News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Macro headwinds test Bitcoin price as $70K crumbles amid US market volatility2Trump filling Democratic seats at SEC, CFTC could advance crypto bill talks, TD Cowen says3Bitcoin price ignores $168M Strategy buy, and falls as Iran tensions escalate

Robinhood's Layer 2 testnet sees four million transactions in first week, CEO Vlad Tenev says

The Block·2026/02/19 08:15

Terra (LUNA) Price Prediction: Terra Struggles to Reverse Downtrend as Leverage Spikes

CoinEdition·2026/02/19 08:13

AIW3 Integrates Snowball’s MNS, CIP, and ORS to Enhance On-Chain Strategy Execution

BlockchainReporter·2026/02/19 08:00

Even major car manufacturers are aware: the surge in electric vehicles has lost momentum

101 finance·2026/02/19 07:09

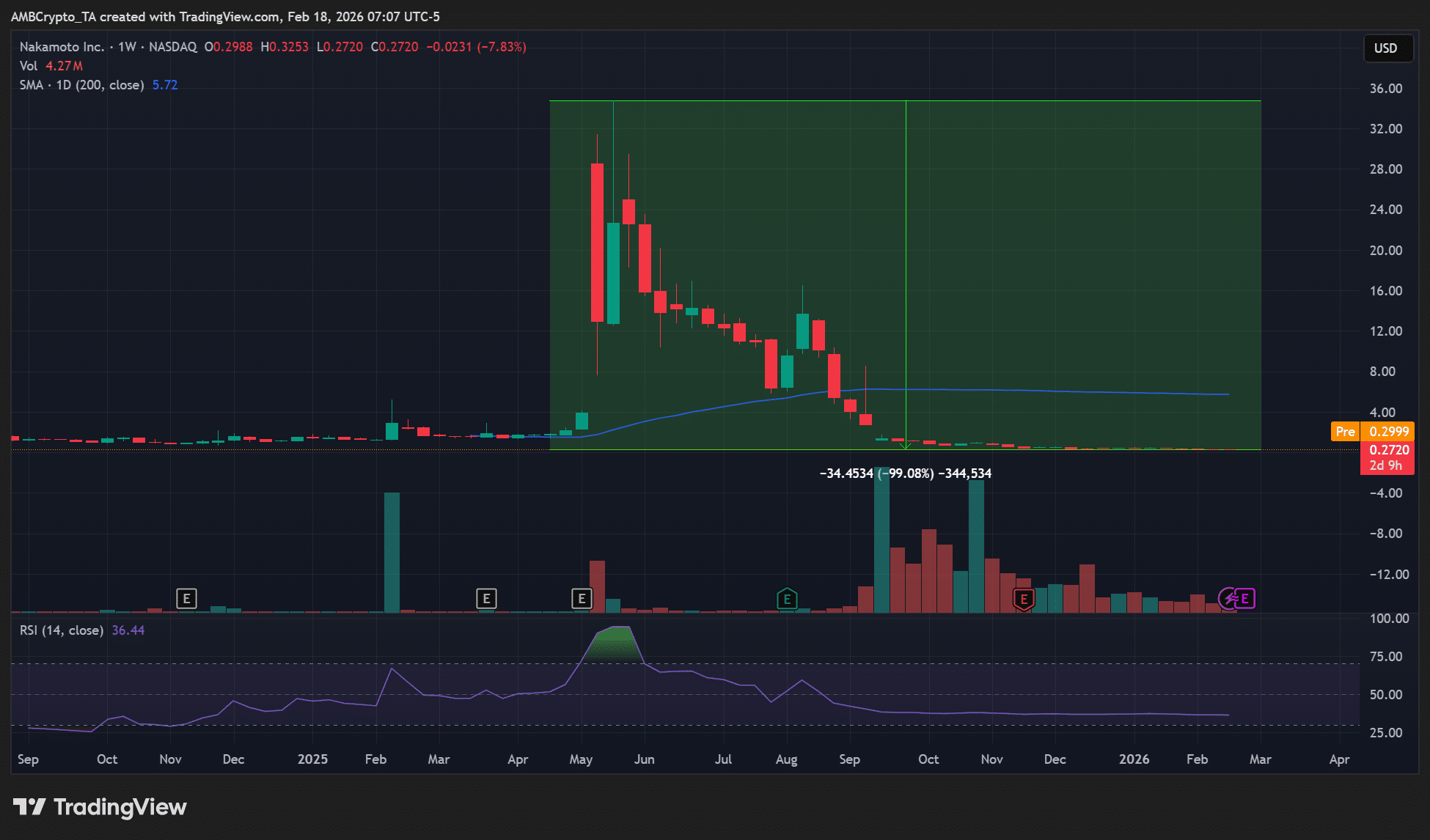

‘Noise on Twitter’ – David Bailey denies scam claims after Bitcoin treasury Nakamoto falls 99%

AMBCrypto·2026/02/19 06:33

Helium (HNT) Price Prediction 2026, 2027 – 2030: Evaluating HNT’s Long-Term Potential Ahead

Coinpedia·2026/02/19 06:30

Bitcoin Could Drop to $55K Before Recovery, Says CryptoQuant CEO

CoinEdition·2026/02/19 05:51

Samsung and SK Hynix "Adjust Strategy": New Memory Factory Production Schedule Moved Up

华尔街见闻·2026/02/19 05:32

Why Wall Street Is Watching Manhattan Associates, Inc. (MANH)' Cloud Expansion Closely

Finviz·2026/02/19 05:03

Analysts Bullish On AppLovin Corporation (APP) Outlook Following Impressive Results

Finviz·2026/02/19 05:03

Flash

08:29

Analyst: Institutional Demand Softness Combined with CEX Inflow Pressure, Bitcoin Market Faces Dual Selling PressureBlockBeats News, February 19th, Cryptocurrency market analyst Axel posted on social media, stating that the data from the past week has revealed a growing gap between the institutional demand narrative and actual fund flows. ETF fund inflows momentum remains unstable, while exchange net flow continues to stay positive, with tokens flowing into exchanges rather than out.

Over the past 7 days, the total net outflow of the US spot Bitcoin ETF reached 11,042 BTC, with only two trading days recording net inflows. On February 12th, a single-day outflow reached 6,120 BTC (approximately $416 million), marking the largest outflow day of this period. On February 17th and 18th, two consecutive trading days saw outflows of 1,520 BTC and 1,980 BTC respectively, indicating that institutional accumulation momentum has not yet formed.

At the same time, exchange platform supply continues to increase. Since early February, the net flow of exchanges has remained positive, ranging from +391 BTC to +841 BTC over the past week. Today's reading is +553 BTC, continuing the two-week trend of positive inflows. This starkly contrasts with the pattern in January, which remained negative (tokens flowing out of exchanges).

Axel stated that both key indicators are pointing in the same direction: over the past week, there has been a 11,042 BTC outflow through the ETF channel, while exchange platform supply continues to grow. Institutional demand has not only failed to absorb the market's new supply but has itself become an additional source of selling pressure. The establishment of a positive accumulation trend requires at least three consecutive trading days of positive ETF net inflows and a sustained shift in exchange net flow to negative territory (indicating tokens being withdrawn from exchanges for custody accumulation). The next 3 to 5 trading days of ETF flows will be a key variable in determining market direction.

08:13

Energy landscape shifts: Central and Eastern Europe suspend diesel exports, Russian drilling drops to three-year low⑴ Hungary and Slovakia have announced the suspension of diesel exports to Ukraine, a move that could impact Ukraine's fuel supply. Meanwhile, Slovakia has urgently released 250,000 tons of oil reserves to cope with the supply disruption. ⑵ Russian oil drilling activities have slowed down, with drilling volume in 2025 expected to fall to the lowest level in three years. In January, India imported 1.1 million barrels per day of Russian oil, the lowest since November 2022, indicating a cooling demand for Russian oil in the Asian market. ⑶ The Italian cabinet has approved a decree to reduce energy costs in order to ease the burden on businesses and residents. Angola's crude oil export plan for April has been lowered, with 28 cargoes to be loaded, down from 35 in March. ⑷ In the mining sector, Rio Tinto has reaffirmed its 2026 copper production target of 800,000 to 870,000 tons, with copper accounting for 85% of its exploration budget. Glencore has reached a land agreement with the Democratic Republic of the Congo to increase copper production. India has removed the additional margin requirement for gold and silver futures and has begun negotiations with the United States on cooperation in critical minerals. Indonesia and the United States have signed agreements totaling $38.4 billion, covering energy, agriculture, technology, and other fields.

08:08

Major European stock indexes open collectively lowerGlonghui, February 19|The UK FTSE 100 Index fell by 0.30%, the Euro Stoxx 50 Index dropped by 0.30%, the French CAC 40 Index declined by 0.31%, and the FTSE MIB Index of Italy decreased by 0.48%.

News