take shape, TDC CEO Cody Carbone said the group aims to boost pro-crypto candidates at every level of government.

Quick Take Following the longest government shutdown ending last week, the focus is now on SEC Chair Paul Atkins’ agenda, TD Cowen’s Washington Research Group said in a note. Atkins is expected to focus on a range of issues, including crypto and allowing retail investors to have access to alternative investments.

Quick Take El Salvador’s Bitcoin Office shows that it bought 1,090 BTC on Monday, bringing its total holdings to 7,474 BTC. However, it is unclear whether El Salvador bought 1,090 BTC from the market as its deal with the IMF required the country to cease new purchases.

Quick Take On Monday, British authorities said they are looking to recover 42 bitcoin and other crypto at today’s value. Joseph James O’Connor reportedly hacked into more than 130 X accounts as part of a bitcoin scam, including accounts held by Apple, Uber, Kanye West, and Bill Gates